Weighted Moving Average: A Precision Tool for Forex Trading Decisions

Weighted moving average assigns greater importance to recent price data, creating a more responsive indicator than simple moving averages. This technique reduces lag in trend identification by applying progressively higher weights to newer prices. Forex traders utilize weighted moving averages to generate earlier entry and exit signals, particularly in volatile currency markets where timing precision determines profitability.

Key Takeaways

- Enhanced Responsiveness: Weighted moving averages react faster to price changes by assigning higher weights to recent data points, reducing the lag inherent in simple moving averages.

- Customizable Weighting Systems: Traders can adjust the weighting scheme to match specific market conditions, with linear weighting being the most common application in forex analysis.

- Signal Generation: The indicator produces crossover signals when price or shorter-period weighted moving averages intersect longer-period ones, indicating potential trend reversals.

- Trend Confirmation: Weighted moving averages serve as dynamic support and resistance levels, with price position relative to the line confirming trend direction and strength.

- Risk Management Integration: The indicator helps establish stop-loss placement and position sizing by identifying key technical levels where trend changes become probable.

What Is Weighted Moving Average?

A weighted moving average represents a technical indicator that calculates the average price over a specified period while assigning different weights to each price point. The calculation places greater emphasis on recent prices and progressively less weight on older data. This weighting structure makes the indicator more sensitive to current market movements compared to simple moving averages, which treat all prices equally.

The fundamental principle behind weighted moving averages stems from the assumption that recent price action holds more predictive value than historical data. Markets evolve continuously, and recent price movements reflect current supply and demand dynamics more accurately. By prioritizing newer information, the weighted moving average adapts more quickly to changing market conditions.

Forex traders employ weighted moving averages across multiple timeframes, from intraday charts to weekly analysis. The indicator functions as both a trend identification tool and a signal generator. When price trades above the weighted moving average, the market exhibits bullish characteristics. Conversely, price below the line suggests bearish momentum. The angle and direction of the weighted moving average line itself provides additional confirmation of trend strength.

Read More: What is Moving Average?

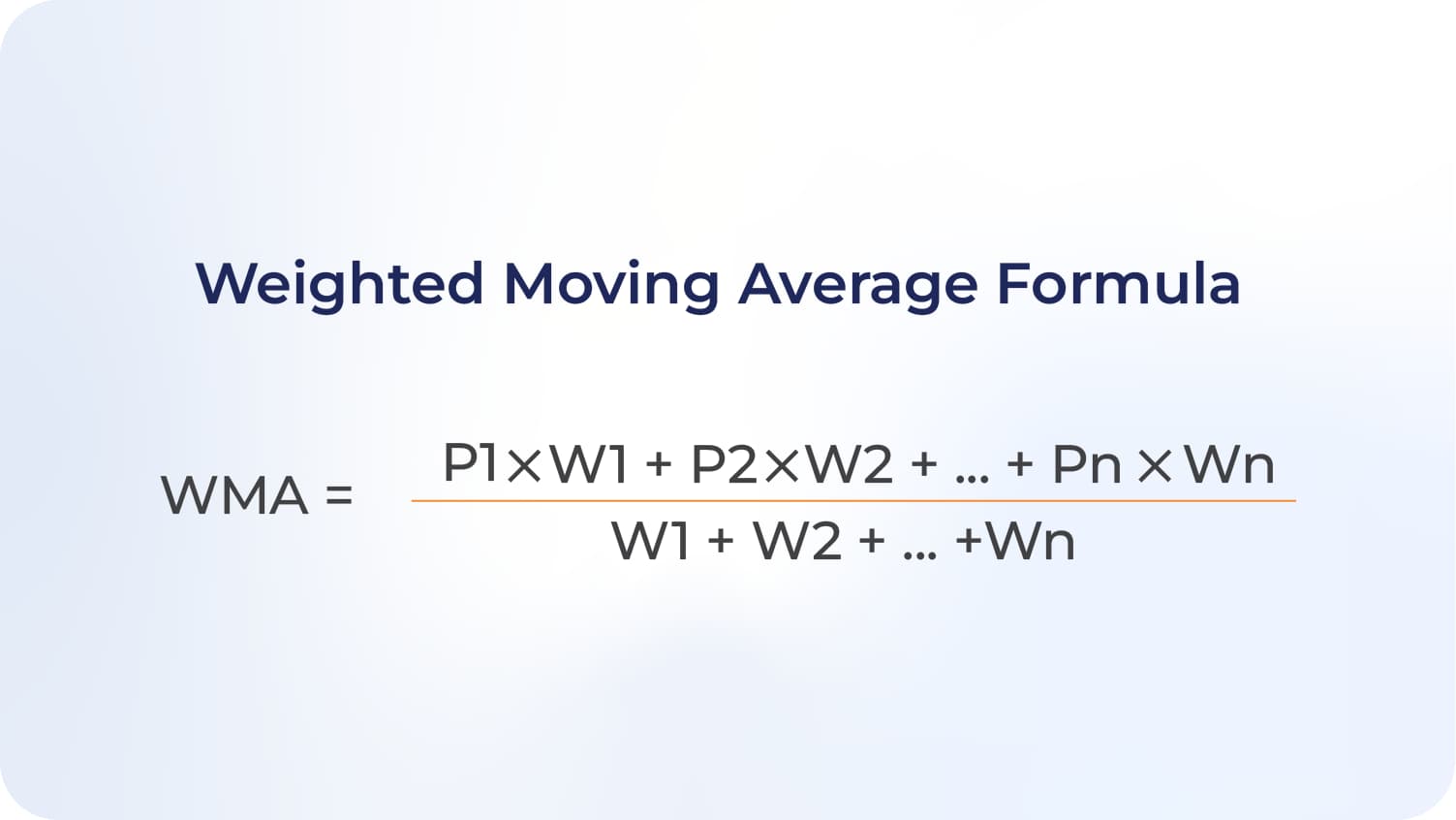

Weighted Moving Average Formula

The weighted moving average formula applies a linear weighting scheme where the most recent price receives the highest weight, and each preceding price receives progressively lower weights. The calculation follows this structure:

WMA = (P₁ × W₁ + P₂ × W₂ + P₃ × W₃ + ... + Pₙ × Wₙ) / (W₁ + W₂ + W₃ + ... + Wₙ)

Where:

- P = Price at each period

- W = Weight assigned to each period

- n = Number of periods in the calculation

In a linear weighting system, weights decrease uniformly. For a 5-period weighted moving average, the most recent price receives a weight of 5, the second most recent receives 4, continuing down to 1 for the oldest price. The sum of weights equals 15 (5+4+3+2+1).

Calculation Example

Consider a 5-period weighted moving average using the following closing prices:

| Period | Price | Weight | Price × Weight |

|---|---|---|---|

| Day 1 (oldest) | 1.0850 | 1 | 1.0850 |

| Day 2 | 1.0875 | 2 | 2.1750 |

| Day 3 | 1.0900 | 3 | 3.2700 |

| Day 4 | 1.0925 | 4 | 4.3700 |

| Day 5 (newest) | 1.0950 | 5 | 5.4750 |

| Sum | 15 | 16.3750 |

WMA = 16.3750 / 15 = 1.0917

This calculation demonstrates how recent prices exert greater influence on the final value. The newest price (1.0950) contributes 5.4750 to the numerator, while the oldest price (1.0850) contributes only 1.0850.

Calculating Weighted Moving Average in Practice

The calculation process requires systematic application across each data point in a price series. Traders typically rely on charting platforms that automate this computation, but understanding the manual process clarifies how the indicator responds to price changes.

Step 1: Define the Period Select the number of periods for calculation. Common choices include 10, 20, or 50 periods, depending on trading timeframe and strategy requirements.

Step 2: Assign Weights Apply linear weights starting from 1 for the oldest price up to n for the most recent price, where n equals the selected period length.

Step 3: Multiply and Sum Multiply each price by its corresponding weight, then sum all products. Simultaneously, sum all weights used in the calculation.

Step 4: Divide Divide the sum of weighted prices by the sum of weights to obtain the weighted moving average value.

Step 5: Repeat As new price data becomes available, drop the oldest price from the calculation and include the newest price, maintaining the same number of periods throughout the analysis.

Weighted Moving Average vs. Simple Moving Average

The distinction between weighted and simple moving averages centers on data treatment. Simple moving averages assign equal weight to all prices within the calculation period. A 10-period simple moving average divides the sum of 10 prices by 10, treating the newest and oldest prices identically.

Weighted moving averages prioritize recent data through the weighting mechanism. This creates several practical differences in trading applications.

Responsiveness to Price Changes Weighted moving averages generate signals earlier than simple moving averages because recent prices dominate the calculation. When a strong price movement occurs, the weighted version reflects this change more quickly. This characteristic proves valuable in trending markets where early entry improves risk-reward ratios.

Signal Quality Trade-offs The enhanced responsiveness of weighted moving averages comes with increased sensitivity to short-term volatility. Markets that consolidate or whipsaw generate more false signals from weighted moving averages compared to simple versions. Traders must balance the benefit of early signals against the cost of increased noise.

Calculation Complexity Simple moving averages require basic arithmetic—addition and division. Weighted moving averages involve multiplication steps for each price point, increasing computational requirements. Modern software eliminates this practical concern, but the complexity affects how traders conceptualize and modify the indicator.

Applications in Forex Trading

Weighted moving averages serve multiple functions within forex trading systems. The indicator adapts to various strategies and timeframes while maintaining consistent interpretation principles.

Trend Identification

The position of price relative to the weighted moving average defines the prevailing trend. Sustained price action above an upward-sloping weighted moving average confirms bullish momentum. Price below a downward-sloping line indicates bearish conditions. The angle of the weighted moving average line adds a second dimension—steeper angles suggest stronger trends.

Traders often employ multiple weighted moving averages with different periods to analyze trend structure. A shorter-period line captures immediate price direction, while a longer-period line identifies the broader trend. When both lines point in the same direction and price trades on the appropriate side, trend conviction increases.

Entry and Exit Signals

Crossover strategies generate specific trade signals. When price crosses above the weighted moving average from below, a buy signal emerges. The opposite crossover—price breaking below the line—produces a sell signal. Some traders require confirmation through bar closes rather than intrabar touches to filter false signals.

Multiple weighted moving average systems create additional signal variations. When a shorter-period weighted moving average crosses above a longer-period line, bullish momentum strengthens. The reverse crossover suggests deteriorating conditions and potential trend reversal. These crossover points often align with significant support and resistance zones, enhancing signal reliability.

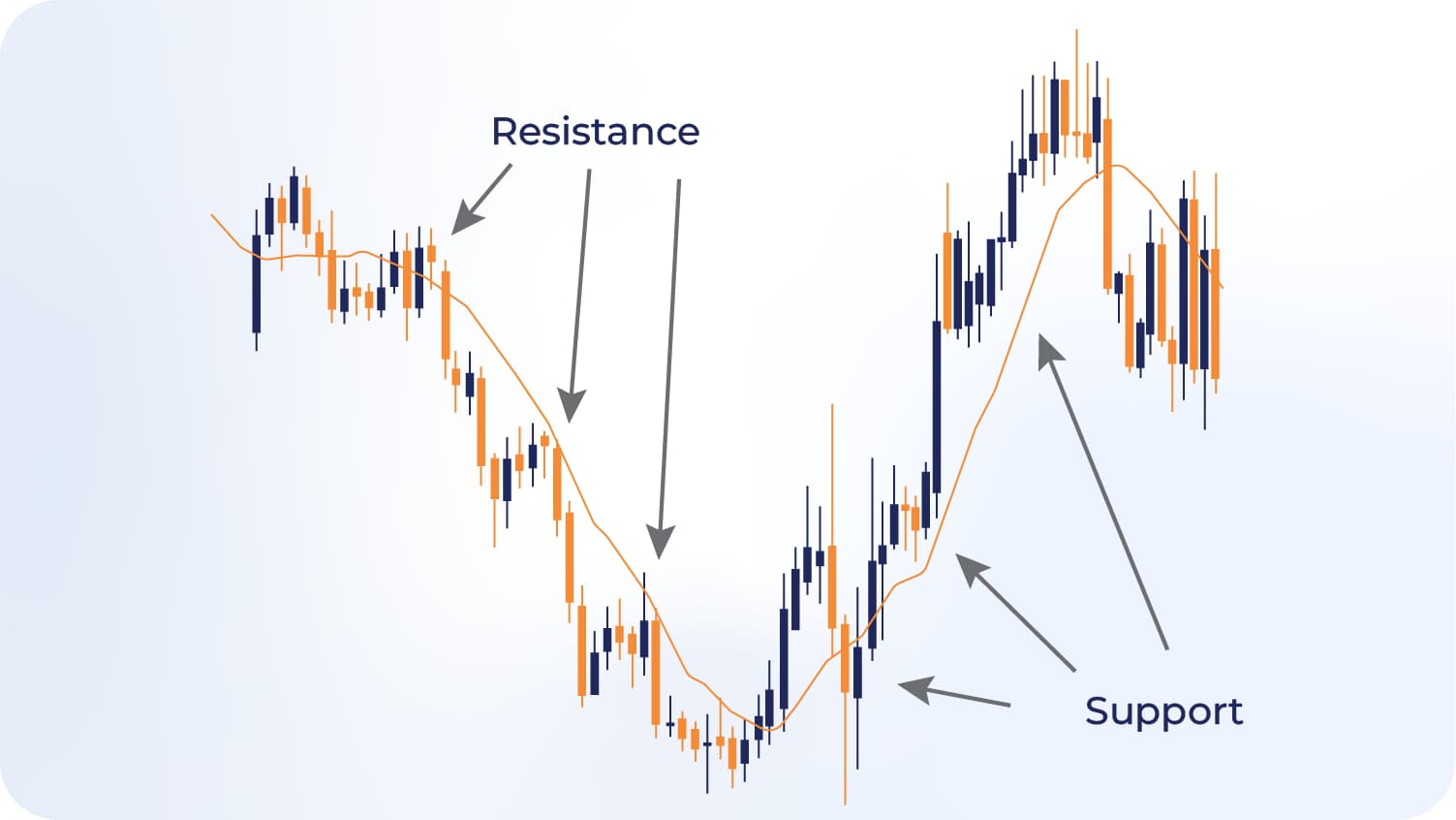

Dynamic Support and Resistance

Weighted moving averages function as moving support and resistance levels that adjust with price. During uptrends, price often retraces to the weighted moving average line before resuming higher. These touches provide lower-risk entry opportunities for trend-following positions. The weighted moving average acts as a floor that supports price during pullbacks.

In downtrends, the weighted moving average serves as resistance, capping rally attempts. Price approaching the line from below faces selling pressure as market participants view the level as an opportunity to enter or add to short positions. Breaks through the weighted moving average in either direction suggest potential trend changes.

Related Article: What is a Trend?

Risk Management

The weighted moving average assists in stop-loss placement. Traders position protective stops beyond the weighted moving average, allowing normal price fluctuations while exiting when the trend structure breaks. The distance from entry to the weighted moving average defines the initial risk per trade, influencing position sizing calculations.

Trailing stops using the weighted moving average protect profits in trending markets. As price advances and the weighted moving average follows, traders raise stop levels to lock in gains. This approach maintains exposure to continuing trends while automatically reducing position size when momentum fades.

Read More: Forex Risk Management Strategies

Optimizing Weighted Moving Average Parameters

Period selection significantly impacts weighted moving average behavior and signal generation. Shorter periods create more responsive lines that generate frequent signals. Longer periods produce smoother lines with fewer but potentially more reliable signals.

Short-Term Applications (5-20 periods) Brief calculation periods suit scalping and day trading approaches. The weighted moving average tracks price closely, identifying minor trend changes quickly. However, increased sensitivity elevates false signal frequency, requiring strict filtering mechanisms or confirmation from additional indicators.

Medium-Term Applications (20-50 periods) Intermediate periods balance responsiveness and stability. These settings work effectively across 4-hour to daily charts, capturing swing trading opportunities. The weighted moving average filters much of the market noise while maintaining adequate sensitivity to legitimate trend changes.

Long-Term Applications (50-200 periods) Extended periods smooth price data substantially, revealing major trends while ignoring short-term fluctuations. Position traders and investors use these settings on daily and weekly charts. Signals occur infrequently but often coincide with significant market turning points.

Market Condition Considerations

Volatile currency pairs benefit from longer weighted moving average periods that reduce whipsaw signals. Stable, trending pairs accommodate shorter periods that capitalize on sustained directional movement. Traders should adjust parameters based on the specific pair's historical volatility characteristics.

Market environments also influence optimal settings. Trending markets reward shorter periods that maintain exposure to persistent moves. Range-bound conditions require longer periods or alternative indicators altogether, as moving averages generate numerous false breakout signals during consolidation.

Limitations and Considerations

Weighted moving averages share inherent limitations with all moving average indicators. Understanding these constraints prevents misapplication and improves trading outcomes.

Lagging Nature Despite enhanced responsiveness compared to simple moving averages, weighted versions still lag price. The calculation relies on historical data, creating inevitable delay in signal generation. Markets can reverse before the weighted moving average produces a signal, resulting in late entries or exits.

Range-Bound Performance Consolidating markets produce problematic signals. Price oscillates around the weighted moving average line, generating frequent crossovers that fail to develop into trends. Traders entering positions based on these signals experience consecutive losses that erode capital. Additional filters, such as volatility or momentum indicators, help identify when moving average signals lose effectiveness.

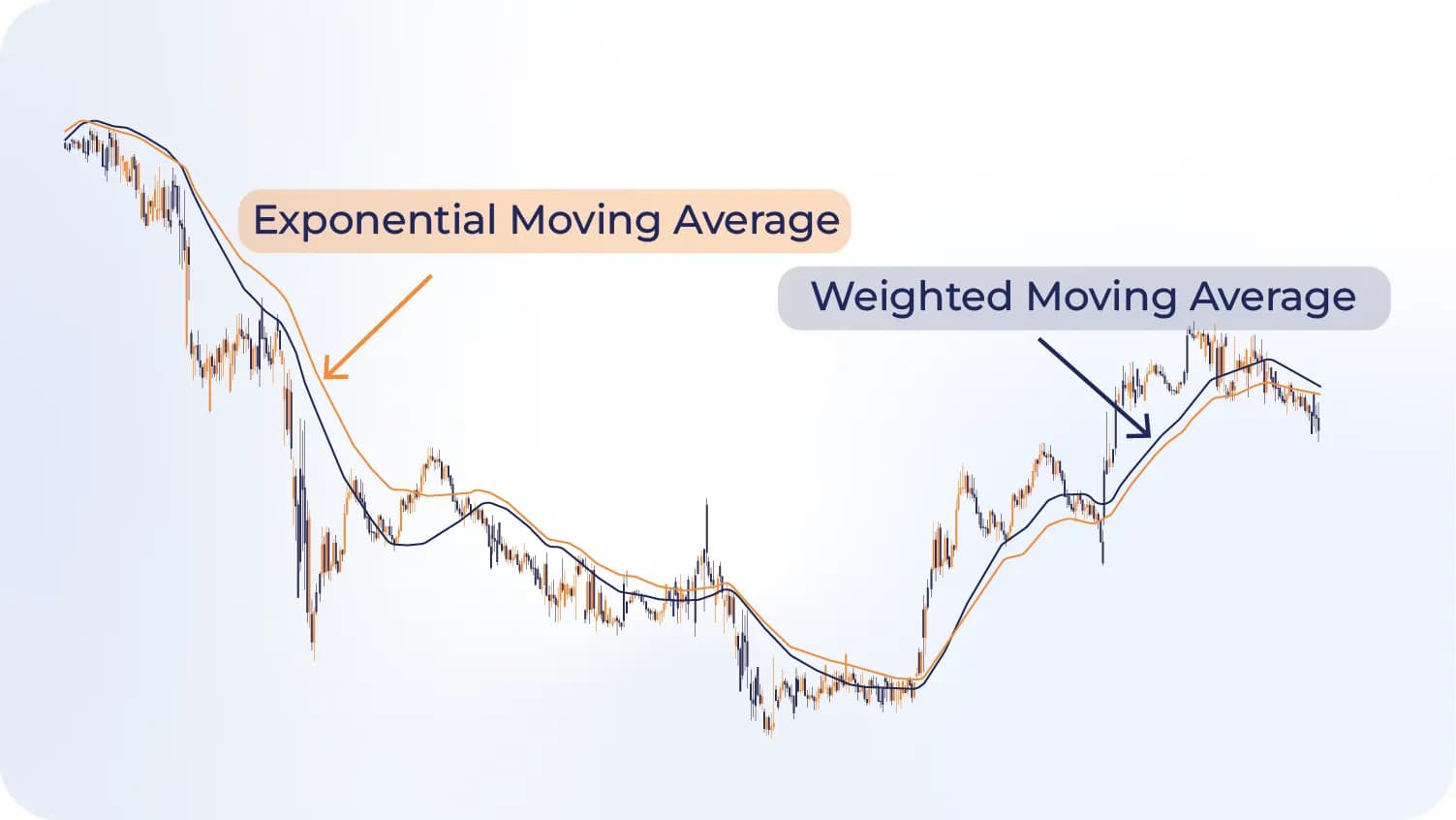

Weighting Scheme Arbitrariness Linear weighting represents convention rather than mathematical optimization. No evidence suggests linear weights produce superior results compared to alternative weighting schemes. Exponential moving averages apply different weight distributions that some traders prefer. The optimal weighting system remains subjective and market-dependent.

Signal Timing Uncertainty Crossover signals lack precision regarding trend duration and magnitude. A weighted moving average crossover indicates potential trend change but provides no information about the move's expected extent. Traders must employ position sizing and risk management techniques that account for this uncertainty.

Combining Weighted Moving Average with Other Indicators

Effective trading systems rarely rely on single indicators. Weighted moving averages integrate well with complementary analysis tools that address their limitations.

Momentum Oscillators: Relative Strength Index (RSI) or Stochastic indicators confirm weighted moving average signals. When price crosses above a weighted moving average while RSI emerges from oversold territory, the combination suggests stronger buy signal validity. Divergences between price, weighted moving average, and momentum indicators warn of potential trend weakness.

Volume Analysis: Volume confirmation enhances weighted moving average crossover reliability. Crossovers accompanied by expanding volume indicate genuine market participation supporting the new trend direction. Low-volume crossovers suggest weak conviction and higher reversal probability.

Support and Resistance Levels: Horizontal support and resistance zones provide context for weighted moving average signals. Crossovers occurring at significant price levels carry greater importance than those in neutral territory. When a weighted moving average aligns with established support or resistance, the level's significance amplifies.

Additional Moving Averages: Multiple weighted moving averages or combinations with exponential moving averages create comprehensive trend analysis frameworks. Triple moving average systems employ short, medium, and long-term lines to identify trend hierarchy. All three lines aligned in the same direction signals strong trends, while conflicting signals suggest transition periods.

Conclusion

Weighted moving averages provide forex traders with a refined approach to trend analysis through enhanced responsiveness to recent price action. The indicator's weighting mechanism reduces lag compared to simple moving averages, enabling earlier signal generation in trending markets. However, this sensitivity increases false signals during consolidation, requiring careful parameter selection and complementary analysis tools.

Successful application depends on matching weighted moving average periods to trading timeframe, market volatility, and strategy objectives. Short-term traders benefit from brief calculation periods that capture rapid trend changes, while position traders employ longer periods that filter noise and identify major trends. Integration with momentum indicators, volume analysis, and support-resistance levels creates robust trading systems that compensate for the weighted moving average's inherent limitations.

The weighted moving average formula offers transparent calculation logic that traders can customize and optimize. Understanding the mathematical foundation enables informed parameter adjustments and realistic performance expectations. Markets continuously evolve, and indicators that performed well historically may require modification. Ongoing analysis of weighted moving average effectiveness across different market conditions ensures the indicator remains a valuable component of trading methodology.

Forex traders incorporating weighted moving averages into their technical analysis gain a proven tool for trend identification and signal generation. The indicator's decades-long presence in trading literature reflects genuine utility when applied appropriately. Combined with disciplined risk management and realistic expectations about indicator limitations, weighted moving averages contribute to systematic, repeatable trading approaches that adapt to changing currency market dynamics.