Fibonacci Trading: Retracements, Extensions and Trading Strategies

Fibonacci trading employs mathematical ratios derived from the Fibonacci sequence to identify potential support and resistance levels in financial markets. Traders utilize these ratios to predict price retracements, extensions, and reversal points, enabling more informed entry and exit decisions. This analytical approach combines historical price patterns with mathematical precision to enhance trading strategies.

Key Takeaways

- Fibonacci retracement levels (23.6%, 38.2%, 50%, 61.8%, 78.6%) identify potential reversal zones where price may find support or resistance during pullbacks

- The golden ratio (61.8%) serves as the most significant Fibonacci level, frequently acting as a strong psychological barrier in price movements

- Combining Fibonacci tools with trend analysis, candlestick patterns, and volume indicators increases the probability of successful trade setups

- Multiple timeframe analysis strengthens Fibonacci trading signals by confirming alignment across different temporal perspectives

- Risk management protocols remain essential, as Fibonacci levels provide probabilistic guidance rather than guaranteed outcomes

What Is Fibonacci in Trading?

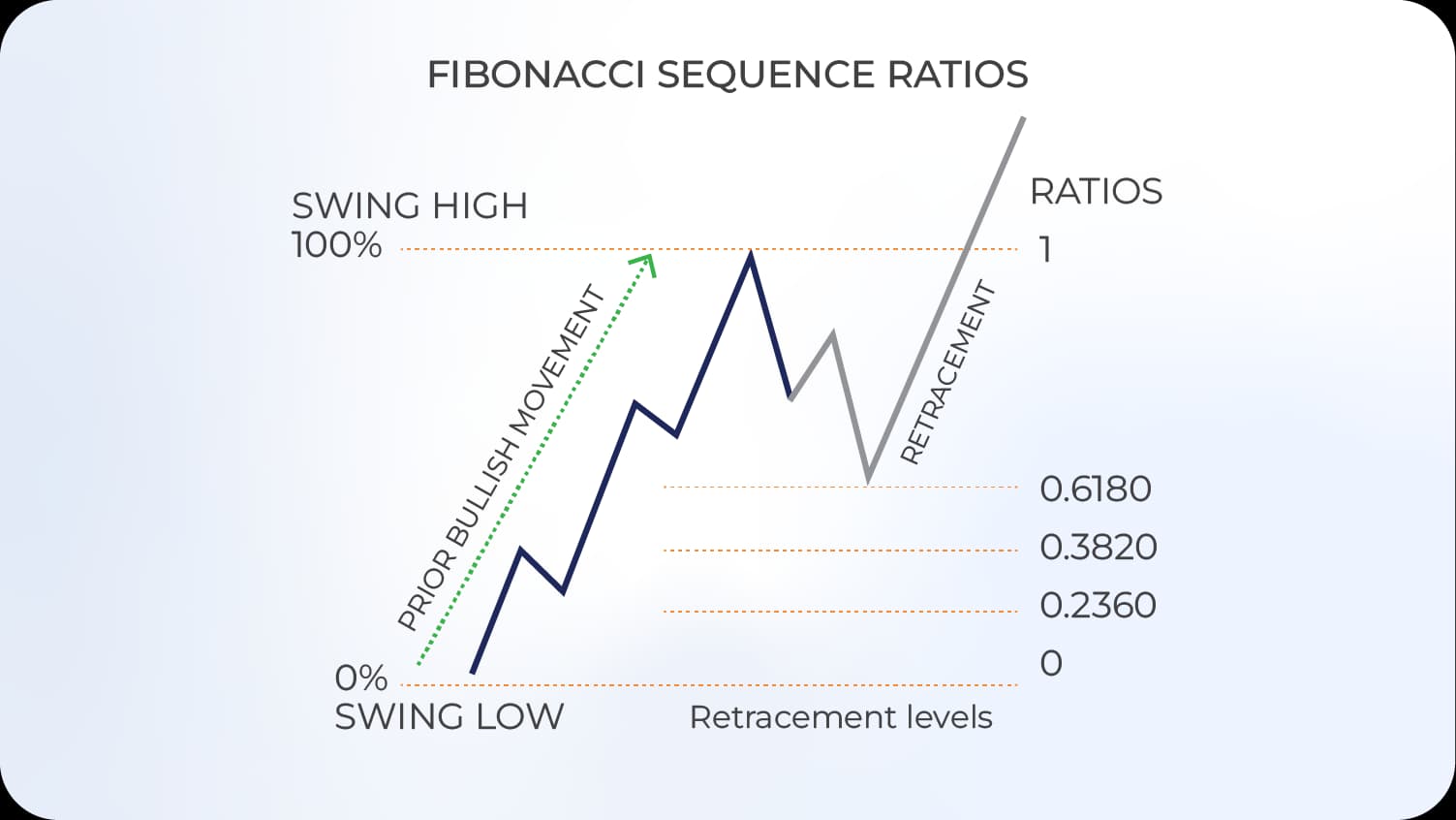

Fibonacci in trading refers to the application of numerical sequences and ratios discovered by Italian mathematician Leonardo Fibonacci to financial market analysis. The Fibonacci sequence (0, 1, 1, 2, 3, 5, 8, 13, 21...) generates ratios that appear throughout natural systems and, remarkably, within price charts.

The primary ratios used in trading derive from dividing numbers within the sequence. The 61.8% ratio emerges when dividing any number by the number immediately following it. The 38.2% ratio results from dividing a number by the number two positions higher. These mathematical relationships translate into horizontal lines on price charts, marking levels where assets may pause, reverse, or consolidate.

Market participants gravitate toward these levels due to psychological factors and widespread adoption. When numerous traders recognize the same support or resistance zones, collective behavior reinforces the technical significance of these levels. This self-fulfilling prophecy element strengthens Fibonacci analysis as a legitimate forecasting tool.

Understanding Fibonacci Retracement

Fibonacci retracement identifies potential reversal zones during temporary price corrections within larger trends. Traders plot retracement levels by measuring the vertical distance between significant swing highs and swing lows, then dividing that range by key Fibonacci ratios.

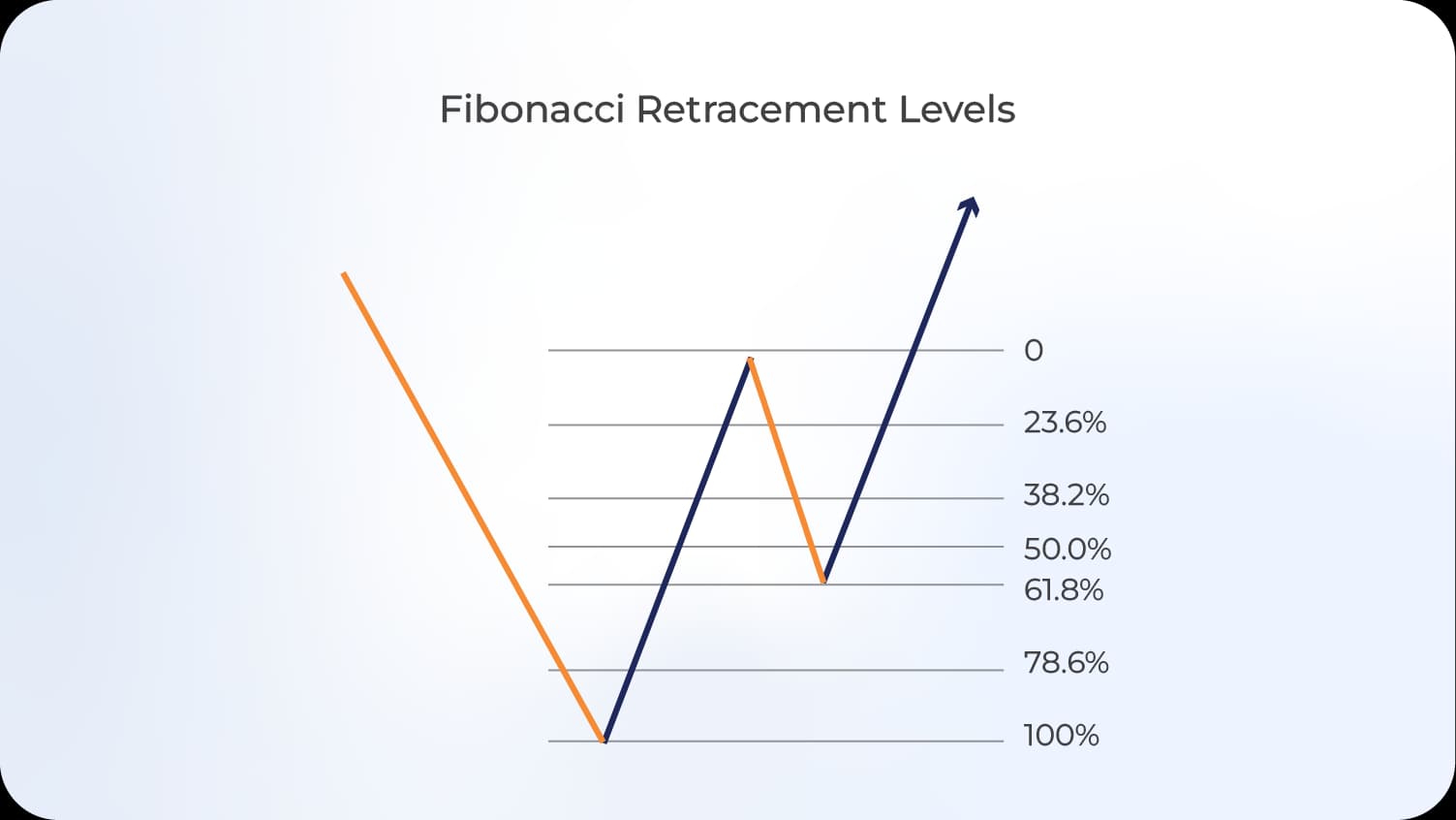

The standard retracement levels include:

| Fibonacci Level | Trading Significance |

|---|---|

| 23.6% | Shallow retracement, strong trend continuation |

| 38.2% | Moderate pullback, common in robust trends |

| 50% | Psychological midpoint, not a true Fibonacci ratio but widely monitored |

| 61.8% | Golden ratio, strongest retracement level |

| 78.6% | Deep pullback, trend validity in question |

Price often respects these mathematical zones during corrective phases. An uptrend experiencing a pullback may find support at the 38.2% or 61.8% retracement level before resuming upward momentum. Conversely, downtrends may encounter resistance at these same levels during temporary bounces.

The effectiveness of retracement analysis depends on proper swing point identification. Major peaks and troughs that represent significant market turning points produce more reliable Fibonacci levels than minor fluctuations. Traders must exercise judgment in selecting appropriate reference points for measurement.

How to Use Fibonacci in Trading

Applying Fibonacci tools requires systematic methodology and integration with broader technical analysis frameworks. The process begins with trend identification, followed by level plotting, and concludes with strategic execution.

Step 1: Identify the Prevailing Trend

Establish whether the market exhibits an uptrend, downtrend, or consolidation pattern. Fibonacci retracements function optimally within trending environments where directional bias exists. Utilize moving averages, trendlines, or higher highs and higher lows (for uptrends) to confirm market direction.

Step 2: Locate Significant Swing Points

Determine the most recent major swing high and swing low. In uptrends, measure from the swing low to the swing high. In downtrends, measure from the swing high to the swing low. The magnitude of the measured move should represent a substantial price leg rather than minor fluctuations.

Step 3: Plot Fibonacci Levels

Apply the Fibonacci retracement tool available in trading platforms. The software automatically generates horizontal lines at standard Fibonacci ratios between the two selected points. These levels now serve as potential zones for price reaction.

Step 4: Wait for Price to Retrace

Allow the market to pull back naturally toward the Fibonacci levels. Premature entry before price reaches these zones reduces the probability of successful trades. Patient observation identifies which specific level price respects.

Step 5: Confirm with Additional Indicators

Strengthen trading signals by requiring confluence with other technical factors. Candlestick reversal patterns (hammer, engulfing, doji) at Fibonacci levels enhance reliability. Volume analysis revealing increased activity at these zones adds confirmation. Oscillators showing oversold or overbought conditions in conjunction with Fibonacci levels create high-probability setups.

Step 6: Execute the Trade

Enter positions when price demonstrates respect for a Fibonacci level through price action confirmation. Place stop-loss orders below the next Fibonacci level or beyond recent swing points to limit potential losses. Establish profit targets at previous swing extremes or subsequent Fibonacci extension levels.

Fibonacci Trading Strategy

A comprehensive Fibonacci trading strategy integrates multiple analytical dimensions to filter noise and identify optimal opportunities. The following approach combines technical precision with risk management discipline.

Trend-Following Fibonacci Strategy

This methodology capitalizes on retracements within established trends. Traders seek entries during temporary pullbacks, anticipating trend resumption.

Uptrend Application:

- Confirm an uptrend through ascending peaks and troughs

- Identify the most recent swing low and current swing high

- Plot Fibonacci retracement levels from low to high

- Monitor price as it retraces toward the 38.2%, 50%, or 61.8% levels

- Observe for bullish reversal patterns at these zones

- Enter long positions upon confirmation

- Place stop-loss below the 78.6% level

- Target the previous swing high or Fibonacci extension levels (127.2%, 161.8%)

Downtrend Application:

- Confirm a downtrend through descending peaks and troughs

- Identify the most recent swing high and current swing low

- Plot Fibonacci retracement levels from high to low

- Monitor price as it retraces toward the 38.2%, 50%, or 61.8% levels

- Observe for bearish reversal patterns at these zones

- Enter short positions upon confirmation

- Place stop-loss above the 78.6% level

- Target the previous swing low or Fibonacci extension levels

Multiple Timeframe Fibonacci Analysis

Enhanced accuracy emerges when Fibonacci levels align across different timeframes. A 61.8% retracement on a daily chart coinciding with a 50% retracement on a 4-hour chart creates a confluence zone with heightened significance.

Traders analyze higher timeframes (daily, weekly) to establish the broader trend context and major Fibonacci levels. Lower timeframes (hourly, 15-minute) provide precise entry timing and stop-loss placement. This hierarchical approach filters weaker signals and emphasizes setups where multiple temporal perspectives converge.

Fibonacci Extension Strategy

While retracements identify reversal zones, Fibonacci extensions project potential profit targets beyond the original move. After price completes a retracement and resumes the trend, extensions estimate how far the continuation may travel.

Common extension levels include 127.2%, 161.8%, 200%, and 261.8%. Traders measure the initial impulse move, then project these percentages beyond the retracement swing point. These levels serve as logical areas to scale out of positions or secure profits.

| Tool | Purpose | Typical Use Case | Key Levels |

|---|---|---|---|

| Fibonacci Retracement | Identify potential reversal zones | Entry points during pullbacks | 38.2%, 50%, 61.8% |

| Fibonacci Extension | Project profit targets | Exit points during trend continuation | 127.2%, 161.8%, 261.8% |

Advanced Fibonacci Techniques

Sophisticated traders employ additional Fibonacci tools to refine analysis and capture nuanced market dynamics.

Fibonacci Fans

Fibonacci fans consist of diagonal trendlines emanating from a significant swing point, angled at Fibonacci ratios. These dynamic levels adjust with time, providing evolving support and resistance projections. Fans prove particularly useful in trending markets where price maintains consistent momentum.

Fibonacci Arcs

Fibonacci arcs draw curved lines at Fibonacci ratio distances from a swing point. These arcs represent potential support and resistance zones that consider both price and time dimensions. The intersection of arcs with price action often coincides with reversal points.

Fibonacci Time Zones

This tool projects vertical lines at intervals corresponding to Fibonacci numbers (1, 2, 3, 5, 8, 13, 21 periods). Traders anticipate potential trend changes or significant price moves occurring near these temporal markers. Time zone analysis complements traditional level-based approaches by introducing temporal forecasting.

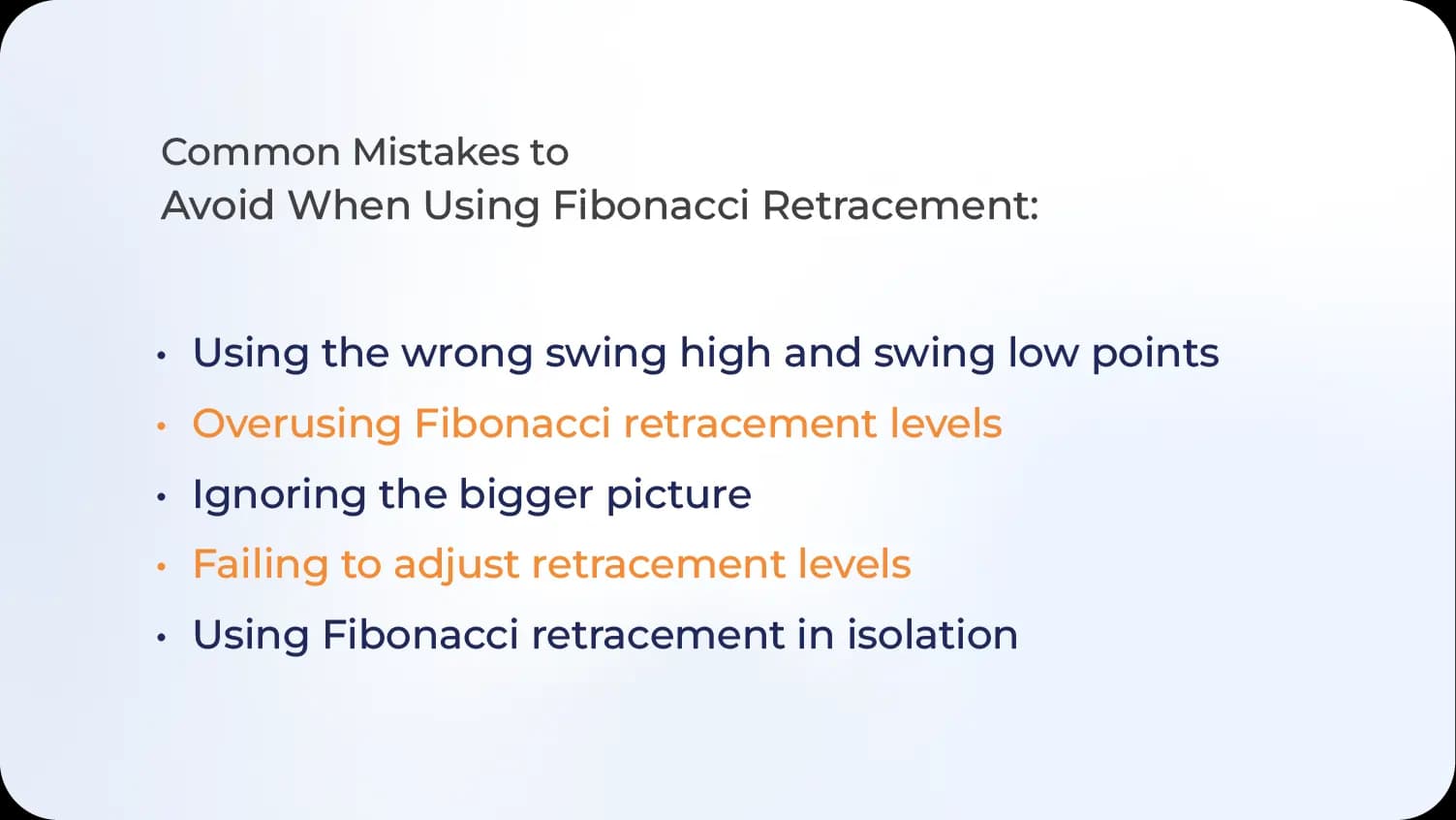

Common Mistakes in Fibonacci Trading

Awareness of frequent errors prevents systematic losses and improves analytical discipline.

Over-Reliance on Fibonacci Alone

Fibonacci levels provide probabilistic guidance rather than certainty. Markets violate these levels regularly, particularly during high-impact news events or fundamental shifts. Traders who ignore broader context, market structure, or risk management face inevitable disappointment.

Improper Swing Point Selection

Arbitrary or inconsistent swing point identification produces unreliable Fibonacci levels. Minor fluctuations within larger movements should not serve as reference points. Focus on swing extremes that represent genuine market turning points and reflect significant trader participation.

Ignoring the Larger Trend

Attempting counter-trend trades at Fibonacci levels contradicts probability. While retracements occur within trends, fighting the dominant direction reduces success rates. Fibonacci analysis functions optimally when aligned with the prevailing market trajectory.

Neglecting Confirmation Signals

Entering positions immediately upon price reaching a Fibonacci level without additional validation increases failure rates. Require candlestick patterns, volume spikes, or indicator signals before committing capital. Confirmation filters premature entries and false signals.

Poor Risk Management

Even the most precise Fibonacci setups fail occasionally. Traders must employ appropriate position sizing, stop-loss placement, and risk-reward ratios. No single trade should jeopardize account viability, regardless of perceived setup quality.

Combining Fibonacci with Other Technical Indicators

Integration with complementary analytical tools creates robust trading systems with higher reliability.

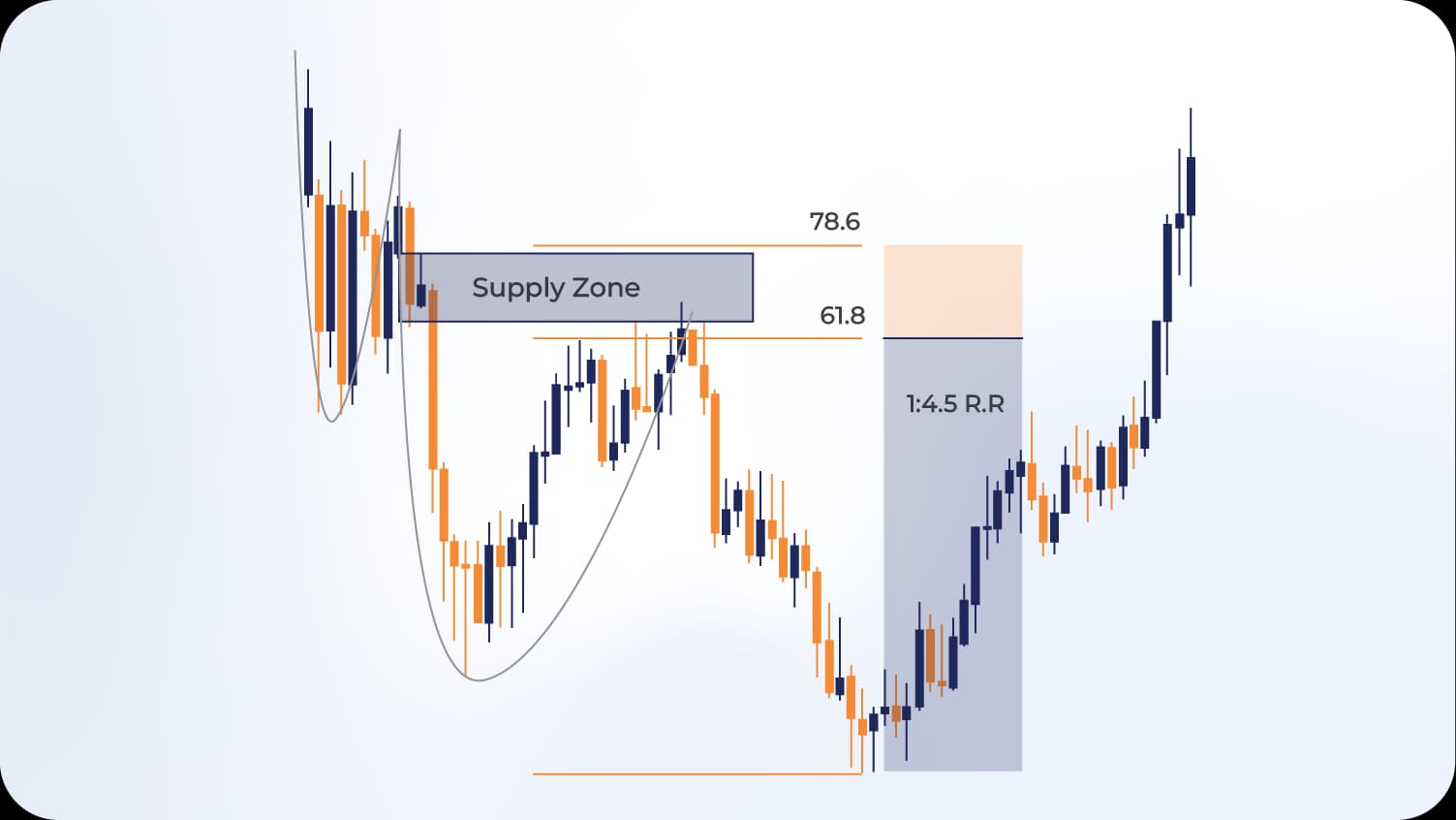

Fibonacci and Moving Averages

Moving averages define trend direction and provide additional support/resistance levels. When Fibonacci retracement zones coincide with key moving averages (50-day, 200-day), the confluence strengthens the technical case for reversals. Price finding support at both a 61.8% Fibonacci level and the 200-day moving average presents a compelling entry opportunity.

Fibonacci and RSI (Relative Strength Index)

The RSI oscillator measures momentum and identifies overbought or oversold conditions. Combining RSI readings with Fibonacci levels adds another confirmation layer. A 61.8% retracement level where RSI simultaneously shows oversold conditions (below 30 in uptrends) creates a high-probability long setup.

Fibonacci and MACD (Moving Average Convergence Divergence)

MACD signals trend direction and momentum shifts through histogram patterns and signal line crossovers. When price reaches a Fibonacci retracement level and MACD shows bullish divergence or generates a buy signal, the convergence of these technical factors enhances trade conviction.

Fibonacci and Candlestick Patterns

Japanese candlestick formations provide immediate price action context. Reversal patterns (hammer, engulfing, morning star) occurring precisely at Fibonacci levels offer visual confirmation of buyer or seller commitment. The combination transforms mathematical levels into tangible behavioral evidence.

Read More: Candlestick Patterns: A Complete Guide for Forex Traders

Fibonacci Trading in Different Market Conditions

Market environments influence Fibonacci effectiveness and require adaptive application.

Trending Markets

Fibonacci retracements excel in trending conditions where clear directional bias exists. Pullbacks regularly respect the 38.2% and 61.8% levels, providing recurring entry opportunities. Extensions accurately project profit targets during strong momentum phases.

Range-Bound Markets

Consolidating markets diminish Fibonacci reliability. Without a significant prior move to measure, retracement levels lack context and predictive power. Traders should reduce position sizes or abstain from Fibonacci strategies during extended consolidation periods.

Volatile Markets

High volatility environments cause price to whipsaw through Fibonacci levels rapidly, triggering stop-losses before reversals materialize. Wider stop-loss placement or temporary strategy suspension preserves capital during extreme volatility. Alternatively, traders may switch to higher timeframes where price action appears less erratic.

Risk Management in Fibonacci Trading

Disciplined risk protocols protect against the inevitable failures inherent in probabilistic trading approaches.

Position Sizing

Never risk more than 1-2% of trading capital on any single Fibonacci-based trade. This conservative approach ensures that consecutive losses do not critically damage account equity. Position size should adjust based on stop-loss distance, maintaining consistent risk per trade.

Stop-Loss Placement

Logical stop-loss locations include:

- Below the next Fibonacci level (e.g., stop below 61.8% if entering at 50%)

- Beyond the recent swing extreme

- A fixed percentage or pip distance based on average true range

Stops must provide sufficient room for normal price fluctuation while preventing catastrophic losses if the setup fails.

Risk-Reward Ratios

Maintain minimum risk-reward ratios of 1:2 or 1:3. If risking 50 pips, target at least 100-150 pips in profit. Fibonacci extensions naturally facilitate favorable risk-reward profiles by projecting distant profit targets relative to entry zones.

Trade Management

Consider partial profit-taking at intermediate Fibonacci extension levels while allowing remaining positions to capture maximum potential. Moving stop-loss to breakeven after achieving the first profit target eliminates downside risk on remaining exposure.

Practical Fibonacci Trading Examples

Example 1: EUR/USD Uptrend Retracement

The EUR/USD currency pair establishes an uptrend, advancing from 1.0800 to 1.1200 over two weeks. Traders identify this 400-pip move and plot Fibonacci retracement levels from the swing low (1.0800) to the swing high (1.1200).

Calculated retracement levels:

- 23.6%: 1.1106

- 38.2%: 1.1047

- 50%: 1.1000

- 61.8%: 1.0952

- 78.6%: 1.0885

Price begins retracing and finds support at the 61.8% level (1.0952). A bullish engulfing candlestick pattern forms at this zone, coinciding with RSI showing oversold conditions. Traders enter long positions at 1.0960 with a stop-loss at 1.0920 (below the 78.6% level). The initial profit target sits at the previous high (1.1200), offering a 240-pip reward against a 40-pip risk (6:1 risk-reward ratio).

Example 2: GBP/JPY Downtrend Retracement

GBP/JPY enters a downtrend, declining from 185.00 to 180.00. Traders measure this 500-pip drop and apply Fibonacci retracement from the swing high (185.00) to the swing low (180.00).

Calculated retracement levels:

- 23.6%: 181.18

- 38.2%: 181.91

- 50%: 182.50

- 61.8%: 183.09

- 78.6%: 183.93

Price retraces toward the 50% level (182.50) where it encounters resistance. A bearish pin bar (shooting star) forms, and MACD generates a sell signal. Traders enter short positions at 182.40 with a stop-loss at 183.20 (above the 61.8% level). The profit target aligns with the previous low (180.00), providing a 240-pip potential gain against an 80-pip risk (3:1 risk-reward ratio).

Frequently Asked Questions

What Is Fibonacci in Trading?

Fibonacci in trading applies mathematical ratios derived from the Fibonacci sequence to identify potential support, resistance, and reversal levels in financial markets. The key ratios (23.6%, 38.2%, 50%, 61.8%, 78.6%) mark zones where price frequently pauses or reverses during corrections within larger trends.

How to Use Fibonacci in Trading?

Using Fibonacci in trading involves five steps: identify the prevailing trend, locate significant swing points (high and low), plot Fibonacci retracement levels between these points, wait for price to retrace toward these levels, and confirm setups with additional technical indicators before entering positions. Stop-losses typically place beyond the next Fibonacci level or recent swing extremes.

Which Fibonacci Level Is Most Important?

The 61.8% level, known as the golden ratio, represents the most significant Fibonacci retracement level. This ratio appears throughout nature and financial markets, often serving as a strong support or resistance zone. Traders prioritize the 61.8% level when multiple setups present themselves simultaneously.

Can Fibonacci Trading Be Used Alone?

Fibonacci trading should not be used in isolation. While Fibonacci levels provide valuable reference points, combining them with trend analysis, candlestick patterns, volume indicators, and momentum oscillators substantially improves success rates. Confluence of multiple technical factors creates higher-probability setups than relying on Fibonacci alone.

Do Fibonacci Levels Work in All Timeframes?

Fibonacci levels function across all timeframes, from one-minute charts to monthly charts. However, higher timeframes (daily, weekly) generally produce more reliable signals due to increased trader participation and reduced market noise. Multiple timeframe analysis, where Fibonacci levels align across different temporal perspectives, generates the most robust trading opportunities.

What Is the Difference Between Fibonacci Retracement and Extension?

Fibonacci retracement identifies potential reversal zones during pullbacks within existing trends, helping traders determine entry points. Fibonacci extension projects profit targets beyond the original price move, estimating how far the trend may continue. Retracements answer where price might pause; extensions answer where price might go.

Conclusion

Fibonacci trading offers a mathematically grounded framework for analyzing price movements and identifying high-probability trading opportunities in forex markets. The integration of Fibonacci retracement levels with trend analysis, confirmation indicators, and disciplined risk management creates a comprehensive methodology capable of consistent results.

Success with Fibonacci trading requires patience, practice, and continuous refinement. Traders must develop proficiency in identifying significant swing points, recognizing valid setups, and executing with proper risk controls. The probabilistic nature of technical analysis means no system achieves perfection, but Fibonacci tools provide a structured approach that improves decision-making over time.

Market participants who master Fibonacci techniques gain a competitive advantage through enhanced pattern recognition and strategic positioning. The widespread adoption of these levels among professional traders reinforces their validity, creating self-fulfilling prophecies that strengthen technical signals.

Begin implementing Fibonacci analysis gradually, testing strategies on demo accounts before committing real capital. Document trades, analyze outcomes, and adjust methodologies based on empirical results. Continuous learning and adaptation separate consistently profitable traders from those who abandon technical analysis prematurely.