How to Draw Support and Resistance Correctly in Forex Trading

Support and resistance levels represent price zones where market forces create barriers to continued movement. Mastering their accurate identification enables traders to predict reversals, plan entries, and manage risk effectively. This guide provides a systematic approach to drawing these critical technical levels with precision and consistency.

Key Takeaways

- Support and resistance zones form at price levels where supply and demand reach equilibrium, creating temporary or lasting barriers to price movement

- Horizontal levels drawn at swing highs and lows provide the most reliable trading signals when validated by multiple price touches

- Psychological round numbers and previous breakout points frequently act as significant support and resistance areas

- Dynamic levels using moving averages and trendlines complement static horizontal zones for comprehensive market analysis

- Proper level validation requires confirmation through volume analysis, multiple timeframe alignment, and price action patterns

What Is Support and Resistance in Forex?

Support and resistance represent fundamental price levels where buying and selling pressure balance, creating zones of price equilibrium. Support occurs at price levels where demand concentration prevents further decline, while resistance forms where selling pressure halts upward movement.

These levels function as psychological and technical barriers within market structure. When price approaches support, buyers enter positions anticipating a bounce, generating demand that stabilizes or reverses downward momentum. Conversely, resistance attracts sellers who believe price has reached a temporary ceiling, creating supply that impedes further advancement.

The reliability of these levels stems from trader behavior patterns and institutional order placement. Market participants remember previous price reactions at specific levels, creating self-fulfilling prophecies when price revisits those zones. Large institutions often place pending orders near established support and resistance, reinforcing their significance.

The Psychology Behind Price Levels

Market memory drives the effectiveness of support and resistance zones. Traders who purchased at previous lows anticipate similar buying opportunities when price returns to those levels. Those who missed earlier selling opportunities at resistance prepare to exit positions when price approaches previous highs.

This collective memory creates clustering of orders around established levels. The concentration of buy orders at support and sell orders at resistance generates the force necessary to halt or reverse price movement, validating the level's significance.

Role in Market Structure

Support and resistance define the framework of price action, establishing boundaries within which markets operate. These levels segment price movement into ranges, trends, and consolidation patterns, providing context for trading decisions.

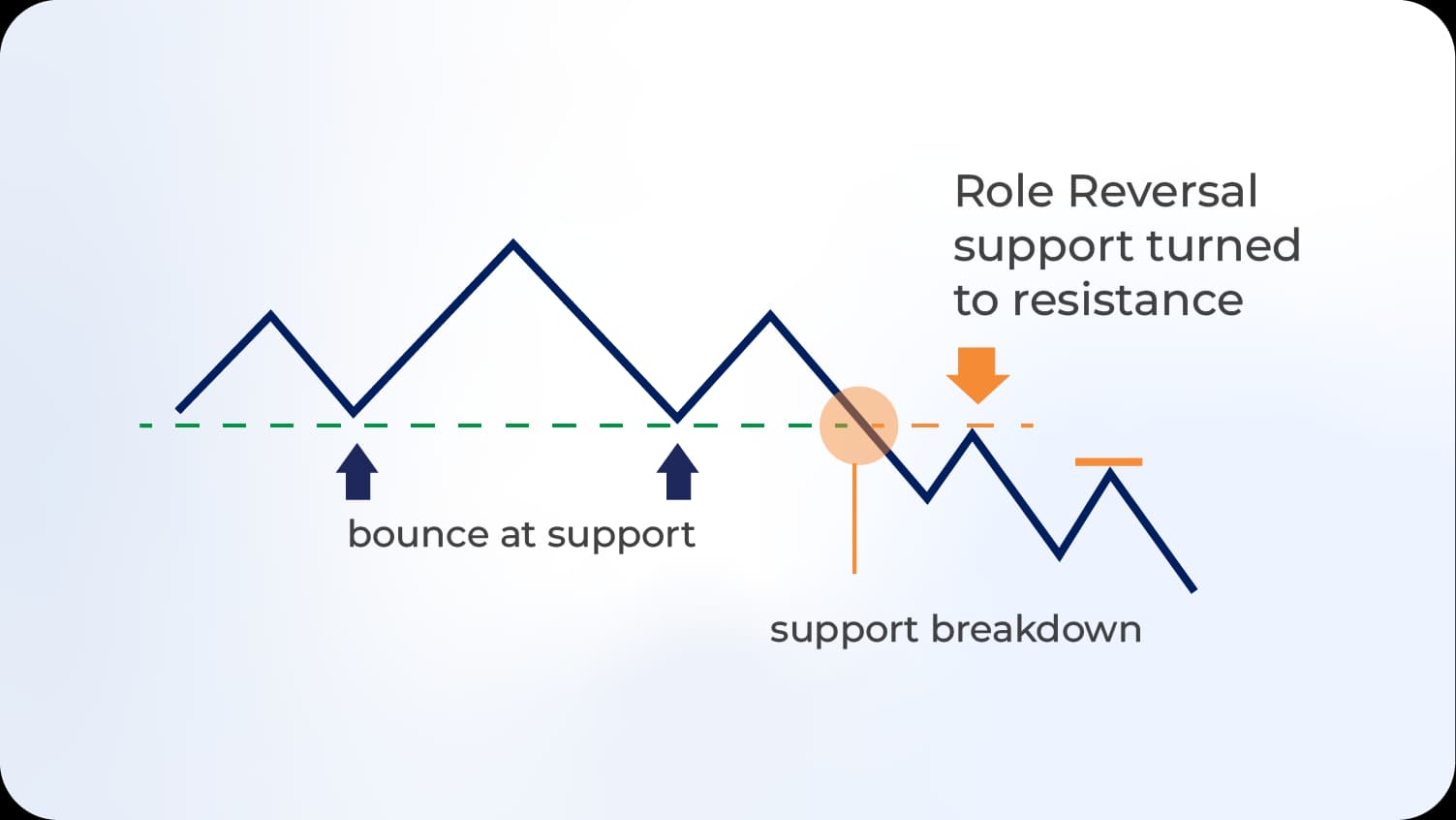

Breakouts beyond established levels signal potential trend changes or continuation, making accurate level identification critical for capturing significant market moves. False breakouts, where price temporarily breaches a level before reversing, test trader discipline and highlight the importance of confirmation signals.

How to Draw Support and Resistance Lines

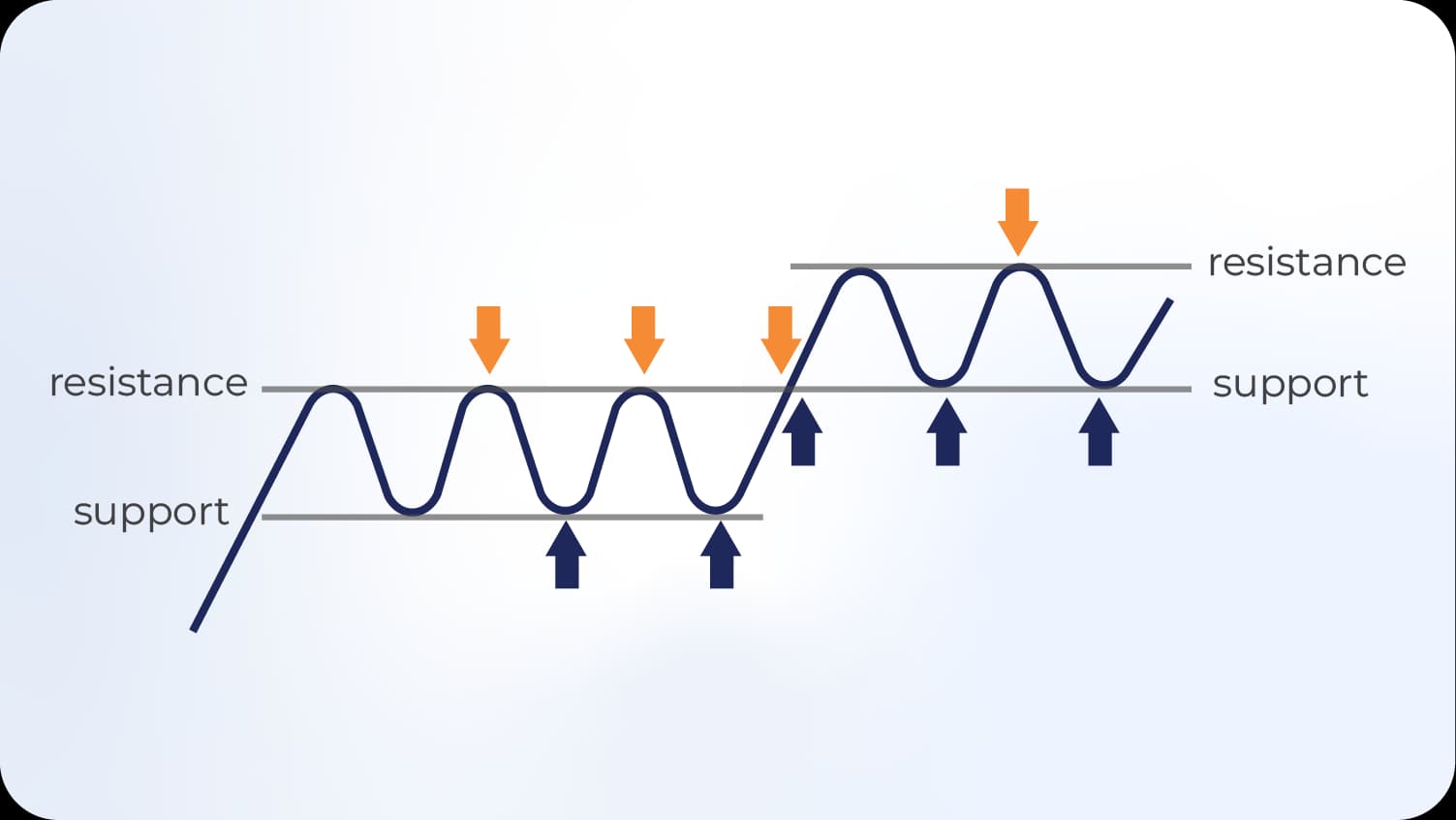

Drawing accurate support and resistance lines requires identifying swing points where price demonstrates clear rejection or consolidation. Connect at least two swing lows for support or two swing highs for resistance, prioritizing levels that show multiple price interactions.

The process begins with higher timeframe analysis to identify major levels, then progresses to lower timeframes for precision entry points. This multi-timeframe approach ensures alignment between macro and micro market structure, reducing false signals.

Identifying Swing Points

Swing highs represent peaks where price reverses downward after upward movement, while swing lows mark troughs where price bounces after declining. These turning points indicate zones where market sentiment shifted, making them ideal anchors for support and resistance lines.

Significant swing points display clear rejection candles with long wicks, demonstrating forceful pushback against continued movement. Volume spikes at these points confirm increased market participation, validating the level's importance.

Horizontal Level Construction

Draw horizontal lines connecting swing points at identical price levels, extending them forward to project potential future zones of interest. Precision matters less than zone identification; markets rarely respect exact price points, instead reacting within narrow ranges.

When multiple swing points align closely but not perfectly, draw the line through the center of the cluster or at the most significant touch point. Slight variations in exact level placement typically have minimal impact on trading outcomes compared to recognizing the general zone.

Guidelines for Accurate Line Placement

| Principle | Application |

|---|---|

| Body vs. Wick | Prioritize candlestick bodies over wicks for level placement, as bodies represent sustained price acceptance |

| Multiple Touches | Levels with three or more price interactions demonstrate greater reliability than those with only two |

| Time Validation | Older levels that continue producing reactions hold more significance than recently formed zones |

| Breakout History | Previous support becomes resistance after breakdown; previous resistance becomes support after breakthrough |

| Clean Reactions | Levels producing sharp, decisive reversals outweigh those showing gradual, hesitant responses |

Dynamic Support and Resistance

Moving averages and trendlines create dynamic levels that adjust with price evolution, complementing static horizontal zones. The 50-period, 100-period, and 200-period moving averages frequently act as support in uptrends and resistance in downtrends.

Trendlines connect successive swing lows in uptrends or swing highs in downtrends, forming diagonal support and resistance. Valid trendlines require at least three touch points and demonstrate consistent angle maintenance, indicating sustained trend momentum.

Support and Resistance Trading Strategies

Trading these levels involves anticipating price reactions rather than waiting for confirmation, balancing aggressive entries against conservative validation. The most effective approach combines level identification with complementary technical indicators and price action patterns.

Bounce Trading

Bounce strategies involve entering positions when price approaches support or resistance with the expectation of reversal. Entry occurs slightly before the exact level using limit orders, while stops position just beyond the level to limit risk if breakthrough occurs.

Confirmation signals strengthen bounce setups. Bullish candlestick patterns at support, such as hammer or engulfing formations, indicate increased reversal probability. Similarly, bearish patterns at resistance suggest impending rejection. Divergence between price and momentum oscillators provides additional reversal evidence.

Read More: Candlestick Patterns: A Complete Guide for Forex Traders

Breakout Trading

Breakout strategies capitalize on price movement beyond established levels, signaling potential trend initiation or continuation. Entry occurs after candle close beyond the level, confirming breakthrough validity rather than entering during initial penetration.

Volume analysis proves critical for breakout validation. Genuine breakouts demonstrate volume expansion during the breach, indicating broad market participation and commitment to the new price direction. Low-volume breakouts frequently reverse, returning price to the original range.

Role Reversal Principle

Previous support transforms into resistance after breakdown, while previous resistance becomes support after breakthrough. This role reversal occurs because traders who held losing positions at the original level attempt to exit at breakeven when price returns.

Trading role reversals offers favorable risk-reward ratios. Entry near the converted level with stops beyond it provides tight risk parameters, while profit targets extend toward the next major level in the breakthrough direction.

Common Mistakes in Drawing Support and Resistance

Overcomplicating charts with excessive lines creates confusion rather than clarity. Focus on major levels that demonstrate clear, repeated price reactions across multiple timeframes. Each additional line should provide distinct value; redundant levels diminish overall effectiveness.

Precision Obsession

Seeking exact price points rather than recognizing zones represents a fundamental misunderstanding of support and resistance functionality. Markets operate through ranges where concentration of orders exists, not precise mathematical levels.

Drawing zones rather than single lines accommodates natural price fluctuation while maintaining level integrity. Zone width varies based on timeframe and volatility; shorter timeframes require tighter zones, while longer timeframes permit broader ranges.

Neglecting Timeframe Analysis

Drawing levels exclusively on one timeframe ignores critical context from higher and lower periods. Major levels on daily or weekly charts override minor levels on hourly charts, yet intraday levels provide precision entry opportunities within the broader structure.

Effective analysis begins on higher timeframes to establish primary levels, then examines lower timeframes for optimal entry and exit timing. This hierarchical approach ensures trading decisions align with dominant market forces while maximizing execution quality.

Ignoring Level Strength Indicators

Not all support and resistance levels carry equal significance. Strong levels demonstrate multiple characteristics that weaker levels lack, requiring differentiated treatment in trading plans.

Level strength factors include:

- Number of price touches (more touches increase reliability until breakdown occurs)

- Time span since formation (older levels command greater respect)

- Strength of reactions (sharp reversals versus gradual turns)

- Volume confirmation (high volume at level validates importance)

- Alignment with psychological levels (round numbers attract additional attention)

Failure to Adapt

Static levels that ignore market evolution lead to outdated analysis and failed trades. Support and resistance dynamics shift as trends develop, requiring ongoing reassessment and adjustment.

Regular chart review identifies which levels remain relevant and which have lost significance through repeated violations or lack of recent interaction. Removing obsolete levels prevents chart clutter and maintains focus on currently active zones.

Advanced Techniques for Level Identification

Confluence zones where multiple technical factors align create high-probability support and resistance areas. When horizontal levels coincide with moving averages, Fibonacci retracements, or trendlines, the combined zone demonstrates enhanced reliability.

Fibonacci Integration

Fibonacci retracement levels identify potential support and resistance zones within trending markets. The 38.2%, 50%, and 61.8% retracement levels frequently align with horizontal support and resistance, creating confluence zones with elevated reversal probability.

Application involves drawing the Fibonacci tool from significant swing low to swing high in uptrends, or swing high to swing low in downtrends. Price often finds support or resistance at Fibonacci levels that coincide with previous price action zones.

Read More: Fibonacci Trading: Retracements, Extensions and Trading Strategies

Volume Profile Analysis

Volume profile displays price levels where maximum trading activity occurred, revealing zones where large position accumulation creates inherent support or resistance. High-volume nodes represent price acceptance, while low-volume nodes indicate rejection zones through which price tends to move rapidly.

Point of Control (POC), the price level with highest volume, frequently acts as magnetic support or resistance. When price approaches POC from above, support often emerges; when approaching from below, resistance typically develops.

Institutional Levels

Round numbers ending in 00 or 50 attract disproportionate attention from institutional traders who place orders at these psychological levels. Currency pairs often demonstrate pronounced reactions at these round figures, making them valuable addition to support and resistance analysis.

Major psychological levels include parity (1.0000) for pairs like EUR/USD, along with significant round numbers like 1.2000, 1.3000, and similar milestones. These levels function independently of swing point analysis, requiring separate consideration in level identification.

Validation and Confirmation Methods

Drawn levels require validation through subsequent price interaction before assuming high confidence. A properly drawn level anticipates future price behavior; if price ignores the level, reassessment becomes necessary.

Multiple Timeframe Confirmation

A level appearing on multiple timeframes demonstrates greater significance than one visible on single periods. When daily, 4-hour, and 1-hour charts all show support or resistance at the same approximate price, confluence increases reliability substantially.

This alignment indicates broad market agreement on the level's importance across different trading communities. Day traders, swing traders, and position traders all recognizing the same zone create concentrated order flow that enhances price reactions.

Price Action Patterns

Specific candlestick formations at support and resistance levels provide entry signals and confirmation. Pin bars, engulfing patterns, and inside bars at key levels suggest impending reversals, while continuation patterns like flags indicate breakout likelihood.

Pattern quality varies based on location. A pin bar at major support after extended decline carries more weight than the same pattern at minor intraday resistance. Context determines pattern significance, requiring evaluation of broader market structure.

Indicator Convergence

Momentum oscillators like RSI or MACD showing divergence at support or resistance strengthen reversal cases. Positive divergence at support (price making lower lows while oscillator makes higher lows) suggests diminishing downward momentum. Negative divergence at resistance indicates fading buying pressure.

Combining indicator signals with level analysis filters low-probability setups while highlighting optimal opportunities. However, indicators serve as confirmation tools rather than primary decision drivers; price action at established levels takes precedence.

Frequently Asked Questions

What distinguishes strong support and resistance from weak levels?

Strong levels demonstrate multiple price touches, significant time validation, sharp reversal reactions, high volume confirmation, and alignment with psychological round numbers or institutional levels. Weak levels show hesitant price reactions, few touches, recent formation, and isolation from other technical factors. Trading strong levels offers superior probability outcomes compared to weak zones that market participants may ignore.

How many touches validate a support or resistance level?

Two touches establish a level initially, three touches confirm validity, and four or more touches indicate major significance. However, excessive touches without breakthrough can signal weakening level strength as market participants anticipate eventual failure. The relationship between touches and reliability follows a curve rather than linear progression; initial touches build confidence while later touches may indicate impending breakdown.

Should wicks or bodies determine exact level placement?

Candlestick bodies represent sustained price acceptance and generally provide more reliable level placement than wicks, which indicate temporary price rejection. However, when multiple wicks align at identical levels across different time periods, they mark valid zones where limit orders cluster. The optimal approach examines both bodies and wicks, prioritizing whichever demonstrates clearer alignment and more consistent reactions.

How do support and resistance levels change during trending markets?

Uptrends establish higher support levels as price advances, with previous resistance converting to new support through role reversal. Downtrends create lower resistance levels, with former support becoming new resistance. Trendlines provide dynamic support and resistance that adjust with price movement, while horizontal levels mark specific zones where trend momentum may pause or reverse.

What timeframe provides optimal support and resistance identification?

Higher timeframes (daily, weekly) identify major levels that large institutions respect, offering substantial profit potential but requiring wider stops. Lower timeframes (1-hour, 15-minute) reveal minor levels suitable for scalping and day trading with tighter risk parameters. Comprehensive analysis examines multiple timeframes hierarchically, establishing primary levels on higher periods then refining entries on lower periods.

Can support and resistance work across different currency pairs?

While each currency pair develops unique support and resistance levels based on its specific price history, correlated pairs often show aligned levels. Additionally, the US Dollar Index (DXY) establishes support and resistance that influences all dollar-based pairs. Traders monitoring multiple pairs benefit from recognizing shared levels driven by common underlying factors.

How does volatility affect support and resistance reliability?

High volatility environments produce wider support and resistance zones as price swings expand, requiring broader stop placement and adjusted position sizing. Low volatility creates tighter zones with more precise reactions but potentially smaller profit targets. Measuring Average True Range (ATR) helps calibrate zone width and stop distance appropriate for current market conditions.

Conclusion

Drawing support and resistance correctly requires systematic analysis combining swing point identification, multiple timeframe confirmation, and validation through price action patterns. These levels form the foundation of technical analysis, providing structure for entry timing, stop placement, and profit targeting across all trading strategies.

Mastery develops through consistent practice and ongoing chart review. Begin with major levels on daily timeframes, gradually incorporating lower timeframe refinement as pattern recognition improves. Maintain discipline in applying objective criteria rather than subjective interpretation, ensuring replicable results across different market conditions.

The principles outlined here enable traders to construct reliable support and resistance frameworks that enhance decision-making quality and improve risk management outcomes. Implementation combined with proper position sizing and emotional discipline creates sustainable trading approaches capable of adapting to evolving market dynamics.