Exponential Moving Average: A Complete Guide for Forex Traders

The Exponential Moving Average (EMA) represents a technical indicator that assigns greater weight to recent price data, enabling traders to identify trends and potential entry or exit points with enhanced responsiveness compared to traditional moving averages. This characteristic makes the EMA particularly valuable in volatile forex markets where timely signals prove essential for trading success.

Key Takeaways

- The Exponential Moving Average applies a weighting factor that prioritizes recent price movements, resulting in faster reaction times to market changes compared to simple moving averages.

- Traders commonly employ multiple EMA periods simultaneously (such as 12-day and 26-day combinations) to generate crossover signals that indicate potential trend reversals or continuations.

- The EMA calculation incorporates a smoothing multiplier that increases sensitivity proportionally as the time period decreases, making shorter EMAs more responsive to price fluctuations.

- Cross-asset applicability allows the EMA to function effectively across forex pairs, stocks, commodities, and cryptocurrencies with consistent reliability.

- Risk management remains essential when utilizing EMA signals, as false signals occur frequently during ranging or choppy market conditions.

What Is Exponential Moving Average?

The Exponential Moving Average constitutes a type of moving average that differs from the simple moving average through its weighting methodology. Unlike the simple moving average, which assigns equal weight to all data points within the calculation period, the EMA applies exponentially decreasing weights to older prices. This mathematical approach results in an indicator that responds more quickly to recent price changes while still maintaining consideration of historical data.

The fundamental distinction lies in the calculation formula. The EMA incorporates a smoothing factor that determines the degree of weight applied to the most recent price observation. This smoothing constant, derived from the selected time period, ensures that recent market activity exerts greater influence on the indicator's value. Consequently, the EMA tracks current price movements more closely than its simple counterpart.

Forex traders favor the EMA specifically because currency markets demonstrate high volatility and rapid directional changes. The indicator's sensitivity to recent price action enables traders to detect trend shifts earlier than would be possible with indicators that treat all historical data equally. This temporal advantage translates into improved entry and exit timing within fast-moving forex environments.

How Exponential Moving Average Works

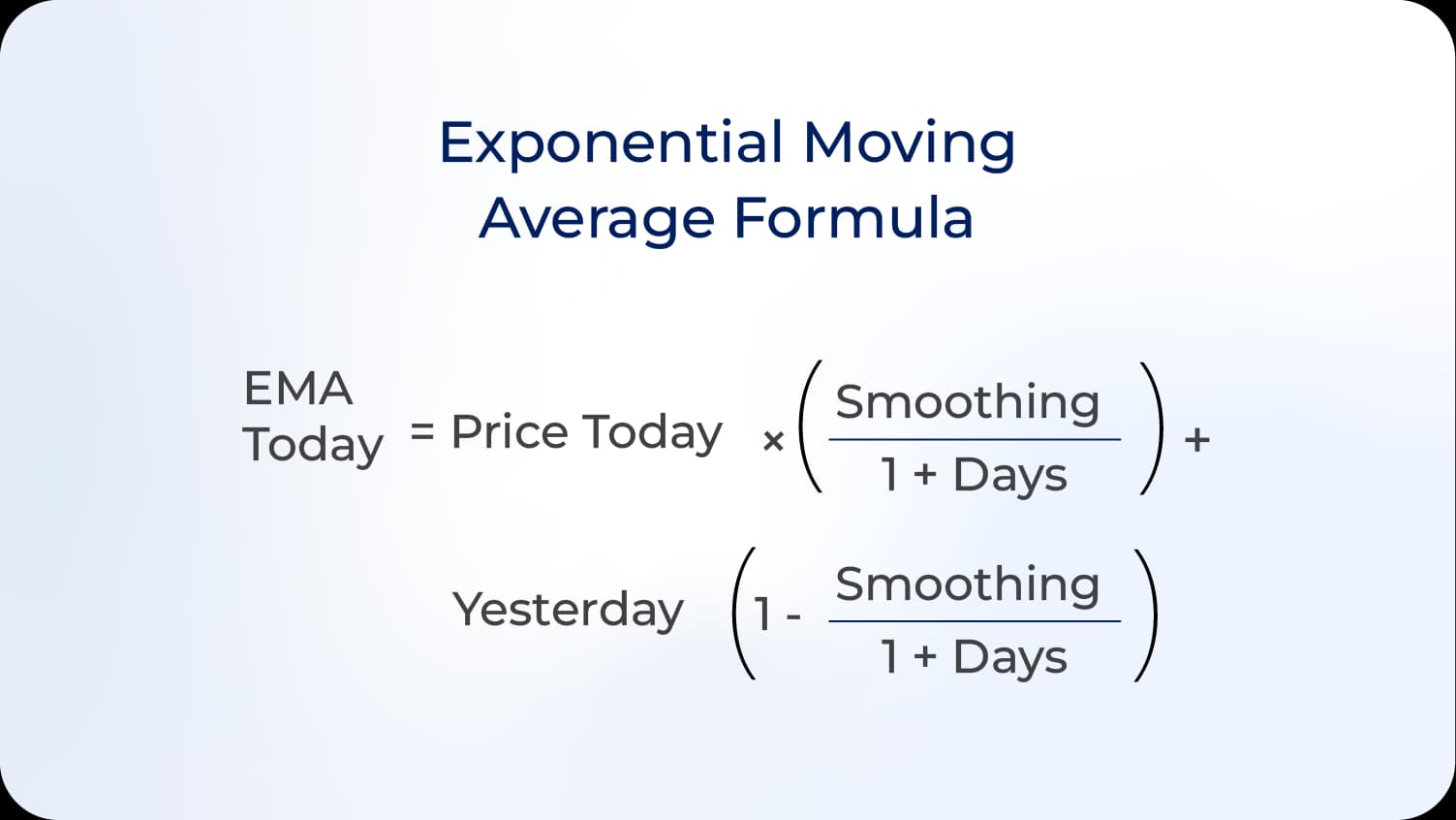

The EMA calculation begins with a simple moving average for the initial value, then applies the exponential smoothing formula for subsequent calculations. The smoothing multiplier equals 2 divided by (the number of periods plus 1). For a 10-period EMA, the multiplier becomes 2/(10+1) = 0.1818 or approximately 18.18 percent.

Each new EMA value derives from the formula: EMA = (Current Price × Multiplier) + (Previous EMA × (1 - Multiplier)). This recursive calculation ensures that each successive EMA incorporates both the newest price information and the weighted history of previous calculations. The multiplier determines how much influence the current price exerts versus the accumulated historical average.

The weighting structure creates a decay function where the impact of any individual price observation diminishes exponentially as time progresses. A price from ten periods ago influences the current EMA value, but with substantially less weight than the price from three periods ago. This graduated weighting system produces an indicator that balances responsiveness with stability.

Simple vs Exponential Moving Average

The simple moving average (SMA) calculates the arithmetic mean of prices over a specified period, assigning identical weight to each data point regardless of when it occurred. If examining a 20-day SMA, the price from 20 days ago receives the same consideration as yesterday's price. This equal-weighting approach produces a smoother line that filters out short-term noise effectively.

The exponential moving average applies progressively greater weight to recent observations while maintaining diminishing influence from older data. This weighting differential causes the EMA to converge toward current prices more rapidly than the SMA. When prices change direction, the EMA reflects this shift sooner, generating signals earlier in the trend development process.

Traders select between these indicators based on their strategic objectives. The SMA suits strategies that prioritize trend confirmation and reduced false signals, accepting delayed response as a trade-off for stability. The EMA serves strategies that require quick reaction to momentum shifts, accepting increased false signals during consolidation periods as a cost of enhanced sensitivity.

The visual difference manifests clearly on price charts. The SMA appears as a smoother line that maintains greater distance from price action during volatile periods. The EMA hugs price movements more closely, crossing above and below the price level more frequently. This behavioral contrast influences which indicator traders incorporate into specific trading systems.

How to Use Exponential Moving Average

Trend Identification

The EMA serves as a dynamic support and resistance level that adapts to price movement. When prices trade above the EMA, the market demonstrates upward momentum, suggesting that buyers control the immediate trend. Conversely, prices below the EMA indicate downward momentum and seller dominance. The slope of the EMA itself provides additional confirmation, with upward-sloping EMAs supporting bullish interpretations and downward-sloping EMAs confirming bearish conditions.

Traders often observe the relationship between price and multiple EMAs simultaneously. A common configuration employs the 50-period and 200-period EMAs. When both indicators slope upward and prices remain above both lines, the trend structure supports long positions. When both slope downward with prices beneath them, short positions align with the prevailing trend.

EMA Crossover Signals

Crossover strategies generate explicit entry and exit signals based on the intersection of two EMAs with different periods. The most widely implemented crossover system uses a fast EMA (commonly 12-period) and a slow EMA (commonly 26-period). When the fast EMA crosses above the slow EMA, the system generates a buy signal. When the fast EMA crosses below the slow EMA, the system produces a sell signal.

These crossovers indicate momentum shifts that precede sustained directional moves. The fast EMA responds to price changes first, changing direction and crossing the slow EMA as the new trend gains strength. The lag between the two indicators creates the crossover event, which traders interpret as confirmation that the price action has established sufficient momentum to justify a position.

The reliability of crossover signals varies with market conditions. Trending markets produce profitable crossover trades as each signal captures a portion of the directional move. Ranging markets generate frequent whipsaw signals where the EMAs cross repeatedly without sustained price movement, resulting in consecutive losing trades. Successful implementation requires filtering mechanisms that distinguish trending from ranging environments.

Multiple EMA Systems

Advanced traders construct systems using three or more EMAs to create zones of support or resistance. A common configuration includes the 8-period, 13-period, and 21-period EMAs. When these indicators align with the fastest on top during an uptrend (or fastest on bottom during a downtrend), the alignment suggests strong trend momentum. When the EMAs compress together, the configuration warns of potential consolidation or reversal.

The spacing between EMAs provides information about trend strength. Wide separation indicates robust momentum with each EMA level serving as a distinct support or resistance zone. Narrow spacing or convergence suggests weakening momentum and increased probability of directional change. Traders monitor these spatial relationships to assess whether to maintain existing positions or prepare for exits.

Read More: Mastering Forex Trends

Integration with Other Indicators

The EMA complements momentum oscillators such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD). Traders combine EMA trend direction with RSI overbought or oversold readings to identify high-probability setups. For example, a bullish EMA alignment accompanied by RSI rising from oversold territory provides stronger confirmation than either signal independently.

Volume analysis enhances EMA interpretation by confirming the strength behind price movements. An EMA crossover accompanied by increasing volume suggests genuine participation and higher probability of follow-through. Conversely, crossovers on diminishing volume warn of potential false signals. This multi-indicator approach reduces false positives and improves trade selection quality.

EMA Calculation Example

Consider calculating a 5-period EMA for a forex pair with the following closing prices: 1.1000, 1.1020, 1.1015, 1.1030, and 1.1040. The multiplier equals 2/(5+1) = 0.3333.

Starting with the simple average of the first five periods: (1.1000 + 1.1020 + 1.1015 + 1.1030 + 1.1040) / 5 = 1.1021. This value becomes the initial EMA.

For the next calculation, assume the sixth period closes at 1.1050. The new EMA equals: (1.1050 × 0.3333) + (1.1021 × 0.6667) = 0.3683 + 0.7347 = 1.1030. This process continues with each subsequent period, using the previous EMA value in the formula.

The table below illustrates how the EMA evolves over ten periods:

| Period | Closing Price | EMA Value |

|---|---|---|

| 1-5 | Various | 1.1021 |

| 6 | 1.1050 | 1.1030 |

| 7 | 1.1045 | 1.1035 |

| 8 | 1.1060 | 1.1043 |

| 9 | 1.1055 | 1.1047 |

| 10 | 1.1070 | 1.1055 |

The EMA responds to each price change, moving higher as prices increase and incorporating the weighted history into each calculation. This example demonstrates the indicator's sensitivity to recent price action while maintaining the influence of prior values through the recursive formula.

Common EMA Periods for Forex Trading

Forex traders select EMA periods based on their trading timeframe and strategy objectives. Short-term traders operating on 5-minute or 15-minute charts frequently employ the 9-period, 12-period, and 26-period EMAs. These fast-responding indicators generate frequent signals suitable for scalping and day trading approaches that seek to capitalize on intraday volatility.

Swing traders working with 4-hour or daily charts commonly utilize the 20-period, 50-period, and 100-period EMAs. These intermediate timeframes filter short-term noise while maintaining sufficient responsiveness to capture multi-day trends. The 50-period EMA particularly serves as a widely watched indicator that often functions as dynamic support during uptrends or resistance during downtrends.

Position traders analyzing weekly or monthly charts rely on the 100-period and 200-period EMAs to identify major trend direction. These slow-moving indicators smooth out minor fluctuations and reveal the underlying market structure. The 200-period EMA specifically holds significance across market participants, with price behavior around this level often triggering substantial institutional activity.

Advantages and Limitations

The EMA's primary advantage lies in its reduced lag compared to simple moving averages. This characteristic enables earlier signal generation, allowing traders to enter trends closer to their initiation points and exit before significant reversals occur. The mathematical weighting structure prevents outdated price information from exerting undue influence on current market assessment.

The indicator demonstrates versatility across different markets and timeframes. Whether analyzing major currency pairs like EUR/USD or exotic crosses, the EMA maintains consistent behavior and reliability. This cross-market applicability allows traders to develop standardized approaches that function across their entire trading universe.

However, the EMA's sensitivity creates vulnerability during consolidation periods. The indicator generates frequent crossover signals when prices lack directional conviction, resulting in whipsaw losses. Traders must implement additional filters or avoid trading EMA signals during identified ranging conditions to mitigate this limitation.

The EMA operates as a lagging indicator despite its reduced delay compared to the SMA. All moving averages derive from historical price data, meaning they confirm trends rather than predict them. By the time an EMA crossover occurs, a portion of the trend has already elapsed. This inherent lag prevents perfect market timing and requires acceptance of missed initial movement.

Risk Management with EMA Trading

Effective EMA trading requires clearly defined risk parameters. Traders should establish stop-loss levels that account for normal price volatility around the EMA. A common approach places stops below the slow EMA for long positions or above the slow EMA for short positions, providing room for typical retracement without premature exit.

Position sizing must reflect the distance between entry and stop-loss levels. Larger EMA periods produce wider spacing between entry and stop prices, requiring smaller position sizes to maintain consistent risk per trade. This inverse relationship between timeframe and position size ensures that account risk remains controlled regardless of which EMA configuration the strategy employs.

False signal probability increases during low-volume periods and before major economic announcements. Traders reduce risk exposure during these times by decreasing position sizes or avoiding new entries entirely. This adaptive approach acknowledges that indicator reliability varies with market conditions and adjusts risk accordingly.

Conclusion

The Exponential Moving Average provides forex traders with a mathematically robust tool for trend identification and momentum analysis. Its weighted calculation methodology delivers improved responsiveness compared to simple moving averages, enabling earlier detection of directional changes within volatile currency markets. Successful implementation requires understanding both the indicator's advantages and limitations, along with appropriate risk management protocols.

Traders who master EMA application gain a versatile analytical framework applicable across multiple timeframes and market conditions. The indicator's effectiveness increases when combined with complementary technical tools and disciplined execution. Those seeking to enhance their technical analysis capabilities should consider incorporating EMA analysis into their trading methodology while maintaining realistic expectations about indicator performance during various market regimes.

Begin testing EMA strategies on a demonstration account to observe how different period combinations perform with specific currency pairs and timeframes. This practical experience builds intuition about signal quality and optimal parameter selection for individual trading styles.