Forex or the stock market

The decision to trade Forex or the stock market depends on your financial goals and risk tolerance. In this article, we will tell you how to choose.

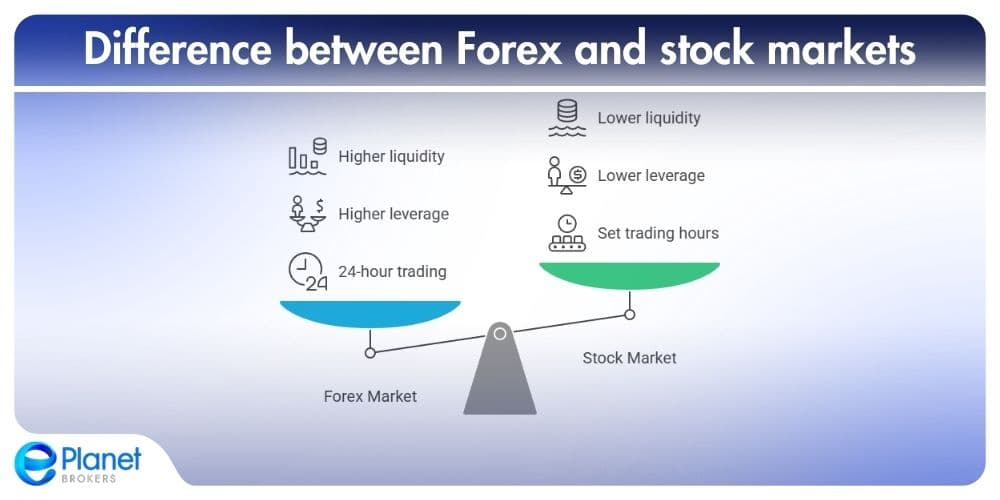

Forex and stock markets differ in hours, liquidity, volatility, leverage, capital, and required expertise. Forex offers 24/7 trading with high liquidity and leverage, while stocks have fixed hours, lower volatility, higher capital needs, and focus on long-term investment.

The decision to trade Forex or the stock market depends on your financial goals and risk tolerance. Forex offers 24/7 trading, high leverage, and profit potential from both rising and falling prices, but it's highly volatile and risky. Stocks are more stable, but trading hours are limited, and profit comes mainly from price increases. As we discussed before in our ultimate guide to the Forex Market, Forex typically requires less starting capital, whereas stocks often demand a larger initial investment. Forex demands strong knowledge of economics and news, while stock investing can be more long-term focused.

Key Takeaways

- Forex trades 24/7 with high liquidity and leverage, requiring strong economic analysis.

- Stocks operate during fixed hours, are generally less volatile, and demand larger capital.

- Both markets involve risks; choose based on your financial goals and risk tolerance.

the difference between Forex and stocks

A brief overview of the difference between Forex and stocks The world's financial markets offer countless opportunities for investment and profit. Among them, Forex and the stock market are two popular options, each with its own unique characteristics. To determine whether the stock market or Forex is better, it is essential to first understand the nature of these two markets.

What is the Forex market?

Forex is the largest and most liquid financial market in the world, where different currencies are traded. This market is open 24 hours a day, 5 days a week, allowing investors to trade anytime and anywhere. Transactions in Forex are carried out in currency pairs, meaning that you simultaneously buy one currency and sell another.

What is the stock market?

The stock market is a platform for buying and selling shares of various companies. In this market, investors, by buying shares, become shareholders of the company and can benefit from its profitability. The working hours of the stock market are usually limited to the business hours of the week, and each country has its own stock exchange. Both Forex and stock markets offer significant profit potential but come with distinct risks. To succeed in these markets, you need knowledge, experience and awareness of the factors affecting prices. In the following of this article, we will examine whether the stock market is better or Forex.

Difference between Forex and stocks in trading hours

Stock exchanges around the world are closed on certain days of the year for various reasons. These holidays are usually related to the national and religious events of each country. For example, the New York Stock Exchange is closed on US Independence Day (July 4th) and the Singapore Stock Exchange is closed on Chinese New Year. Some markets also have fewer working hours on certain days. For example, the New York Stock Exchange is only open until 1 p.m. on Christmas Eve. Even the London Stock Exchange takes a two-minute break for traders every day at noon.

Forex market trading hours

Which market’s trading hours are better, stock market or Forex?

In the following, we will introduce the most important stock markets and their working hours.

NameLocationTime zoneTrading hoursNew York Stock Exchange (NYSE)New York, USAEDT9:30 am to 4:00 pmNasdaq Stock MarketNew York, USAEDT9:30 am to 4:00 pmToronto Stock Exchange (TSX)Toronto, CanadaEDT9:30 am to 4:00 pmShanghai Stock Exchange (SSE)Shanghai, ChinaCSTFrom 9:30 am to 11:30 and 13:00 to 2:57 pmTokyo Stock ExchangeTokyo, JapanJST9:00 am to 11:30 am and 12:30 pm to 3:00 pmShenzhen Stock Exchange (SZSE)Shenzhen, ChinaCSTFrom 9:30 am to 11:30 and 13:00 to 2:57 pmHong Kong Stock Exchange (SEHK)Hong KongHKT9:00 am to 11:30 am and 12:30 pm to 4:00 pmLondon Stock ExchangeLondon, EnglandGMT8:00 am to 4:30 pmFrankfurt Stock ExchangeFrankfurt, GermanyCEST8:00 am to 10:00 pmSIX Swiss ExchangeZurich, SwitzerlandCEST9:00 am to 5:20 pmAustralian Securities Exchange (ASX)Sydney, AustraliaAEDT10:00 am to 4:00 pmJohannesburg Stock Exchange (JSE)Johannesburg, South AfricaSAST9:00 am to 5:00 pmB3 S.A.Sao Paulo, BrazilBRT10:00 am to 5:55 pm

To find out the exact trading hours on holidays in different markets or the difference between the stock market and Forex in terms of trading hours, you can refer to the economic calendar of ePlanet Broker. These calendars provide complete information about the closure of global markets. Considering that stock trading involves buying and selling shares of public companies, paying attention to market hours is very important for investors. Because investors can only profit by increasing the price of shares and receiving dividends, and the closure of markets can affect their trading planning.

Which trading hours are better, the stock market or Forex?

Forex trading hours are more flexible compared to the stock market, because Forex is active 24 hours, but the stock market is limited to fewer trading hours.

So far, we have learned that financial markets such as Forex or the stock market provide investment opportunities for making profits. Forex is the largest financial market in the world where currencies are exchanged and it operates 24 hours a day and 5 days a week. The stock market is a platform for buying and selling company shares and its working hours are usually limited to business hours. Both the stock market or Forex have profit potential and risk and require knowledge, experience and awareness.

Forex market: Active 24 hours a day Stock market: Usually active between 9:30 and 12:30. Comparison of Forex and the Stock Market. What are the reasons for the difference between the stock market and Forex? In the following, we will examine the most important differences between the Forex and stock markets.

Is Forex better or the stock market in terms of impact?

To succeed in any financial market, it is essential to know the factors that affect prices. In the Forex and stock markets, the forces that drive prices can be different. Although supply and demand play a fundamental role in the stock market or Forex, other factors also affect prices that must be understood. In the stock market, factors such as the amount of company debt, cash flow and its income, as well as economic data related to the stock in question, are issues that should be considered.

These factors directly affect the company's performance and consequently the price of its shares. But in the Forex market, the range of influential factors is much wider. In addition to supply and demand, you should pay attention to the macroeconomics of countries, including the unemployment rate, inflation and gross domestic product (GDP), as well as political news and events.

The difference between the stock market and Forex is that in the stock market, a stock is bought, but in Forex, traders buy one currency and simultaneously sell another currency. For this purpose, in Forex, they must monitor the economic performance of both relevant countries. For example, if the interest rate in the United States increases, the dollar is likely to appreciate against other currencies. In such cases, investors, seeking higher returns, direct their capital towards the US dollar. Also, political events such as elections or social unrest can affect the value of currencies.

Difference between the stock market and Forex in terms of liquidity

In the world of trading, liquidity is paramount. Liquidity means being able to sell or buy your assets quickly and easily. The more traders there are in a market, the more money flows in it, and it becomes easier to find a buyer or seller. Is liquidity better in Forex or the stock market? The Forex market has no rival in terms of liquidity. The daily trading volume in this market is incredibly high. This means that at any moment, many people are ready to buy and sell currencies, and transactions are carried out quickly.

The stock market also has good liquidity, but not as much as Forex. Liquidity is one of the differences between the stock market and Forex. Shares of large and well-known companies like Apple and Microsoft have high liquidity because there are always buyers and sellers for them. But the shares of smaller companies may have less liquidity, and finding a buyer or seller for them may take some time. Is liquidity better in the stock market or Forex? If you are looking for high liquidity and speed in transactions, Forex is considered a better option. But if you want to invest in companies and benefit from their long-term profits, the stock market is more suitable.

Difference between the stock market and Forex in terms of price volatility

In terms of higher price fluctuations, is Forex better or the stock market? The Forex market, due to the ease of transactions, experiences more fluctuations. The high volume of transactions in this market causes prices to change quickly. Forex traders should be aware of global events, because political, economic and social news have a great impact on the fluctuations of this market. In contrast, the stock market shows more stable price patterns. However, this market is also affected by the domestic policies of the country and can experience periods of intense volatility. For example, trade tensions between countries can lead to a sharp drop in stock indices. High fluctuations in the Forex market provide more profit opportunities for traders. But these fluctuations also carry a higher risk. Traders should manage risk in both the stock market or Forex and use appropriate tools to avoid unnecessary losses.

Price volatility in Forex Market

Difference between the Forex and stock markets in terms of leverage

Is leverage better in the stock market or Forex? In the US stock market, low leverage is usually offered. For example, an American brokerage may allow you to buy shares with twice your capital. That is, with $1,000 of capital, you can buy $2,000 worth of American company shares. Whereas in the Forex market, leverage can be much larger. Some brokerages offer leverage up to 1:500 and even 1:1000. That is, with $1,000 you can make a transaction worth $500,000 or even $1 million! What is the difference between the stock market and Forex in the field of leverage? This significant difference in the amount of leverage is due to the nature of these two markets. The stock market generally has less volatility than the Forex market. On the other hand, liquidity in Forex is much higher and transactions are carried out quickly. For this reason, the risk of leveraged transactions in Forex is much higher.

Difference between the Forex and stock markets in terms of trading hours

Global financial markets each have their own specific schedules for activity. As we discussed the difference between the stock market and Forex in terms of trading hours in the previous paragraphs, we will briefly review the points below. Which trading hours are better, the stock market or Forex? In the stock market, each country sets specific hours for buying and selling shares. These hours are limited and usually during the day. But the Forex market does not include time restrictions.

This market, due to its international nature and the presence of traders from all over the world, operates around the clock. In fact, Forex never sleeps! This feature provides more trading opportunities for Forex traders. They can trade and make a profit at any hour of the day. This difference in trading hours is one of the important points that traders should consider regarding the difference between the stock market and Forex. Choosing the right market depends on various factors such as lifestyle, amount of free time and trading strategy of each person.

Difference between the stock market and Forex in terms of trading knowledge

To enter any financial market, whether stocks or Forex, you must have basic knowledge about that market, how it works, analysis and investment methods. But the difference between Forex and the Iranian stock market in terms of trading knowledge is that in Forex, mastery of news, economic data and central bank policies becomes more important. When you buy a company's stock, you share in its profits, and the company makes every effort to increase profitability.

This reduces the risk of long-term investment. But in the Forex market, although there are more opportunities to make a profit in the short term, using these opportunities requires high knowledge and skill. In fact, your goal of entering the market determines the amount of knowledge you need. If you are looking for long-term investment, you need less knowledge. But if you want to earn money from the market weekly or monthly, you must increase your knowledge and information in various fields. To succeed in investment, is the stock market a better choice or Forex? To succeed in Forex, you must be able to analyze economic news and events, be familiar with important economic indicators, and monitor the policies of central banks.

Also, mastery of technical analysis is essential to predict currency price fluctuations. Forex and the stock market are two important financial markets that, despite having similarities, also have fundamental differences. Forex is a global currency market that operates around the clock and with high liquidity, while the stock market is dedicated to buying and selling company shares and has limited working hours. In terms of price volatility, Forex experiences more fluctuations and is affected by global news and events. In contrast, the stock market is more stable, but is still affected by the country's domestic policies.

Difference between the stock market and Forex in terms of required capital

One of the factors in choosing between Forex or the stock market is the amount of initial capital required to start activity. In the US stock market, there are strict rules for minimum capital. The US Securities and Exchange Commission (SEC) has set a minimum capital of $25,000 for day traders. This law applies to stock and options trading. If your account balance is less than this amount, you will not be allowed to day trade until you replenish the minimum capital required.

In addition, there are other costs such as transaction fees, trading platform fees, market data fees, and taxes that can affect your profit and loss, as well as your choice between Forex and the stock market. For this reason, the suggested capital to start activity in the stock market is between $30,000 and $50,000. But in the Forex market, there is no limit to the minimum capital. Interested parties can start their activity with any amount of capital, even very small amounts, and earn income. This feature makes Forex an attractive option for people who have little initial capital. How is the difference between Forex and the Iranian stock market in terms of capital? In the Iranian stock market, you also need a minimum of 500,000 Tomans to trade in the market.

Is trading better in the stock market or Forex?

Two-way transactions In the past, one of the main advantages of the Forex market over the stock market was the possibility of conducting two-way transactions. That is, you could profit from the increase or decrease in the price of a currency. In simpler terms, you could buy a currency in the hope that its price would increase (buy position) or sell a currency in the hope that its price would decrease (sell position).

While in the stock market, it was only possible to profit by buying shares and increasing their price. In fact, the main difference between Forex and the stock market was this. But today, with the emergence of CFDs (Contract for Difference), this limitation has been eliminated in the US stock market. CFDs allow you to trade in both directions of the market (bullish and bearish) without the need to actually own the shares, and benefit from stock price fluctuations, both positive and negative. However, the difference between the stock market and Forex in terms of the two-sided nature of the market is still significant.

In the Forex market, currency pairs are bought and sold between individuals, meaning that you simultaneously buy one currency and sell another, and vice versa. This structure inherently creates a two-sided market and provides more flexibility for traders. In contrast, in the stock market, although CFDs have made two-way transactions possible, the main focus is still on buying and holding shares for long-term investment.

Difference between Forex and stock markets

- Liquidity in the Forex market is several times higher than the US stock market

- Price volatility in the stock market is much higher than in Forex

- In the Forex market, you have access to unlimited leverage, but stocks are not like that!

- Forex is open 24 hours, but stocks are active from morning to noon

- The stock market requires $25,000 and the Forex market requires $100 in capital

- In Forex, you profit from both the rise and fall of prices, in stocks only from the rise in prices.

Cryptocurrency Market: The Third Trading Option in 2024-2025

In recent years, the financial trading landscape has expanded beyond traditional Forex and stock markets. Cryptocurrency ownership reached 659 million people globally by the end of 2024, growing 13% from 583 million in January, making digital assets a mainstream investment option that traders must now consider alongside Forex and stocks.

What is Cryptocurrency Trading?

Cryptocurrency trading involves buying and selling digital currencies like Bitcoin, Ethereum, and thousands of other altcoins on specialized exchanges. Unlike traditional currencies, cryptocurrencies operate on blockchain technology, a decentralized, distributed ledger system that ensures transparency and security without central authority control.

The crypto market operates 24/7, providing continuous trading opportunities, which makes it even more accessible than Forex's 24/5 schedule and significantly more flexible than stock market hours.

Cryptocurrency Market Growth and Size

The cryptocurrency market has experienced explosive growth in 2024-2025. The total cryptocurrency market capitalization hit a record high of USD 3.2 trillion in November 2024, according to CoinGecko. Looking forward, the cryptocurrency market rose to USD 4.87 trillion in 2025 and is projected to reach USD 18.15 trillion by 2030, registering a vigorous 30.10% CAGR.

This rapid expansion reflects increasing institutional adoption, technological advancements, and growing acceptance of digital assets as legitimate investment vehicles.

Regulatory Developments Shaping the Crypto Market

One of the most significant developments in the cryptocurrency space has been the establishment of clear regulatory frameworks:

United States Regulation

The GENIUS Act, signed July 18, 2025, established the first comprehensive federal cryptocurrency framework in U.S. history, creating regulatory structure for the $260 billion stablecoin market. Additionally, the SEC approved Bitcoin and Ethereum ETFs in 2024, marking a major shift toward institutional acceptance.

European Union Framework

The EU's Markets in Crypto-Assets Regulation (MiCA) achieved full implementation in December 2024, creating the world's most comprehensive crypto framework. This regulation provides a single passport for service providers across member states, removing duplicate compliance burdens and smoothing cross-border activities.

These regulatory advancements have significantly reduced uncertainty and opened the door for institutional investors, pension funds, and traditional financial institutions to enter the crypto market with confidence.

Comparing Cryptocurrency with Forex and Stocks

Trading Hours and Accessibility

Cryptocurrency: 24/7/365 trading. The market never closes, not even on weekends or holidays

Forex: 24/5 trading. Open around the clock but closed on weekends

Stocks: Limited hours. Typically 9:30 AM to 4:00 PM with restricted after-hours trading

Market Volatility

Cryptocurrencies have higher volatility than both Forex and stocks. While this volatility creates opportunities for substantial returns, it also carries significantly higher risk. Crypto prices can surge or crash within minutes, driven by news, sentiment, or large market participants making significant trades.

In contrast, stock prices generally offer more stability than cryptocurrencies, while Forex sits in the middle with moderate volatility.

Liquidity Comparison

Forex has exceptional liquidity with a daily trading volume exceeding $6 trillion, making it the most liquid market. Cryptocurrency liquidity varies depending on the coin's market capitalization. Popular coins like Bitcoin and Ethereum have better liquidity than smaller, lesser-known coins.

Market Structure and Control

Forex is heavily regulated and influenced by central banks, governments, and large financial institutions, while cryptocurrency operates on decentralized networks independent of traditional institutions. This fundamental difference appeals to traders seeking financial autonomy and freedom from centralized control.

Capital Requirements

Similar to Forex, cryptocurrency trading typically requires less initial capital than stock market investing. Many crypto exchanges allow users to start trading with as little as $10 to $50, making it accessible to beginners and those with limited funds.

Advantages of Cryptocurrency Trading

Decentralization and Autonomy: Crypto is not controlled by governments or banks, providing autonomy to traders

24/7 Market Access: Unlike any other traditional market, crypto never closes, allowing traders to respond to global events in real-time

High Return Potential: Early Bitcoin adopters who purchased coins for dollars watched their investments grow to millions, while even latecomers to emerging protocols like Solana or Avalanche have seen returns exceeding 5,000% within single years

Low Entry Barriers: Minimal capital requirements and user-friendly mobile apps make crypto accessible to newcomers

Innovation and Technology: Access to cutting-edge financial technologies including DeFi, NFTs, and smart contracts

Risks and Challenges in Cryptocurrency Trading

Extreme Volatility: Crypto's volatility can lead to rapid losses, making it a riskier option than Forex or stocks

Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving in many jurisdictions, which could affect trading conditions

Security Concerns: From elaborate rug pulls where developers abandon projects after collecting funds, to sophisticated pump-and-dump operations, the crypto space remains plagued by bad actors exploiting the technology's anonymity

Limited Practical Use: Cryptocurrencies are not universally accepted, limiting their practical use in day-to-day transactions

Market Manipulation: Smaller cryptocurrencies can be vulnerable to price manipulation by large holders (whales)

Institutional Adoption: A Game Changer

Institutional users accounted for 68.50% of cryptocurrency market value in 2024, reflecting how custody readiness and ETF vehicles have de-risked entry for large asset pools. Major corporations like BlackRock, Fidelity, and JPMorgan have integrated digital currencies into their investment strategies, lending legitimacy to the asset class.

Public companies in North America collectively held over 688,000 BTC by May 2025, demonstrating significant corporate investment in cryptocurrency.

Should You Trade Cryptocurrency?

The decision to trade cryptocurrency alongside or instead of Forex and stocks depends on several factors:

Consider Cryptocurrency If:

- You can tolerate high volatility and significant price swings

- You're interested in cutting-edge financial technology

- You want 24/7 market access for maximum trading flexibility

- You're seeking high-risk, high-reward investment opportunities

- You have time to research and understand blockchain technology

Stick with Forex or Stocks If:

- You prefer more stable, predictable markets

- You want well-established regulatory frameworks

- You're focused on long-term, conservative investing

- You need consistent dividend income (stocks only)

- You're risk-averse and prioritize capital preservation

Combining All Three Markets: A Diversified Approach

Many experienced traders don't choose just one market. They diversify across all three. Professional traders often trade Forex as their main market while occasionally trading crypto and holding long-term investments in stocks. This multi-market approach allows traders to:

- Capitalize on opportunities in different market conditions

- Spread risk across uncorrelated assets

- Take advantage of 24/7 trading when needed

- Build long-term wealth through stocks while actively trading volatile assets

The Future: Cryptocurrency's Growing Integration

Mobile super-apps across Southeast Asia and Africa now permit users to top up wallets with Bitcoin, Ether, and stablecoins, extending day-to-day utility. As infrastructure improves and regulations solidify, cryptocurrency is transitioning from a speculative asset to a functional component of the global financial system.

The integration of cryptocurrency into traditional finance is accelerating. JPMorgan's Kinexys initiative to settle on-chain USD-EUR FX by early 2025 hints at corporate demand for same-day cross-border workflows, blurring the lines between traditional Forex and crypto markets.

frequently asked questions

Q: Which market is riskier, Forex or stocks? A: Both markets carry risk, but Forex is generally considered more volatile and thus potentially riskier due to high leverage and rapid price swings. However, individual stocks can also experience significant volatility, especially smaller companies. Understanding and managing risk is crucial in both markets.

Q: Is it possible to get rich quickly through Forex or stock trading? A: While both markets offer profit potential, the idea of "getting rich quickly" is generally unrealistic and often leads to significant losses. Success in either market requires knowledge, skill, discipline, and often considerable time and effort. Focus on long-term strategies and risk management rather than chasing quick profits.

Q: How much money do I need to start trading Forex or stocks? A: Forex often has lower minimum deposit requirements, sometimes as low as $100, making it seem more accessible. However, it's important to have enough capital to withstand potential losses. Stocks can require larger initial investments, especially for day trading, with some brokers requiring minimum account balances. Consider your financial situation and risk tolerance before starting.

Q: Which market is better for beginners? A: Neither market is inherently "better" for beginners. Both require learning and practice. Many find Forex more complex due to leverage and macroeconomic factors. Starting with a demo account in either market is highly recommended to gain experience without risking real money.

Q: Are Forex and stock trading regulated? A: Yes, both Forex and stock markets are subject to regulation, though the specific regulations vary by country. It's crucial to choose a reputable and regulated broker to protect your funds. Research the regulatory bodies in the regions where your chosen brokers operate.

Conclusion

Whether the stock market is better or Forex depends on several factors, and it is not possible to introduce one option as the definitive winner. Both markets have their own advantages and disadvantages, and the final decision depends on your personal preferences, risk tolerance, and financial goals. If you are looking for excitement and speed in trading and want to profit from short-term fluctuations, the Forex market can be a good option. This market offers high liquidity and many trading opportunities. But you should be aware that the risk in this market is also higher and requires sufficient knowledge and experience.

On the other hand, if you are looking for long-term investment and making a profit from the growth of companies, the stock market can be a better choice. In this market, you can invest by fundamental analysis and identifying companies with high growth potential and earn good profits in the long run. Now that you are familiar with the difference between the stock market and Forex, we will introduce you to the best Forex broker for Iranians in the following.