Volume Analysis: The Hidden Secret Behind Smart Forex Trading

Volume analysis is the art of reading market sentiment through trading activity—think of it as checking the pulse of the market before making your move. By examining how many trades happen during price movements, you'll spot genuine trends versus fake-outs, identify when big players are entering positions, and make smarter trading decisions. This guide breaks down everything from basic concepts to advanced indicators, giving you the edge that separates profitable traders from those flying blind.

Introduction: Why Volume Speaks Louder Than Price

Here's something most beginner traders get wrong: they obsess over price charts while completely ignoring the story volume tells.

I learned this the hard way during my first year trading forex. I'd see a currency pair shooting upward and jump in, thinking I'd caught a breakout. But without checking volume? Half the time, those moves fizzled out faster than a firecracker in a rainstorm. The price would climb on pathetically low volume—a clear sign that nobody with serious money actually believed in that move.

Volume is like the soundtrack to price action. Price tells you what's happening, but volume tells you how much conviction is behind it. When EUR/USD surges on massive volume, that's thousands of traders putting real money where their mouths are. When it inches up on volume thinner than gas station coffee? That's noise you should probably ignore.

While most traders focus solely on technical analysis tools like moving averages, trendlines, and candlestick patterns, they're missing half the picture. Technical analysis without volume is like watching a movie with the sound off—you see the action but miss the emotional intensity. Volume adds that crucial dimension, revealing whether the technical patterns you're seeing have real market participation backing them up.

The forex market trades over $7.5 trillion daily, making it the world's largest financial market. Within that massive ecosystem, volume analysis helps you separate the signal from the noise, identifying where smart money flows and where amateur traders get trapped.

Key Takeaways

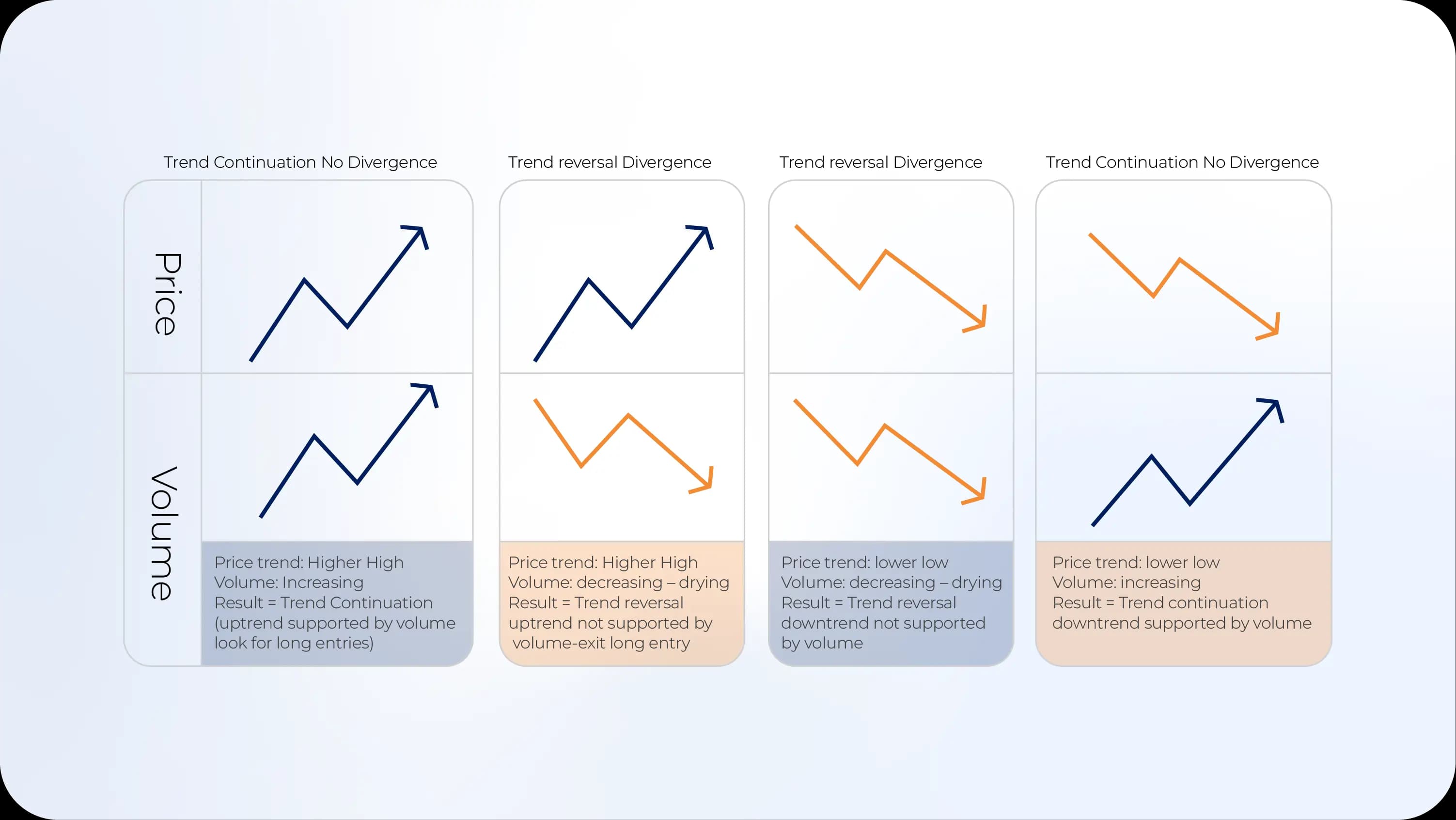

- Volume confirms price trends: Rising prices with increasing volume signal strong bullish momentum, while rising prices on declining volume suggest a weakening trend that might reverse soon

- Volume precedes price movements: Unusual volume spikes often appear before major price breakouts, giving savvy traders early warning signals to position themselves

- Multiple indicators paint the complete picture: Combining tools like On-Balance Volume (OBV), Volume Weighted Average Price (VWAP), and Accumulation/Distribution Line creates a more reliable trading strategy than relying on any single metric

- Context matters more than raw numbers: A volume spike means different things during different market conditions—what's normal for London open might signal something unusual during Asian trading hours

What Is Volume Analysis?

Volume analysis is the practice of examining trading activity to understand the strength behind price movements and predict future market direction. It's your backstage pass to market psychology.

Think about it this way: imagine you're at an auction. When two people are casually bidding on an item, prices might creep up slowly. But when thirty people start aggressively competing? Prices skyrocket. The number of active bidders (volume) tells you how desperately people want that item.

Currency markets work the same way. When GBP/USD drops on light volume, it might just be a slow day with limited participation. But when it plummets on triple the average volume? That's panic selling or major institutions dumping positions—information you definitely want to know.

Here's what makes volume analysis particularly powerful in forex: unlike stocks, where you can see exact share counts, forex is decentralized. Most platforms show "tick volume" (the number of price changes) rather than actual traded volume. While not perfect, tick volume strongly correlates with actual trading activity and provides the insights you need.

The beauty of volume analysis lies in its simplicity. You're not predicting the future or reading tea leaves—you're observing actual market behavior. When thousands of traders agree strongly enough to execute trades, they're leaving footprints. Your job is learning to read those tracks.

Volume and Price: The Dynamic Duo

Price and volume work together like peanut butter and jelly—good separately, but magical together.

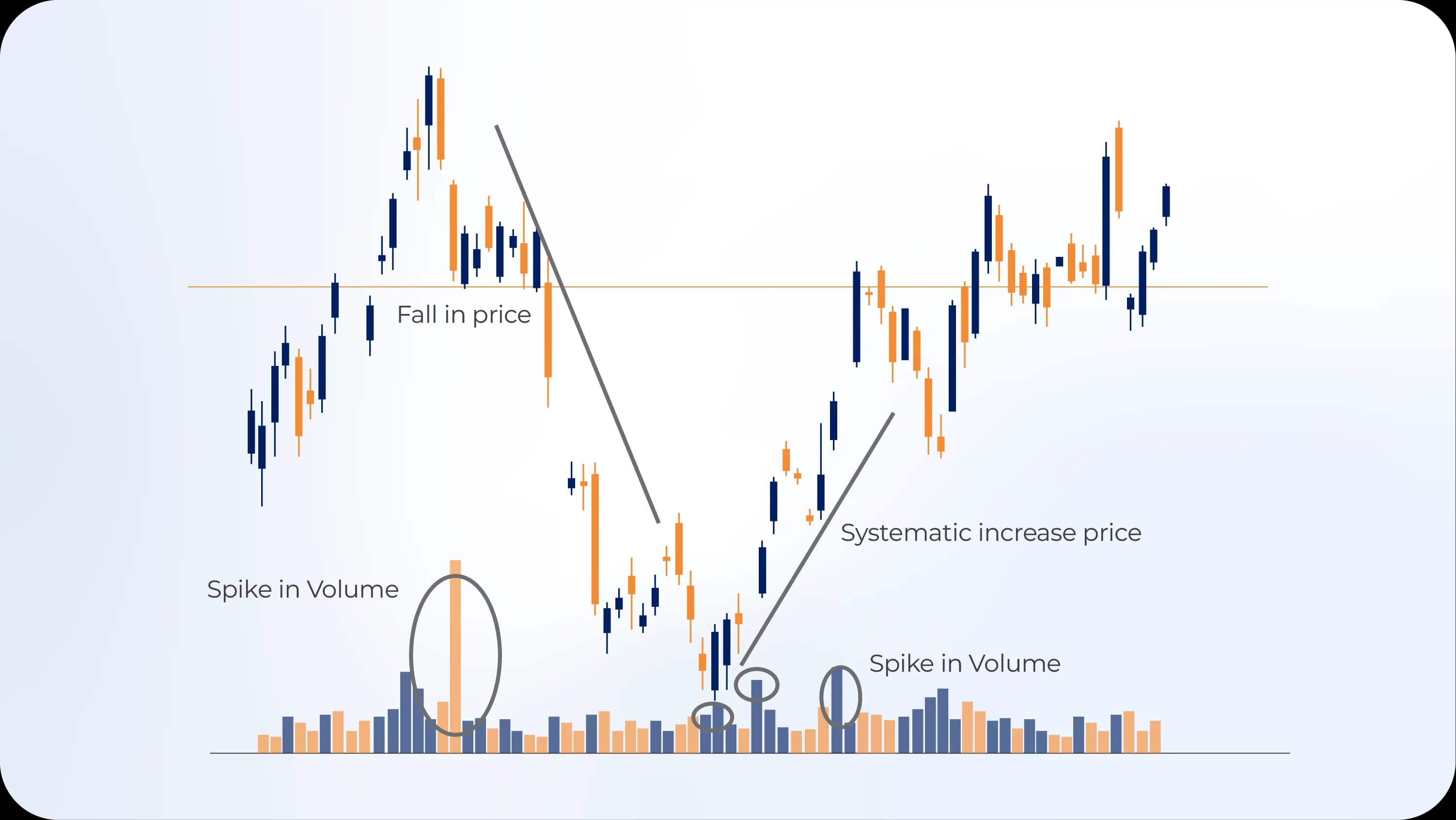

When price and volume move in the same direction (both rising or both falling), you've got confirmation. The market isn't just moving; it's moving with conviction. This is when trends tend to continue, and jumping aboard can be profitable.

But when they diverge? That's when things get interesting. Picture this: a currency pair keeps making higher highs, but volume keeps shrinking. Fewer and fewer traders believe in this rally. It's like a party where people keep leaving—the music might still be playing, but the vibe is dying. This divergence often precedes reversals.

I once watched USD/JPY grind higher for three weeks straight while volume steadily declined. Every technical indicator screamed "buy," but volume whispered "this is exhausted." Sure enough, the pair reversed sharply. The traders who noticed that volume divergence protected their capital or even profited from the reversal.

What Are the Indicators for Volume Analysis?

Volume indicators transform raw trading activity data into actionable insights. Let's break down the most powerful tools in your analytical arsenal.

On-Balance Volume (OBV)

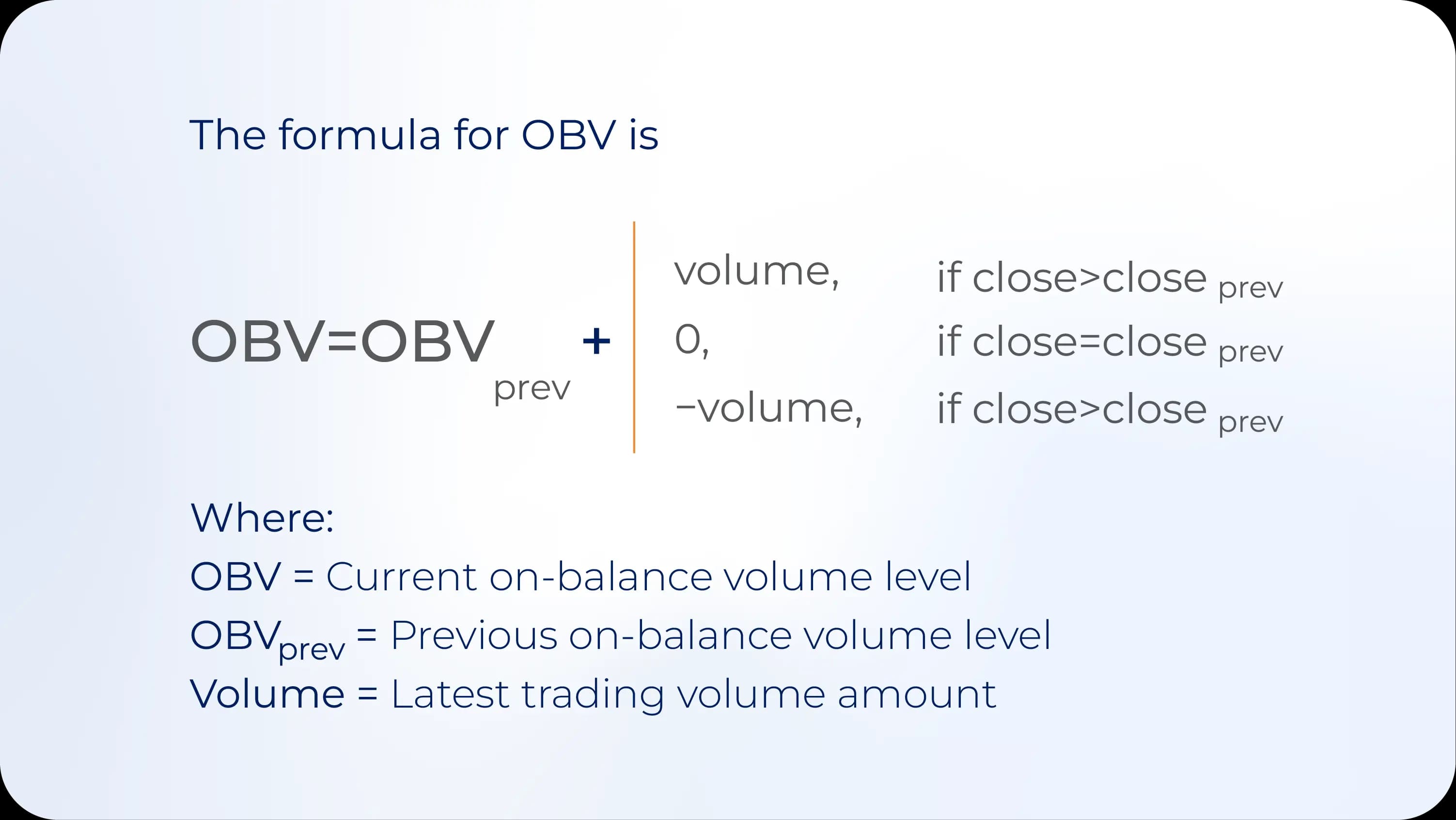

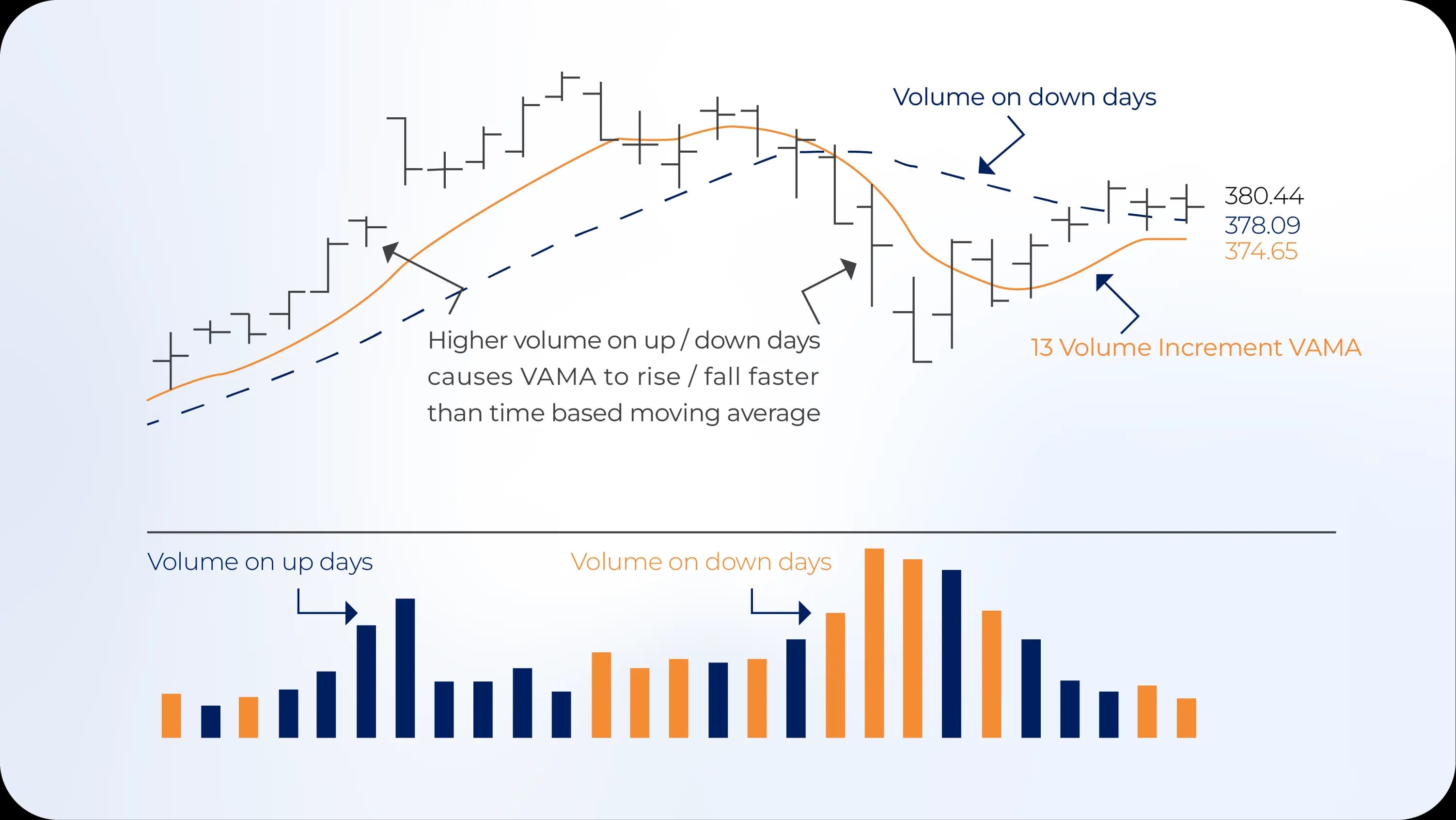

On-Balance Volume is brilliantly simple: it adds volume on up days and subtracts volume on down days, creating a running total that reveals whether volume is flowing into or out of a currency pair.

Joe Granville created OBV in the 1960s with one core insight: volume precedes price. When OBV trends upward while price consolidates, smart money is quietly accumulating positions. When OBV diverges from price—say, price makes a new high but OBV doesn't—that's your warning bell.

Here's the practical magic: OBV smooths out the noise. Instead of obsessing over each day's volume bars, you see the big picture trend. I use OBV as a confirmation tool. If I'm considering a long position and OBV has been climbing steadily, that gives me confidence. If OBV is trending down while price drifts higher? I'll wait for a better setup or look elsewhere.

Volume Weighted Average Price (VWAP)

VWAP calculates the average price weighted by volume—essentially showing you where most trading activity happened during a session. Institutional traders love this indicator because it helps them assess whether they're getting good execution.

Think of VWAP as the market's "fair value" line for the day. When price trades above VWAP, buyers are in control. Below VWAP? Sellers have the upper hand. Many traders use VWAP as a dynamic support/resistance level.

The really clever play is watching how price interacts with VWAP. A currency pair that keeps bouncing off VWAP as support during a trending day shows strong buying interest. But if price can't reclaim VWAP after falling through it? That signals seller strength that might continue.

Day traders particularly worship VWAP because it resets each session, providing a fresh benchmark. I've watched EUR/USD respect VWAP with uncanny precision during strong trending days—price might deviate briefly, but it gets pulled back like a magnet.

Read More: VWAP: Complete Guide to Volume Weighted Average Price Trading

Accumulation/Distribution Line (A/D Line)

The Accumulation/Distribution Line measures whether a currency pair is being accumulated (bought) or distributed (sold) by analyzing the relationship between closing prices and volume.

Here's what makes A/D different from OBV: it doesn't just look at whether price closed higher or lower. It examines where price closed within the day's range. If GBP/USD rallies all day but closes near the low of that range on high volume, the A/D Line barely budges—because that action suggests sellers jumped in and overpowered buyers despite the earlier rally.

This nuance catches turning points that cruder indicators miss. When price keeps climbing but A/D flattens or declines, distribution is happening. Smart money is selling into the rally, and less-informed traders are eagerly buying. Guess who usually wins that trade?

I track A/D alongside price action during major news events. Sometimes a currency pair spikes on a headline but closes back near opening levels on huge volume. A/D reveals that initial enthusiasm got sold into—valuable information suggesting the market doesn't truly believe the news justifies a sustained move.

Chaikin Money Flow (CMF)

Chaikin Money Flow combines price and volume to measure buying and selling pressure over a specific period—typically 20 or 21 days. It oscillates around a zero line: positive values indicate buying pressure, negative values signal selling pressure.

Marc Chaikin built CMF on a straightforward premise: during periods of accumulation, prices close in the upper half of their daily range on volume. During distribution, prices close in the lower half. CMF quantifies this pattern, helping you identify whether bulls or bears are winning the volume game.

What I love about CMF is its momentum perspective. When CMF turns positive after a downtrend, it often precedes price reversals. The money flow shifted before price acknowledged it—giving you that precious early signal.

The sweet spot for CMF comes when it aligns with price action. Rising prices with positive and increasing CMF? That's a strong trend you can ride confidently. Rising prices with declining CMF? Start looking for exits, because that momentum is evaporating.

IndicatorBest ForKey SignalTime HorizonOn-Balance Volume (OBV)Trend confirmation, divergence spottingOBV trending opposite to priceAll timeframesVWAPIntraday support/resistance, institutional levelsPrice interaction with VWAP lineIntraday onlyAccumulation/Distribution LineIdentifying smart money activityA/D diverging from price trendSwing trading, position tradingChaikin Money FlowMeasuring buying/selling pressureCMF crossing zero lineShort to medium-term

Volume Oscillator

The Volume Oscillator displays the difference between two volume moving averages—typically a fast one (14 periods) and a slow one (28 periods). It shows whether recent volume is increasing or decreasing relative to longer-term averages.

This indicator excels at highlighting when volume is abnormally high or low. When the oscillator spikes sharply upward, you know current volume significantly exceeds recent norms—possibly signaling a major move beginning. When it dips into negative territory, current activity is sluggish compared to the recent past.

I use Volume Oscillator to filter out false breakouts. If USD/CAD breaks above resistance but Volume Oscillator shows declining relative volume, I'm skeptical. Real breakouts happen when everyone rushes through the door simultaneously, not when they trickle through.

How to Calculate Volume Analysis?

Let's demystify the math behind these indicators. Don't worry—you won't need to calculate these manually (your trading platform handles it), but understanding the formulas helps you interpret signals correctly.

Calculating On-Balance Volume

OBV uses simple addition and subtraction:

- If today's close is higher than yesterday's close: OBV = Previous OBV + Today's Volume

- If today's close is lower than yesterday's close: OBV = Previous OBV - Today's Volume

- If today's close equals yesterday's close: OBV = Previous OBV (unchanged)

You start with an arbitrary baseline (often zero or the first day's volume) and build from there. The absolute OBV number doesn't matter—you're watching the direction and trend of OBV relative to price.

Example: If EUR/USD closed at 1.1050 yesterday and closes at 1.1080 today on 50,000 volume, you'd add 50,000 to yesterday's OBV. If it closes at 1.1020 tomorrow on 30,000 volume, you'd subtract 30,000. Over time, you see whether volume is accumulating in the direction of bullish or bearish closes.

Calculating VWAP

VWAP formula: VWAP = Cumulative(Price × Volume) / Cumulative Volume

More specifically:

- Calculate typical price for each period: (High + Low + Close) / 3

- Multiply typical price by volume for that period

- Sum all (typical price × volume) values from session start

- Sum all volume values from session start

- Divide cumulative (price × volume) by cumulative volume

Let's say GBP/USD has these first three 1-minute bars of the day:

- Bar 1: High 1.3010, Low 1.3000, Close 1.3005, Volume 1000

- Typical Price: 1.3005

- Price × Volume: 1,300.50

- Bar 2: High 1.3015, Low 1.3005, Close 1.3012, Volume 1500

- Typical Price: 1.3010.67

- Price × Volume: 1,951.60

- Bar 3: High 1.3020, Low 1.3010, Close 1.3018, Volume 2000

- Typical Price: 1.3016

- Price × Volume: 2,603.20

Cumulative (Price × Volume) = 5,855.30 Cumulative Volume = 4,500 VWAP = 5,855.30 / 4,500 = 1.3012

As each new bar appears, you add its values to the cumulative totals and recalculate. VWAP continuously adjusts throughout the session, giving you an evolving reference point.

Calculating Accumulation/Distribution Line

The A/D Line formula involves two steps:

Step 1: Calculate Money Flow Multiplier Money Flow Multiplier = [(Close - Low) - (High - Close)] / (High - Low)

This ranges from -1 to +1. When close is at the high, the multiplier is +1. When close is at the low, it's -1. Mid-range closes produce values near zero.

Step 2: Calculate Money Flow Volume and A/D Line Money Flow Volume = Money Flow Multiplier × Volume A/D Line = Previous A/D Line + Current Money Flow Volume

Example: USD/JPY has High 150.50, Low 150.00, Close 150.40, and Volume 80,000.

Money Flow Multiplier = [(150.40 - 150.00) - (150.50 - 150.40)] / (150.50 - 150.00) = [0.40 - 0.10] / 0.50 = 0.30 / 0.50 = 0.6

Money Flow Volume = 0.6 × 80,000 = 48,000

If previous A/D Line was 1,200,000, the new A/D Line is 1,248,000.

The A/D Line's absolute value doesn't matter—watch for divergences between A/D Line direction and price direction.

Calculating Chaikin Money Flow

CMF averages the Money Flow Volume over a specific period (typically 20 or 21 days):

CMF = Sum of Money Flow Volume for n periods / Sum of Volume for n periods

Remember, Money Flow Volume = [(Close - Low) - (High - Close)] / (High - Low) × Volume

You calculate Money Flow Volume for each of the last 20 periods, sum them, then divide by the total volume over those 20 periods. The result oscillates around zero, usually between -0.5 and +0.5.

Values above 0.05 typically indicate buying pressure. Values below -0.05 signal selling pressure. The further from zero, the stronger the pressure.

Reading Volume Patterns Like a Pro

Understanding calculations is one thing; interpreting patterns in real market conditions is where you make money. Let me share some volume patterns that have saved my account repeatedly.

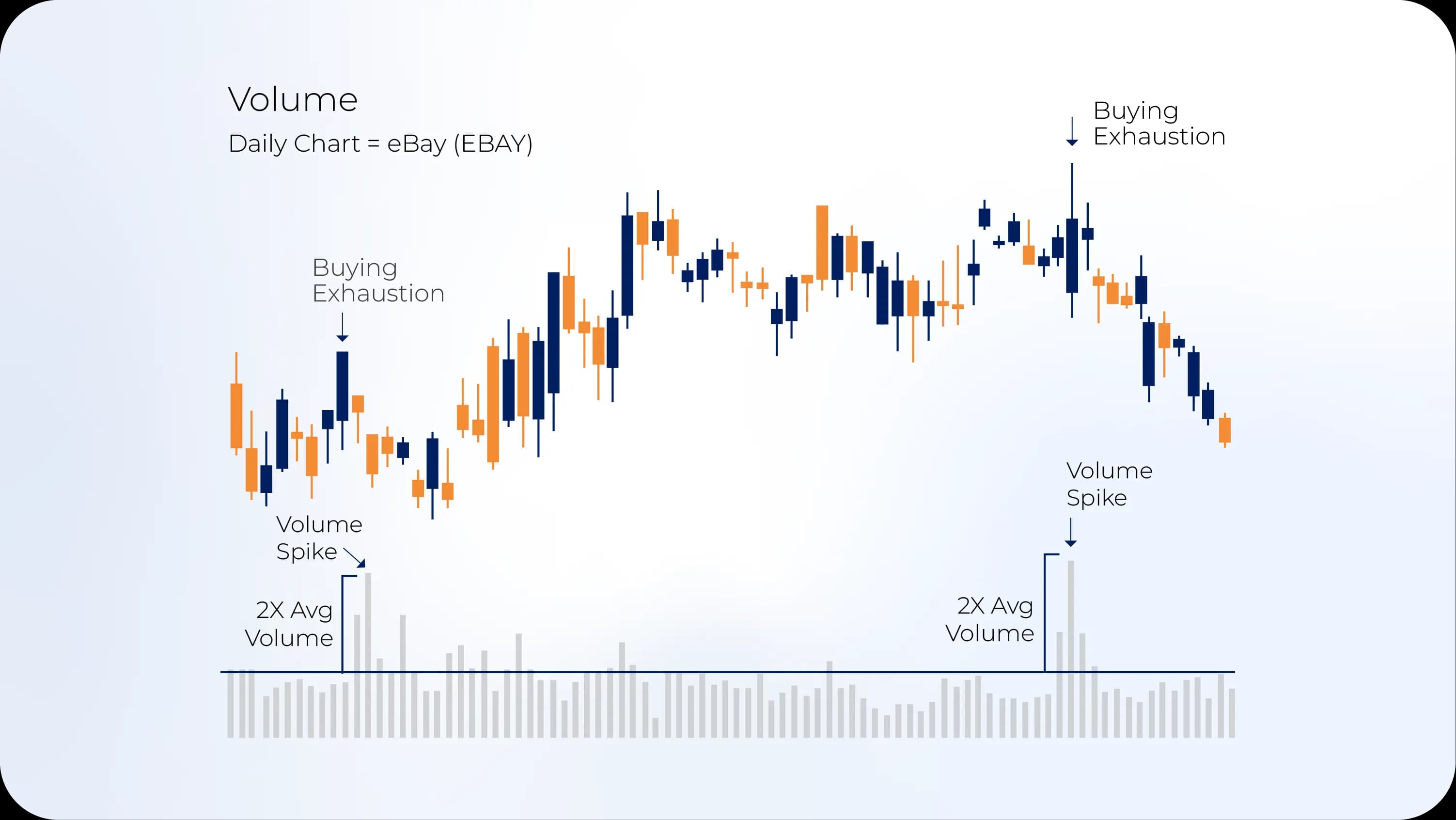

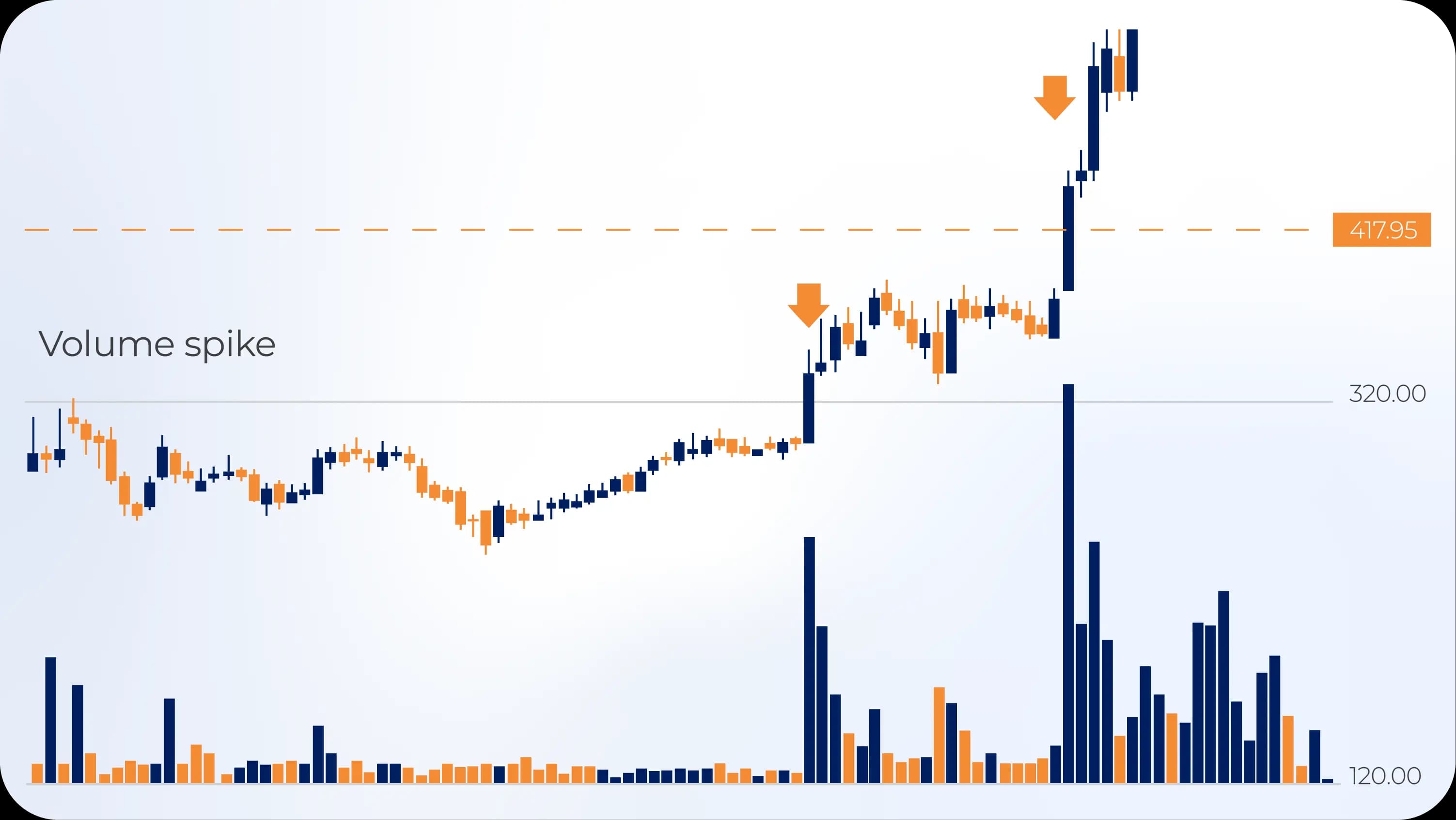

The Volume Surge

When volume suddenly spikes to 2-3 times average levels, pay attention. This signals a shift in market dynamics—either the beginning of a new trend or exhaustion of the current one.

Context determines interpretation. If AUD/USD has been consolidating and suddenly breaks resistance on massive volume, that's the market signaling "we're moving now, join us or get left behind." This often starts multi-day trends.

But if a currency pair has already rallied strongly for weeks and then gaps higher on enormous volume, that might be a blowoff top. Everyone who wanted in finally jumped aboard, and there's nobody left to buy. Contrarian traders look for reversals after these exhaustion volume spikes.

Volume Dries Up

Decreasing volume during price movement suggests weakening conviction. It's like a conversation where people talk progressively softer—interest is fading.

I've seen EUR/JPY grind higher for days with volume shrinking daily. Chart watchers thought "the trend is my friend" and kept buying. But when volume finally spiked as price reversed sharply lower, all those late buyers got trapped. The lack of volume was screaming "this rally is fake" to anyone listening.

Low volume environments also create danger because they're illiquid. A single large order can push prices dramatically without much underlying shift in sentiment. Be cautious trading breakouts or breakdowns on abnormally thin volume—they're often false signals.

Volume Climax

A volume climax occurs when volume explodes to extreme levels alongside rapid price movement, often marking significant tops or bottoms. It's the market's exclamation point.

These typically happen on major news events or when a trend reaches its emotional peak. If NZD/USD has been falling for weeks and suddenly plunges on volume five times average—with everyone panicking out of positions—that often marks a selling climax. Once every scared seller exits, there's nobody left to push it lower, and the pair bounces.

The most reliable volume climaxes combine massive volume with a wide-range bar (big distance between high and low) and price reversal. If that happens after an extended trend, start thinking about trading the opposite direction.

Practical Volume Analysis Strategies

Theory is nice, but let's talk tactics you can use tomorrow morning when markets open.

Strategy 1: Volume Confirmation Breakouts

Breakouts fail roughly 70% of the time in forex. Volume analysis dramatically improves your odds.

Here's the play: when a currency pair approaches major resistance, watch volume like a hawk. As price hits resistance, you want to see volume expanding—ideally to 1.5-2 times average. This shows increased participation and suggests the breakout has legs.

If price breaks resistance but volume is meh—below average or barely above—walk away. Those breakouts typically fail within hours, and you'll get a better entry when price returns to the range.

I combine this with OBV. If OBV is already trending higher before the breakout attempt, it confirms that accumulation has been happening. When price finally breaks, it's catching up to what volume already telegraphed.

Strategy 2: Divergence Trading

Divergences between price and volume indicators rank among the most reliable reversal signals in trading.

Classic bullish divergence: price makes a lower low, but OBV or A/D Line makes a higher low. This shows that despite price weakness, volume/money flow is actually improving. Sellers are losing control. When price reverses upward, you've got confirmation to enter long.

Bearish divergence works oppositely: price makes a higher high while OBV/A/D Line makes a lower high. The rally is happening on decreasing participation—a red flag that it's running out of steam.

I wait for price action confirmation before trading divergences. A divergence alone doesn't give you entry timing; you need price to show reversal signals (like a bullish engulfing candle or break of short-term trendline) before pulling the trigger.

Strategy 3: VWAP Mean Reversion

Day traders can build entire strategies around VWAP. The simple version: when price deviates significantly from VWAP (typically 0.2-0.3% or more), it tends to revert.

If USD/CHF opens and rallies hard in the first hour, pushing 0.4% above VWAP, that's an extended move. Scalpers short it, expecting price to drift back toward VWAP. Place stops just beyond recent highs, and target VWAP or slightly below.

The opposite works too: when price dips well below VWAP, look for long entries anticipating reversion. Best setups occur when VWAP is relatively flat (ranging days) rather than strongly trending.

Add volume context: if price is above VWAP but volume is declining, mean reversion becomes more likely. If volume remains strong, price might stay extended longer.

Strategy 4: Volume-Price Trend (VPT) Analysis

The Volume-Price Trend indicator combines percentage price changes with volume, creating a cumulative line similar to OBV but with more sensitivity to the magnitude of price changes.

VPT = Previous VPT + [Volume × (Today's Close - Yesterday's Close) / Yesterday's Close]

Use VPT to identify when money is flowing aggressively. Sharp VPT increases show strong buying (or selling if declining). When VPT trends steadily in one direction, expect that price trend to continue.

I watch for VPT to break its own trendlines before price does. If VPT has been trending higher with price but then breaks its uptrend while price keeps rising, that's early warning the rally is on borrowed time.

StrategyMarket ConditionRisk LevelBest TimeframeVolume Confirmation BreakoutsConsolidation to trend transitionMedium4H, DailyDivergence TradingExtended trends nearing exhaustionMedium-HighDaily, WeeklyVWAP Mean ReversionRanging, moderate volatilityLow-Medium5-min to 1HVolume-Price TrendTrending marketsMedium1H, 4H

Common Volume Analysis Mistakes to Avoid

Even experienced traders stumble into these traps. Learn from others' expensive lessons.

Ignoring Market Context

Volume that's normal during London open looks huge during Sydney session. Always compare current volume to typical volume for that specific time of day and day of week.

I cringe when I see traders getting excited about "big volume" at 2 AM EST on a Tuesday. That's not significant activity—that's barely above average for off-hours trading. Wait for comparable contexts before drawing conclusions.

Similarly, volume around major economic releases (NFP, FOMC, central bank announcements) will dwarf normal volume. A spike on those days doesn't carry the same implication as a spike during routine trading.

Over-Relying on Single Indicators

OBV is great. VWAP is useful. Neither is infallible.

Volume analysis works best when you combine multiple indicators with price action confirmation. If OBV shows bullish divergence, A/D Line is rising, and price breaks above a key moving average, you've got confluence—multiple factors agreeing. That's when conviction should be high.

But if only one indicator shows something interesting while others contradict it or stay neutral, proceed cautiously. The market might not be giving you a real signal—could be noise or an indicator quirk.

Forgetting That Tick Volume Isn't Real Volume

In forex, most retail platforms show tick volume (number of price changes) not actual traded volume. While these usually correlate, they're not identical.

During extremely fast markets or flash events, you might see massive tick volume that doesn't reflect proportional actual trading. A price that jumps 50 pips in one second with thin actual liquidity creates huge tick volume without the genuine market participation real volume represents.

Keep this limitation in mind, especially during chaotic market conditions. Tick volume is a useful proxy but not gospel truth.

Chasing Volume Spikes

Seeing huge volume bar appear is exciting. Your instinct might be "I need to get in NOW before this move gets away from me!"

Stop. Breathe. That volume spike might be the end of the move, not the beginning.

Volume spikes often occur at turning points—when the last buyers rush in at tops or the last sellers panic out at bottoms. If you chase that spike without considering context, you're often buying the high or selling the low.

Let the dust settle. See how price behaves over the next few bars. Does the move continue with sustained volume, or did that one spike mark exhaustion? Patience saves capital.

Advanced Volume Concepts

Once you've mastered basics, these sophisticated concepts elevate your analysis.

Volume Profile

Unlike standard volume bars that show activity over time, Volume Profile displays volume at different price levels. It answers: "At which prices did most trading occur?"

Volume Profile reveals support and resistance zones based on where heaviest trading happened. The Point of Control (POC)—the price level with highest volume—acts as a magnet. Price tends to gravitate toward POC areas because that's where market participants agree value exists.

High Volume Nodes (HVN) represent prices where significant trading occurred, often providing support/resistance. Low Volume Nodes (LVN) show prices that traded quickly without much activity—price tends to move through these areas rapidly.

I use Volume Profile for swing trading. If USD/CAD is approaching an HVN from below, I expect it to slow down or reverse there, because many traders have positions around that price and will defend it. If it breaks through an HVN on strong volume, that signals conviction and often leads to extended moves.

Market Profile and TPO Charts

Market Profile organizes price and time data to show where and when trading occurred, using Time Price Opportunity (TPO) charts. Each letter represents a 30-minute period, creating a distribution showing which prices attracted most activity.

The Value Area (where 70% of the day's volume occurred) defines the day's accepted price range. When price moves outside the Value Area, you're in rejection areas—prices the market didn't accept. These often provide turning points.

I check Market Profile before US session opens to see where overnight session established value. If price is trading above previous day's Value Area High, that's bullish context. Below Value Area Low? Bearish context. This frames my directional bias for the day.

Cumulative Volume Delta (CVD)

CVD tracks the difference between buying volume and selling volume cumulatively over time. If buy orders consistently exceed sell orders, CVD trends upward, confirming bullish pressure. Declining CVD shows sellers dominating.

This indicator is particularly powerful for spotting institutional accumulation or distribution that might not be obvious from price alone. When price consolidates sideways but CVD steadily rises, somebody is aggressively accumulating—often a precursor to upward breakouts.

The challenge is that CVD requires actual trade-level data (which side initiated each trade), not available on most forex platforms. If you have access through a quality broker or platform, CVD provides incredible insight. If not, OBV and A/D Line serve as decent proxies.

Integrating Volume Analysis with Other Tools

Volume analysis doesn't exist in isolation. The real magic happens when you combine it with complementary techniques.

Volume + Moving Averages

Moving averages identify trends; volume confirms their strength. When price trades above the 200-day moving average on expanding volume, that's a robust uptrend worth riding. But if price crosses above the 200-day MA on weak volume, skepticism is warranted.

I wait for volume expansion when price tests major moving averages. If EUR/USD drops to the 50-day MA (a common support level) and bounces on increased volume, that confirms the MA is holding and signals a long entry. If it touches the MA on light volume, I wait—there's not enough conviction to trust that support yet.

Volume + Support/Resistance

Support and resistance levels become more reliable when volume validates them. If GBP/JPY approaches resistance that previously stopped rallies, watch what volume does.

Low volume as price approaches resistance suggests weak buying interest—the move might stall without breaking through. But if volume expands as price nears resistance, that shows conviction. If it breaks through on heavy volume, you've got a legitimate breakout worth trading.

After breakouts, volume should initially surge (the breakout), then gradually decline as the new trend establishes (consolidation), before surging again on the next leg. This rhythm—expansion, consolidation, expansion—characterizes healthy trending markets.

Volume + Momentum Indicators

RSI, MACD, and Stochastic oscillators measure momentum and overbought/oversold conditions. Volume indicators add the conviction layer.

Let's say RSI shows USD/JPY is oversold (below 30). That alone doesn't guarantee a bounce—markets can stay oversold during strong downtrends. But if OBV starts trending higher while price remains oversold, now you've got divergence plus oversold readings. The probability of reversal increases significantly.

Combine momentum and volume for high-probability setups: oversold momentum + bullish volume divergence = strong buy signal. Overbought momentum + bearish volume divergence = strong sell signal.

Volume + Candlestick Patterns

Candlestick patterns show price action psychology; volume shows the strength behind those patterns.

A bullish engulfing candle at support looks nice. A bullish engulfing candle on volume three times average? That's a compelling signal institutions are stepping in. The volume confirms genuine buying interest, not just random price fluctuation.

Same with doji candles (indecision patterns). A doji at a key level on high volume shows intense battle between bulls and bears, making the next move potentially explosive. A doji on light volume? Probably just a quiet, meaningless session.

I rank candlestick patterns based on accompanying volume. High-volume patterns get priority; low-volume patterns get ignored or require additional confirmation.

Volume Analysis Across Different Market Conditions

Your approach should flex based on what the market is doing.

Trending Markets

During strong trends, volume should generally align with trend direction. In uptrends, up-days should show higher volume than down-days. In downtrends, down-days should dominate volume.

Use volume to gauge trend health. As long as volume confirms the trend, ride it. When volume diverges—trend continues but volume declines—tighten stops and prepare for potential reversal.

Counter-trend volume spikes during trends often fail. If AUD/NZD is trending higher and has a down-day with huge volume, that seems scary. But if it's just one spike amid generally declining volume on pullbacks, the uptrend likely continues. Genuine reversals require sustained volume shift, not one aberrant bar.

Ranging Markets

Volume typically declines during ranges as uncertainty keeps traders sidelined. This makes volume expansion especially significant when it appears.

When price tests range boundaries (support or resistance), watch volume. If volume expands as price hits resistance and then reverses, that confirms the range is holding. If volume surges as price breaks the boundary, prepare for the range to end and a trend to begin.

The deadliest trading environment is false breakouts from ranges. Volume analysis helps filter these—real breakouts show volume expansion, while false breakouts occur on light volume and quickly reverse.

High Volatility / News Events

Major economic releases create massive volume spikes that can be misleading. Price might whipsaw violently, creating huge volume without clear directional conviction.

I typically avoid trading the immediate aftermath of major news. Let the volume surge settle, see which direction price closes relative to its range, then assess whether follow-through occurs on sustained volume. Trading into the chaos is gambling; waiting for clarity post-news is strategy.

One exception: if a currency pair has been coiling tightly before a major announcement (low volume, narrow range), and then the news breaks it out on sustained directional volume, that often starts multi-day moves. The news provided the catalyst everyone was waiting for.

Read More: Forex Factory News: Your Complete Guide to Making Smarter Trading Decisions

Tools and Platforms for Volume Analysis

Having the right tools makes volume analysis practical rather than theoretical.

TradingView

TradingView offers excellent volume analysis capabilities with clear visualization. Most volume indicators (OBV, VWAP, Volume Oscillator) are built-in or available through community scripts.

The platform's advantage is combining volume tools with robust charting, making it easy to overlay indicators and analyze relationships. The replay feature lets you practice reading volume patterns on historical data—invaluable for skill development.

For forex specifically, remember TradingView shows tick volume. It's reliable for pattern recognition but not actual traded volume.

MetaTrader 4/5

MT4 and MT5 remain popular among forex traders, with decent volume indicator support. You'll find OBV, volumes indicators, and can install custom volume indicators from the community.

The platform's strength is execution and broker integration rather than advanced volume analysis. Use MT4/5 for trading execution while doing deeper volume analysis on TradingView or specialized platforms.

NinjaTrader

NinjaTrader excels at order flow and volume analysis, offering Volume Profile, Market Profile, and advanced volume-based indicators. It's overkill for beginners but powerful for serious traders.

The platform provides actual volume data for futures (and forex futures), giving you superior information compared to tick volume. If you're committed to volume-based trading strategies, NinjaTrader deserves consideration despite its complexity.

cTrader

cTrader provides cleaner volume visualization than MetaTrader, with better charting tools and more intuitive interface. Volume bars are crisp and easy to read, and adding volume indicators is straightforward.

Like other forex platforms, you're still working with tick volume, but cTrader presents it clearly alongside price action, making pattern recognition easier.

The Psychology Behind Volume

Understanding the human behavior volume reveals makes you a better trader.

Volume represents collective market emotion and decision-making. High volume shows strong emotions—fear or greed—driving widespread action. Low volume indicates apathy or uncertainty, with most traders sitting on their hands.

When EUR/USD surges on enormous volume, thousands of traders are so convinced of that direction they're risking real money. That collective conviction has weight and tends to continue (at least temporarily) because everyone who wanted in just got in, and they're not immediately turning around.

Conversely, when a pair drifts higher on declining volume, it's like a conversation where fewer people participate each day. The bullish story isn't resonating. Eventually, someone questions whether this makes sense, a few traders exit, and suddenly the fragile move collapses.

Volume also reveals fear versus greed. Panic selling creates massive volume spikes as everyone rushes for the exit simultaneously. Nobody wants to be last out during a crash. Greed works similarly—FOMO (fear of missing out) drives volume explosions as traders pile into seemingly unstoppable rallies.

The smart money understands this psychology and often acts opposite to the crowd. When retail traders panic and volume explodes on selling, institutions accumulate. When retail chases breakouts on enthusiasm spikes, institutions distribute. Learning to read volume helps you identify whether you're trading with smart money or getting trapped with the herd.

Building Your Volume Analysis Routine

Consistent analysis beats sporadic brilliance. Here's how to integrate volume into your daily trading process.

Pre-Market Preparation

Before markets open, scan your watchlist checking where volume closed yesterday relative to recent averages. Did any pairs close on unusually high or low volume? This gives context for today's action.

Check volume indicators across multiple timeframes. If the daily chart shows OBV trending higher but the 4-hour chart shows recent divergence, you've got conflicting signals worth monitoring. Maybe the broader trend is bullish but short-term exhaustion is developing.

I spend 15 minutes each morning reviewing volume patterns on my key pairs. This primes my brain to recognize significant developments when they occur during the trading day, rather than discovering them too late.

During Market Hours

Keep volume indicators visible on your charts. I run a setup with price and volume bars front and center, plus OBV and VWAP as overlays. This creates instant visual feedback about whether price moves have volume backing.

When considering a trade, specifically check: Is volume above or below average? What's OBV doing—confirming or diverging? Where's price relative to VWAP? These three quick checks catch many losing trades before you enter them.

Set alerts for unusual volume spikes on your watchlist pairs. If NZD/USD suddenly trades twice average volume, you want to know immediately so you can assess whether an opportunity is developing.

Post-Session Review

After market close, review any trades you took or considered. Did volume confirm your analysis, or did you ignore contradictory volume signals? Honest post-trade review accelerates learning.

Look at big winners and losers from the day. What did volume look like on those moves? Over time, you'll develop intuition for volume patterns that precede significant price action.

Keep a trading journal documenting volume conditions on your trades. After 50+ trades, patterns emerge showing which volume setups work best for your style and which ones fool you. Data beats opinions.

Frequently Asked Questions About Volume Analysis

Let's tackle the most common questions traders have about implementing volume strategies.

What Is Volume Analysis?

Volume analysis is the study of trading activity to understand market strength, confirm trends, and predict potential reversals. By examining how many trades occur during price movements, you determine whether moves have genuine conviction or represent weak, unsustainable action. It's essentially measuring the energy behind price changes—high volume suggests strong participant agreement and likely continuation, while low volume indicates uncertainty and potential reversal.

Think of volume as the market's megaphone. Loud volume screams that something important is happening and you should pay attention. Quiet volume whispers that current price action might not matter much. The technique helps you distinguish meaningful market signals from random noise, improving timing and reducing false signals.

What Are the Indicators for Volume Analysis?

The primary indicators include On-Balance Volume (OBV), which tracks cumulative volume flow; Volume Weighted Average Price (VWAP), showing the average price weighted by trading activity; Accumulation/Distribution Line, revealing whether smart money is accumulating or distributing positions; Chaikin Money Flow, measuring buying and selling pressure over time; and Volume Oscillator, comparing short-term and long-term volume trends.

Each indicator offers a unique perspective. OBV excels at spotting divergences between price and volume trends. VWAP provides intraday reference levels for institutional pricing. The A/D Line catches subtle shifts in market sentiment before price reflects them. CMF quantifies momentum behind moves. Volume Oscillator highlights abnormal activity periods. Using multiple indicators together creates a comprehensive view of market dynamics that single indicators miss.

How to Calculate Volume Analysis?

Volume indicators use different mathematical formulas but share common principles. OBV adds volume on up days and subtracts it on down days, creating a running total. VWAP calculates (Price × Volume) cumulative sum divided by cumulative volume. The A/D Line uses a multiplier based on where price closes within the day's range, multiplied by volume, then accumulated. CMF averages money flow volume over a specific period relative to total volume.

While your trading platform automatically calculates these, understanding the math helps interpret signals. For example, knowing OBV simply adds and subtracts volume based on close direction explains why it can diverge from price—the indicator treats all volume equally regardless of price magnitude. VWAP's formula reveals why it acts as a "fair value" level—it weights prices by how much activity occurred there, not just arithmetic averages.

Can volume analysis work on lower timeframes?

Absolutely, though noise increases on shorter timeframes. Volume patterns on 5-minute charts change faster and show more false signals than daily charts. You need quicker reactions and tighter stops. Many scalpers successfully use VWAP mean reversion on 1-5 minute charts. Just understand that volume on very short timeframes includes more random fluctuation, so confirmation becomes even more important.

Should I trust volume during Asian session?

Asian session typically shows lower volume than London or New York sessions, but that doesn't make it unreliable—just different context. A volume spike during Tokyo hours means something different than the same spike during London. Compare current Asian volume to typical Asian volume, not to European session volume. Many currency pairs involving JPY, AUD, and NZD show excellent volume-based signals during Asian hours.

Do volume indicators work during ranging markets?

Yes, but differently than in trends. During ranges, watch for volume expansion at support and resistance boundaries—this often signals whether the range will hold or break. Volume typically contracts mid-range as uncertainty keeps traders sidelined. When volume suddenly expands while price is away from boundaries, that often precedes a range breakout. VWAP becomes less useful in ranges, but OBV and A/D Line still provide valuable divergence signals.

How do I know if volume is "high" or "low"?

Compare current volume to recent average volume for that pair and time of day. Most platforms show a moving average of volume (often 20-period) as a reference line. Volume exceeding 1.5-2× this average qualifies as high. Volume below 0.5× average is low. Context matters enormously—what's high for USD/CAD might be normal for EUR/USD. Build a mental database of typical volume ranges for pairs you trade regularly.

Avoiding Analysis Paralysis

Here's the trap: volume analysis offers endless indicators and combinations. You could spend hours analyzing every aspect before taking a single trade. Don't.

Start simple. Pick one or two volume indicators (I recommend OBV and volume bars) and master reading them alongside price. Get comfortable identifying divergences, confirming breakouts, and spotting exhaustion. This foundation covers 80% of useful volume analysis.

After you're consistently profitable using basics, gradually add complexity. Maybe introduce VWAP for intraday reference. Then experiment with A/D Line for swing trades. Let each addition prove its value before adding another layer.

The goal isn't becoming a volume analysis expert—it's becoming a profitable trader. Volume analysis is a tool, not the entire toolbox. Use what works, ignore what doesn't, and remember that simple approaches consistently executed beat complex systems inconsistently applied.

Practical Tips for Implementation

Let me share some battle-tested wisdom that books don't usually cover.

Start with higher timeframes. Daily charts show cleaner volume patterns than 15-minute charts. Build your pattern recognition skills where signal-to-noise ratio is favorable, then work toward shorter timeframes once you're confident.

Volume matters most at key levels. Don't obsess over volume on random price action mid-range. Focus your analysis when price approaches significant support, resistance, or previous highs/lows. That's when volume reveals important information about whether levels will hold or break.

One good signal beats five mediocre ones. Wait for clear, unambiguous volume setups rather than forcing trades on marginal signals. When OBV, A/D Line, and price action all align perfectly at a major support level, bet big. When indicators give mixed signals, bet small or skip it entirely.

Volume lags during holidays and summer. Expect thinner volume during major holidays, late August, and late December. Patterns become less reliable because participation drops significantly. Either adjust your strategy for low-liquidity environments or take time off during these periods.

Paper trade new strategies first. Before risking capital on volume-based strategies, practice them with demo accounts or paper trading for at least 20-30 trades. This builds pattern recognition without financial pressure and reveals which setups you naturally read well versus which ones confuse you.

The Bottom Line on Volume Analysis

Volume analysis transforms you from someone reacting to price changes into someone understanding the forces driving those changes. You stop being surprised by reversals because volume telegraphed them. You stop getting trapped in false breakouts because volume revealed their weakness. You start making decisions based on what the entire market is actually doing, not just what price charts show.

Is volume analysis a crystal ball? Absolutely not. It doesn't predict the future—it reads the present more accurately. You'll still face losing trades, surprises, and uncertainty. But your winning percentage improves. Your risk management sharpens. Your confidence grows because decisions rest on logical analysis rather than hope or fear.

The traders making consistent money aren't necessarily smarter or more disciplined than you. They just see things you're currently missing. Volume analysis reveals a significant portion of that invisible information, leveling the playing field between retail traders and professionals.

Take Action: Your Next Steps

You've absorbed the concepts—now put them into practice. Here's your roadmap:

This week: Add volume bars and OBV to your main trading charts. Spend 30 minutes daily just observing how they move relative to price. Don't trade based on volume yet—just watch and learn the patterns.

This month: Identify three instances where volume divergence preceded price reversals. Document these with screenshots and notes. Understanding how divergence looks in real time builds your pattern recognition faster than any amount of reading.

This quarter: Implement one volume-based strategy (I suggest volume confirmation breakouts) with small position sizes. Track 20+ trades, recording volume conditions and outcomes. Review results to see if it improves your performance.

This year: Build a complete trading system integrating volume analysis with your existing technical approach. Volume shouldn't replace your current methods—it should enhance them, adding confirmation and filtering weak signals.

Remember, every expert trader started exactly where you are now: excited about volume analysis but unsure how to implement it. The difference between them and struggling traders isn't talent—it's consistent practice and willingness to learn from mistakes.

Start small, stay consistent, and let volume become the secret weapon that elevates your trading to the next level. The market is speaking through volume every single day. It's time you learned to listen.

Ready to dive deeper into forex trading strategies? Bookmark this guide and revisit it as you develop your volume analysis skills. The concepts that seem abstract now will become second nature with practice—and your account balance will thank you.