Market Structure in Forex Trading: A Complete Guide

Market structure represents the framework through which price movements unfold in financial markets, revealing the underlying dynamics between buyers and sellers. This analytical tool enables traders to identify trends, anticipate reversals, and position entries with greater precision. Understanding market structure transforms raw price action into actionable intelligence, forming the foundation for disciplined trading strategies across all timeframes.

Key Takeaways

- Market structure defines trend direction through the sequential formation of higher highs and higher lows (uptrends) or lower highs and lower lows (downtrends)

- Market structure shifts signal potential reversals when price breaks previous swing points, alerting traders to changing market conditions

- Price action analysis within market structure provides context for support and resistance levels, enhancing entry and exit timing

- Multiple timeframe analysis strengthens trading decisions by aligning market structure across different temporal perspectives

What Is Market Structure?

Market structure defines the organization of price movements within financial markets, specifically identifying how peaks and troughs form sequential patterns that reveal directional bias. This concept examines the relationship between successive highs and lows to determine whether buyers or sellers maintain control of price action.

The framework operates on a fundamental principle: trending markets create specific patterns of swing points that distinguish bullish conditions from bearish ones. When price establishes higher highs accompanied by higher lows, an uptrend exists. Conversely, lower highs followed by lower lows indicate a downtrend. These patterns emerge across all timeframes, from minute charts to monthly intervals, providing traders with a universal language for market analysis.

Market structure transcends subjective interpretation by anchoring analysis to observable price extremes. Rather than relying on indicators that lag price movement, this approach examines the raw architecture of market behavior. The methodology recognizes that markets alternate between trending and consolidating phases, with each phase displaying distinct structural characteristics.

Understanding Price Action Through Market Structure

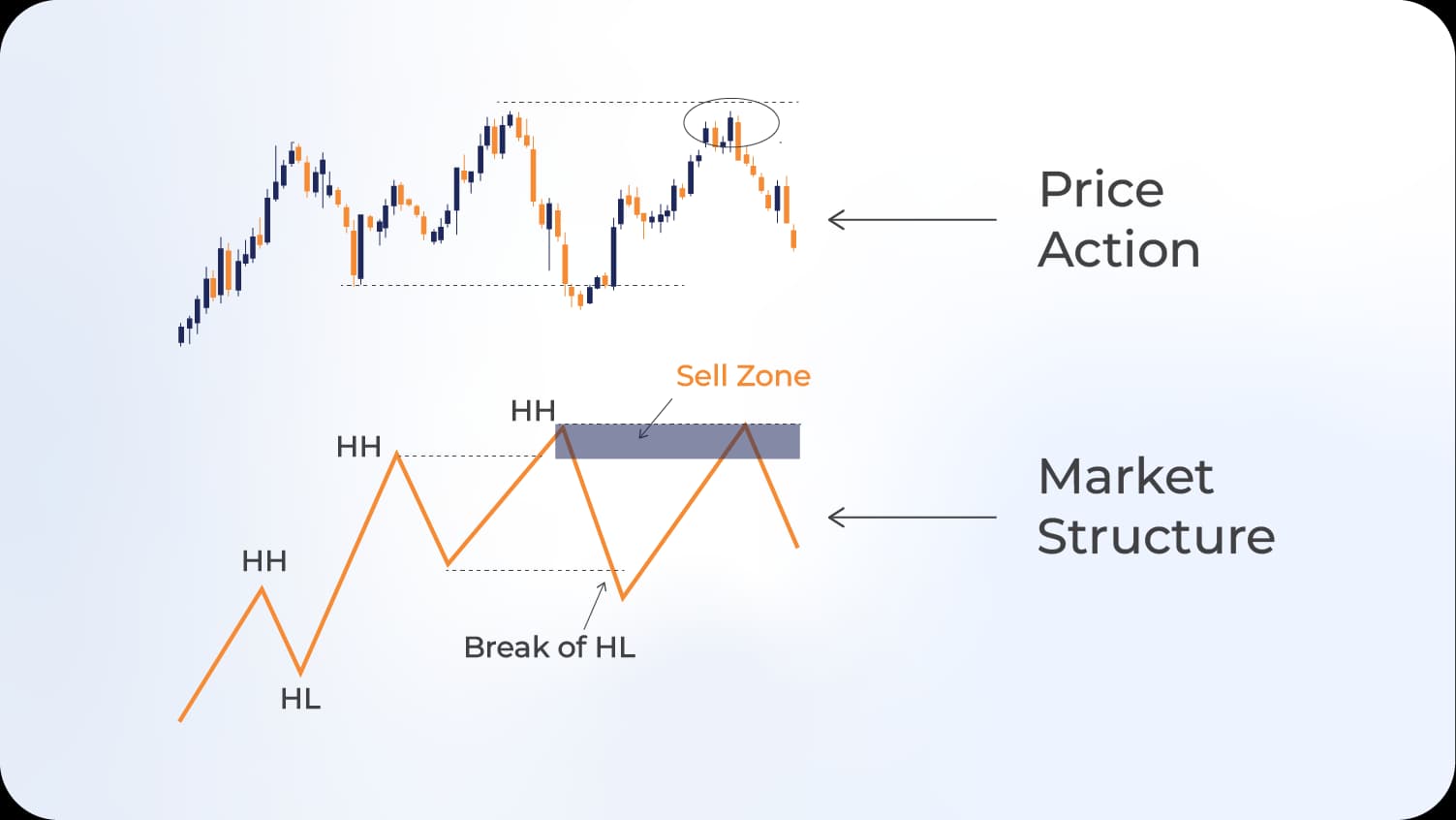

Price action represents the movement of security prices over time, displaying the psychological battle between bulls and bears through candlestick patterns, swing points, and trend formations. Market structure provides the organizational framework that converts isolated price movements into coherent narratives.

Within this framework, each candlestick contributes to larger swing formations. A swing high forms when price creates a peak flanked by lower highs on both sides, while a swing low emerges when price establishes a trough bordered by higher lows. These swing points function as the building blocks of market structure, marking the boundaries where momentum shifted between market participants.

The relationship between consecutive swing points determines structural integrity. In healthy uptrends, each subsequent swing high exceeds the previous peak, while swing lows remain above prior troughs. This pattern confirms accumulation, where buyers consistently overwhelm selling pressure at progressively higher levels. Distribution occurs when the inverse pattern develops, with lower highs and lower lows signaling bearish control.

Price action within established structure often respects previous swing points as support or resistance zones. A swing high that price previously rejected becomes a resistance level until broken, at which point it may transform into support. This dynamic reflects market memory, where participants reference historical levels when making trading decisions.

Types of Market Structure

Bullish Market Structure

Bullish market structure manifests when price creates a sequence of higher highs and higher lows, indicating sustained buying pressure and upward momentum. Each rally extends beyond the previous peak, while corrections find support above prior low points.

This structure develops in three phases. Accumulation initiates the pattern as informed participants establish positions near relative lows. Advancement follows, characterized by strong upward movement with minimal retracements. Distribution eventually emerges at exhaustion points, where selling pressure begins overwhelming buyers despite recent strength.

Traders utilize bullish structure to identify optimal entry zones during pullbacks. When price retraces to a previous swing high that now functions as support, it presents favorable risk-reward opportunities for long positions. The structure itself defines logical stop-loss placement below the most recent swing low.

Bearish Market Structure

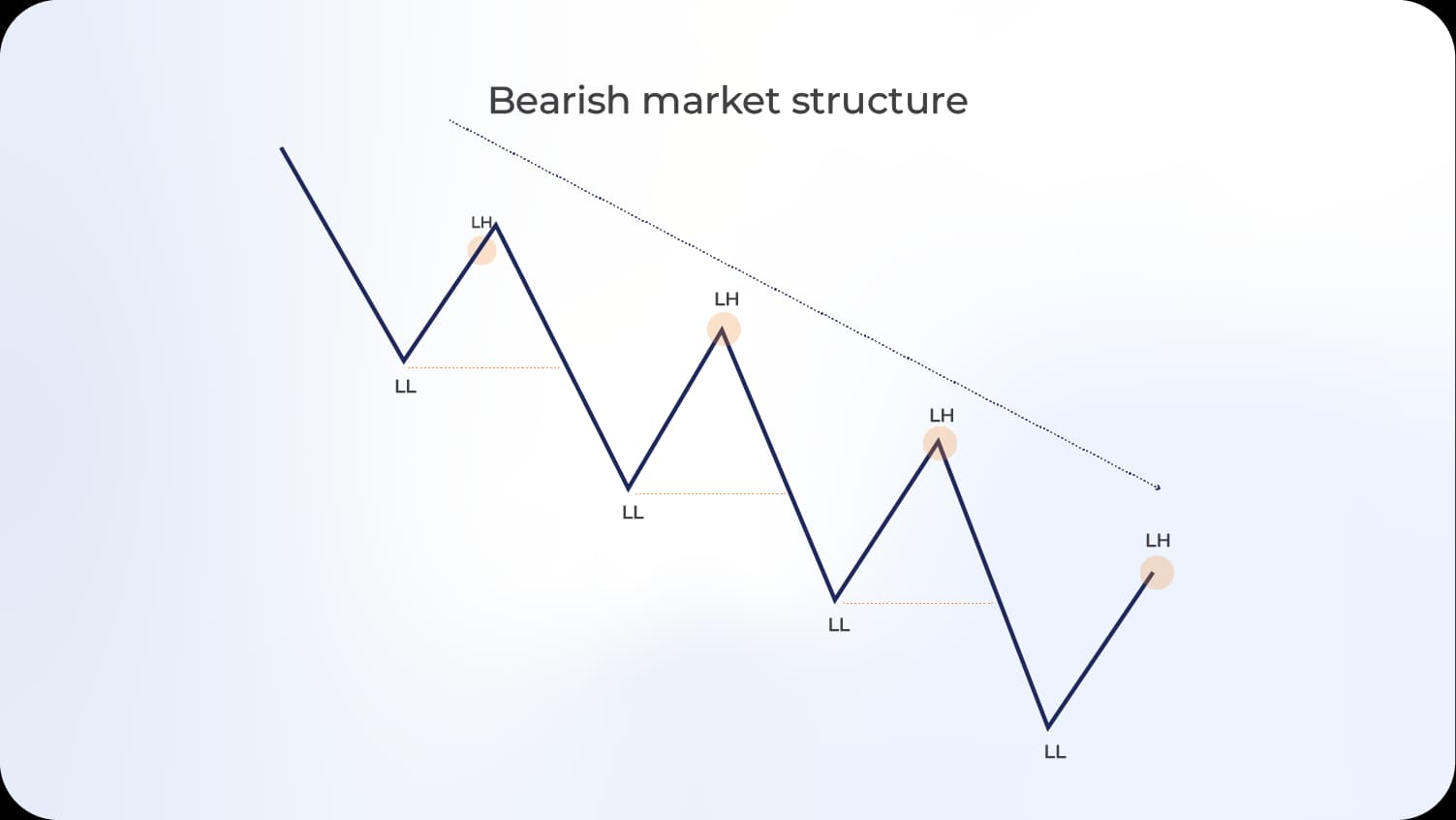

Bearish market structure presents the inverse pattern, with price forming successive lower highs and lower lows. This configuration signals that sellers dominate market dynamics, pushing price downward in stages punctuated by weak corrective rallies.

The bearish sequence typically emerges following distribution phases in established uptrends. As buyers exhaust themselves at elevated levels, sellers initiate downward pressure. Each subsequent rally fails to reach the previous high, while declines penetrate prior support zones, confirming the structural shift.

Short-selling opportunities emerge during rallies within bearish structure. When price retraces to a broken support level that now acts as resistance, bears gain advantageous positioning. Risk management parameters derive from the structure, with stops placed above recent swing highs.

Range-Bound Market Structure

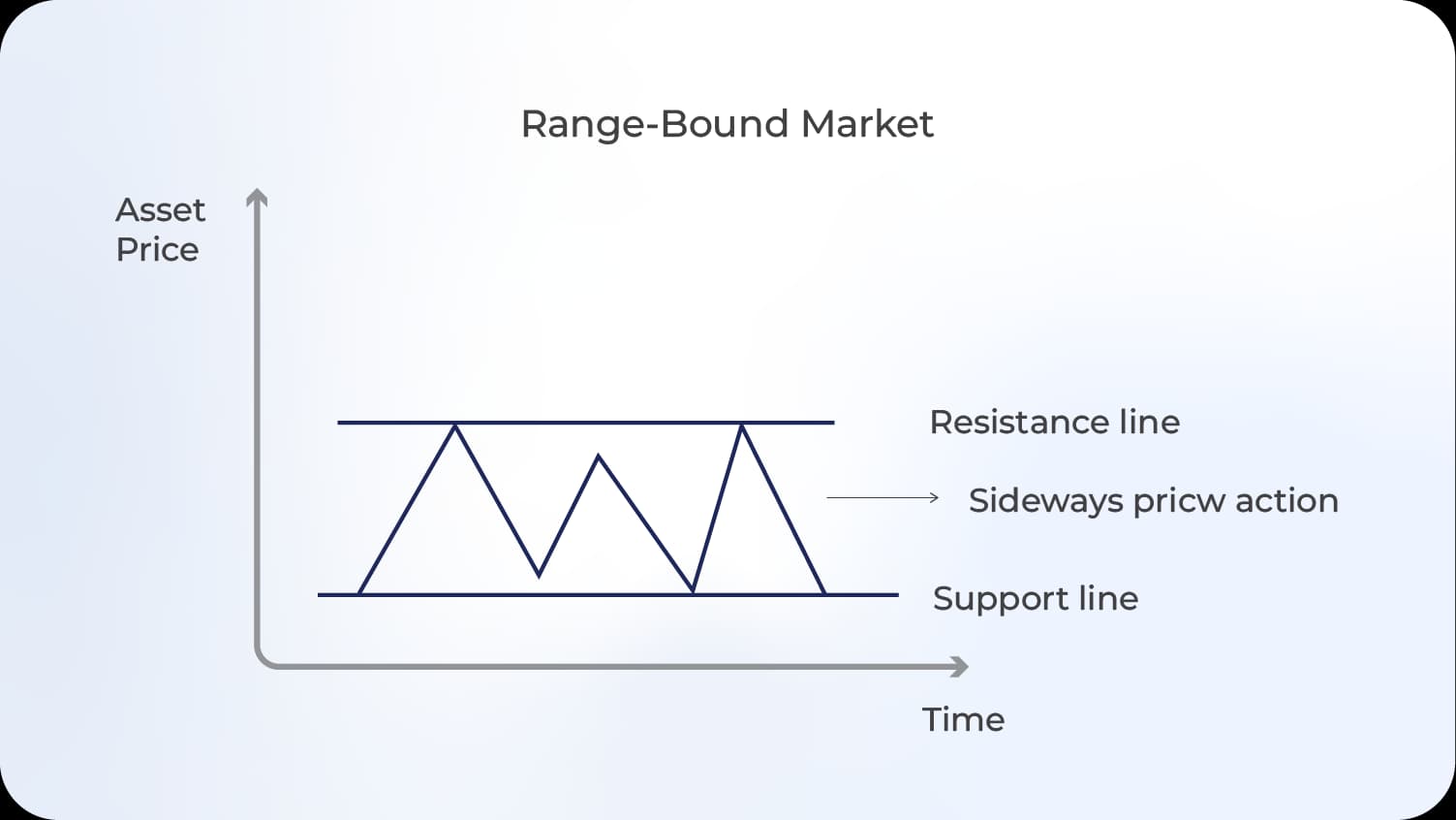

Range-bound market structure occurs when price oscillates between defined support and resistance levels without establishing clear directional bias. This consolidation phase features relatively equal highs and equal lows, indicating equilibrium between buying and selling forces.

Ranges develop for multiple reasons: profit-taking after extended trends, uncertainty regarding fundamental developments, or accumulation and distribution processes by institutional participants. Price behavior within ranges differs fundamentally from trending markets, as momentum strategies underperform while mean-reversion approaches gain effectiveness.

Traders adapting to range-bound structure employ different tactics. Buying near support and selling near resistance capitalizes on the predictable oscillation. However, ranges eventually resolve through breakouts, requiring vigilance for structural shifts that indicate resumption of directional movement.

Read More: Mastering Forex Trends: The Ultimate Guide for Traders

| Market Structure Type | Swing Point Pattern | Trend Direction | Trading Approach |

|---|---|---|---|

| Bullish | Higher Highs, Higher Lows | Upward | Buy pullbacks to support |

| Bearish | Lower Highs, Lower Lows | Downward | Sell rallies to resistance |

| Range-Bound | Equal Highs, Equal Lows | Sideways | Mean reversion trades |

Market Structure Shift: Identifying Trend Reversals

Market structure shift represents the critical transition point where established directional bias deteriorates, signaling potential trend reversal or significant correction. This phenomenon occurs when price violates the pattern of sequential swing points that defined the previous structure.

In uptrends, a market structure shift materializes when price breaks below a previous swing low, failing to maintain the pattern of higher lows. This violation indicates that selling pressure has intensified sufficiently to overwhelm the prior bullish momentum. The shift does not guarantee immediate reversal, but it invalidates the existing uptrend assumption and demands reassessment.

Bearish market structure shifts occur through the opposite mechanism. When price surpasses a recent swing high within a downtrend, it breaks the pattern of lower highs. This development suggests buying interest has strengthened enough to challenge bearish control, potentially initiating consolidation or reversal.

The identification process requires precise swing point definition. Traders must establish clear criteria for what constitutes a swing high or low, typically requiring price to form specific patterns such as three-bar formations where the middle bar represents an extreme flanked by lower extremes.

False shifts present a significant challenge. Markets frequently test structural boundaries through minor violations that quickly reverse, trapping traders who react prematurely. Confirmation techniques reduce this risk: waiting for a decisive close beyond the swing point, requiring multiple timeframe alignment, or demanding follow-through movement in the new direction.

Read More: Technical Analysis Reversal Patterns: A Complete Guide for Forex Traders

Applying Market Structure Across Multiple Timeframes

Multiple timeframe analysis strengthens market structure interpretation by revealing how shorter-term movements align with or contradict longer-term trends. This hierarchical perspective prevents traders from positioning against dominant forces while identifying optimal timing for entries.

The approach typically examines three timeframes: a higher timeframe establishing the primary trend, an intermediate timeframe refining structural context, and a lower timeframe providing precise entry timing. For swing traders, this might involve daily charts for trend identification, four-hour charts for structural context, and one-hour charts for entries.

Alignment creates high-probability scenarios. When all timeframes display congruent market structure, directional conviction increases. For example, a daily uptrend maintaining higher highs and higher lows, combined with a four-hour pullback completing at a previous swing high support, and a one-hour structure shift back to bullish, presents compelling long positioning.

Divergence between timeframes signals caution or opportunity depending on interpretation. A daily uptrend experiencing a four-hour market structure shift to bearish indicates potential correction, suggesting reduced position sizing or profit-taking. Conversely, contrarian traders might view such divergence as temporary retracement creating value for trend-aligned entries.

The key lies in respecting the hierarchy: longer timeframes exert greater influence than shorter ones. A weekly uptrend will eventually reassert itself despite daily structure shifts, though the timing and path remain uncertain. This reality guides position duration and risk allocation decisions.

Common Mistakes in Market Structure Analysis

Overcomplicating Swing Point Identification

Traders frequently introduce excessive complexity when defining swing points, employing convoluted rules that obscure rather than clarify market behavior. Simple three-bar patterns provide sufficient structure: a swing high requires the middle bar's high to exceed the highs of bars immediately before and after it, with swing lows following inverse logic.

Ignoring Failed Structure Breaks

Markets routinely test structural boundaries through false breaks that reverse quickly. Inexperienced traders react to every structural violation, entering positions that immediately move against them. Requiring confirmation through decisive closes or follow-through movement filters many failed breaks.

Neglecting Higher Timeframe Context

Focusing exclusively on single timeframes creates blind spots regarding dominant trends. A trader might observe a market structure shift to bearish on a one-hour chart while remaining unaware that daily structure maintains a strong uptrend. Such disconnection leads to positioning against primary momentum, reducing probability of success.

Forcing Trades in Unclear Structure

During consolidation phases or transitional periods, market structure often lacks clarity. Attempting to force directional trades when structure remains ambiguous generates unnecessary losses. Patience to wait for definitive patterns distinguishes successful structural traders from those who struggle.

Integrating Market Structure with Trading Strategies

Market structure functions as the foundation upon which specific trading strategies build. Rather than operating as a standalone system, it provides context that enhances various methodological approaches.

Breakout strategies benefit substantially from structural analysis. Identifying when price penetrates key swing points with confirming volume and momentum increases breakout reliability. The structure itself suggests targets, with previous swing points on higher timeframes serving as logical profit objectives.

Reversal trading gains precision through market structure shifts. Rather than attempting to pick tops and bottoms based on oscillators or patterns alone, traders wait for structural confirmation that momentum has genuinely shifted. This discipline reduces premature entries into continuing trends.

Trend-following approaches utilize structure to time entries during pullbacks. Within established uptrends, corrections to previous swing highs that now function as support create favorable risk-reward scenarios. The structure defines both entry level and stop-loss placement, enabling quantified risk management.

Supply and demand zones integrate seamlessly with market structure. These institutional levels often correspond with significant swing points where structure previously shifted. Combining zone analysis with structural context refines entry precision and directional probability.

Frequently Asked Questions

What is market structure?

Market structure is the framework that organizes price movements through patterns of swing highs and swing lows, revealing whether buyers or sellers control market direction. It identifies trends through sequential higher highs and higher lows (bullish) or lower highs and lower lows (bearish), providing traders with an objective method to assess market conditions and anticipate potential reversals.

How does market structure differ from technical indicators?

Market structure derives directly from price action without mathematical transformations or lagging calculations that characterize technical indicators. While indicators apply formulas to historical prices, often generating delayed signals, market structure examines the raw sequence of swing points in real-time. This fundamental difference means structure changes occur simultaneously with significant price events rather than after them, potentially offering earlier recognition of trend shifts. Indicators complement structural analysis but cannot replace the primary information conveyed by price architecture itself.

Can market structure be applied to all financial markets?

Market structure principles apply universally across financial markets including forex, stocks, commodities, and cryptocurrencies. The concept relies on the fundamental interaction between buyers and sellers, which manifests similarly regardless of asset class. However, market characteristics influence structural behavior: highly liquid forex pairs may form cleaner structures than illiquid small-cap stocks, while cryptocurrency volatility can generate rapid structure shifts. Traders must calibrate their structural analysis to account for specific market behaviors while maintaining core interpretive principles.

What timeframe works best for market structure analysis?

Optimal timeframe selection depends on trading style and holding period objectives. Day traders typically analyze structures on five-minute to one-hour charts, swing traders focus on one-hour to daily timeframes, and position traders examine daily to weekly structures. Effectiveness increases when traders analyze multiple timeframes simultaneously, using longer periods to establish directional bias and shorter periods to refine entry timing. No single timeframe proves universally superior; alignment between structure across multiple timeframes generates the highest-probability trading scenarios.

How reliable are market structure shifts as reversal signals?

Market structure shifts indicate changed conditions but do not guarantee reversals with absolute certainty. Many shifts lead to consolidation rather than immediate directional reversal, while some prove temporary before the original trend resumes. Reliability improves significantly when shifts receive confirmation through volume analysis, multiple timeframe alignment, or confluence with significant support and resistance levels. Traders should view structure shifts as alerts requiring further analysis rather than definitive reversal signals demanding immediate action.

Conclusion

Market structure transforms the complex flow of price action into an organized framework that reveals trend direction, momentum shifts, and high-probability trading opportunities. Through systematic identification of swing highs and lows, traders gain objective insight into whether buyers or sellers dominate market conditions. The methodology applies universally across markets and timeframes, providing a foundation upon which diverse trading strategies can build.

Mastery requires consistent practice in identifying swing points, patience to await clear structural formation, and discipline to respect timeframe hierarchy. The integration of market structure with additional analytical tools such as supply and demand zones, volume analysis, and confirmation patterns enhances decision-making quality while managing risk effectively.

Traders who invest time in understanding market structure develop a competitive advantage grounded in price reality rather than derivative indicators. This skill enables more confident position-taking during optimal conditions and prudent restraint when structure lacks clarity. Begin applying these principles across multiple markets and timeframes to refine pattern recognition capabilities and build structural analysis into a systematic trading approach.