Candlestick Patterns: A Complete Guide for Forex Traders

Candlestick patterns represent the visual foundation of technical analysis, translating price movements into recognizable formations that signal potential market reversals or continuations. These graphical representations, originating from 18th-century Japanese rice trading, enable traders to interpret market psychology through the relationship between opening, closing, high, and low prices within specific timeframes, forming the basis for informed trading decisions.

Introduction: The Language of Price Action

Financial markets communicate through price, and candlestick patterns serve as the grammar of this universal language. Each candlestick encapsulates four critical price points—open, high, low, and close—within a defined period, creating visual patterns that reveal the ongoing battle between buyers and sellers. Understanding these formations transforms raw price data into actionable intelligence, allowing traders to anticipate potential market movements before they fully materialize.

The evolution of candlestick analysis from Japanese rice markets to modern forex trading platforms demonstrates its enduring relevance. While Steve Nison introduced these techniques to Western markets in the 1990s, their application has expanded significantly with the advent of electronic trading and real-time charting capabilities. Contemporary forex traders leverage candlestick patterns as primary tools for entry and exit timing, risk management, and market sentiment assessment.

Read More: Price Action: A Comprehensive Guide for Forex Traders

Key Takeaways

- Candlestick patterns combine multiple price bars to form recognizable formations that indicate potential trend reversals, continuations, or periods of market indecision.

- Pattern reliability increases substantially when confirmed by additional technical indicators such as volume analysis, support and resistance levels, or momentum oscillators.

- Bullish and bearish patterns provide symmetrical signals for upward and downward price movements, requiring traders to master both categories for comprehensive market analysis.

- Proper pattern identification demands attention to preceding price action, as context determines whether a formation signals reversal or continuation.

- Risk management protocols remain essential regardless of pattern strength, with position sizing and stop-loss placement protecting capital during failed signal scenarios.

Understanding Candlestick Anatomy

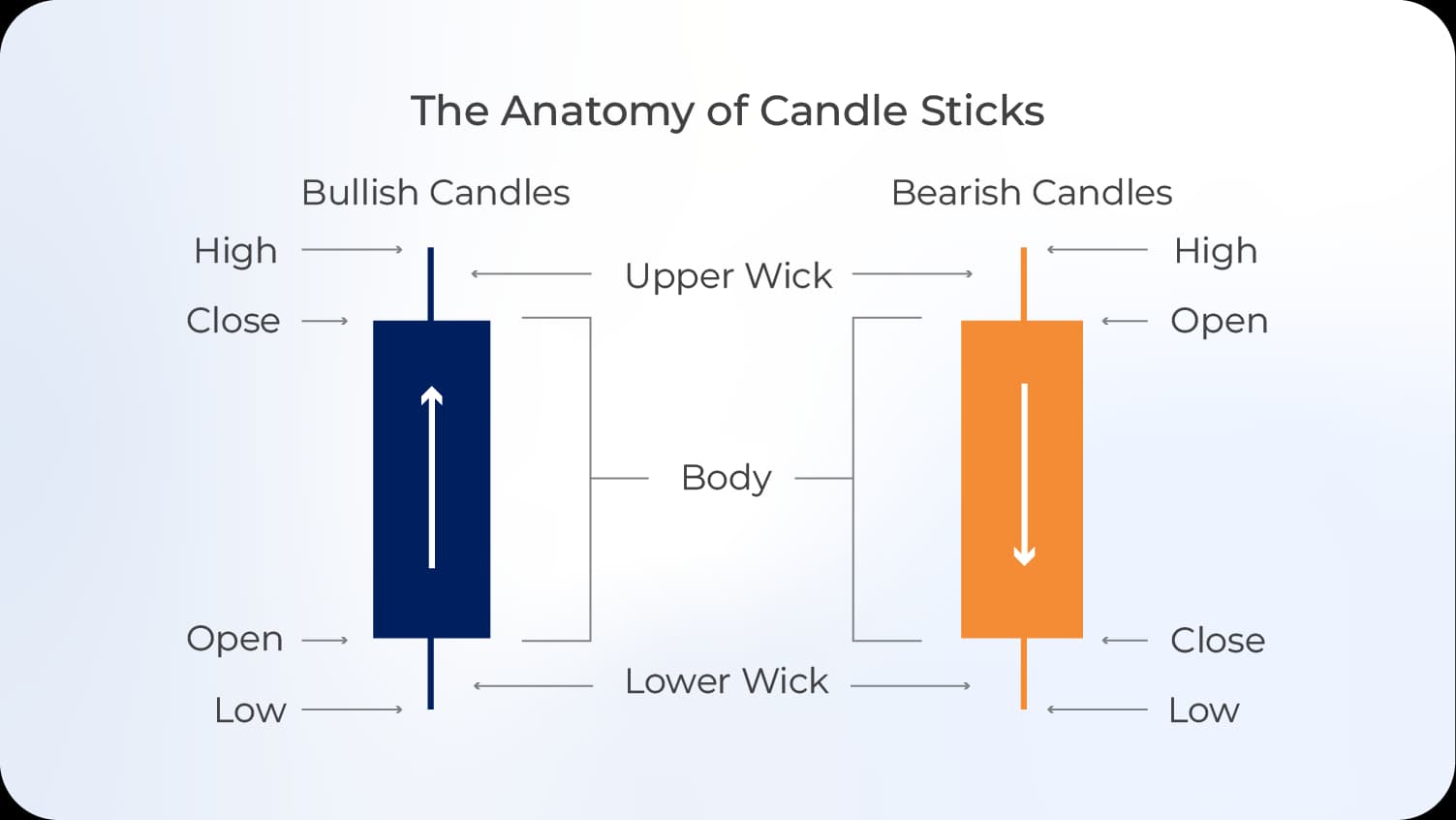

The fundamental structure of individual candlesticks establishes the foundation for pattern recognition. Each candlestick consists of a body and wicks (also called shadows). The body represents the range between opening and closing prices, while the upper and lower wicks indicate the highest and lowest prices reached during the trading period.

Candlestick coloring conventions follow standardized rules: bullish candles (closing price exceeds opening price) typically appear green or white, while bearish candles (closing price below opening price) display red or black. The body size reflects the strength of directional movement—larger bodies indicate stronger momentum, while smaller bodies suggest uncertainty or equilibrium between opposing forces.

The relationship between body and wick proportions conveys critical information about market dynamics. Long upper wicks demonstrate rejection of higher prices, often indicating seller dominance at those levels. Conversely, long lower wicks show rejection of lower prices, suggesting buyer interest and potential support. Candles with minimal wicks and large bodies signal strong directional conviction, while those with small bodies and extended wicks indicate indecision and potential reversal points.

How to Read Candlestick Patterns

Reading candlestick patterns effectively requires systematic analysis that extends beyond memorizing formations. The process begins with identifying the overall market context—whether prices are trending, ranging, or transitioning between phases. Patterns appearing at trend extremes carry greater significance than those occurring mid-trend, as they often signal exhaustion and potential reversals.

Pattern classification follows several organizational frameworks. Single-candle patterns such as doji, hammer, and shooting star require only one period for formation. Two-candle patterns including engulfing and piercing formations combine consecutive candles to generate signals. Three-candle patterns like morning star and three white soldiers provide more robust confirmation through extended price action sequences.

The temporal aspect of pattern recognition influences trading decisions significantly. Patterns forming on daily charts generate longer-term signals compared to those appearing on hourly or 15-minute timeframes. Higher timeframe patterns generally demonstrate greater reliability due to increased data incorporation, though shorter timeframes offer more frequent trading opportunities with proportionally higher noise levels.

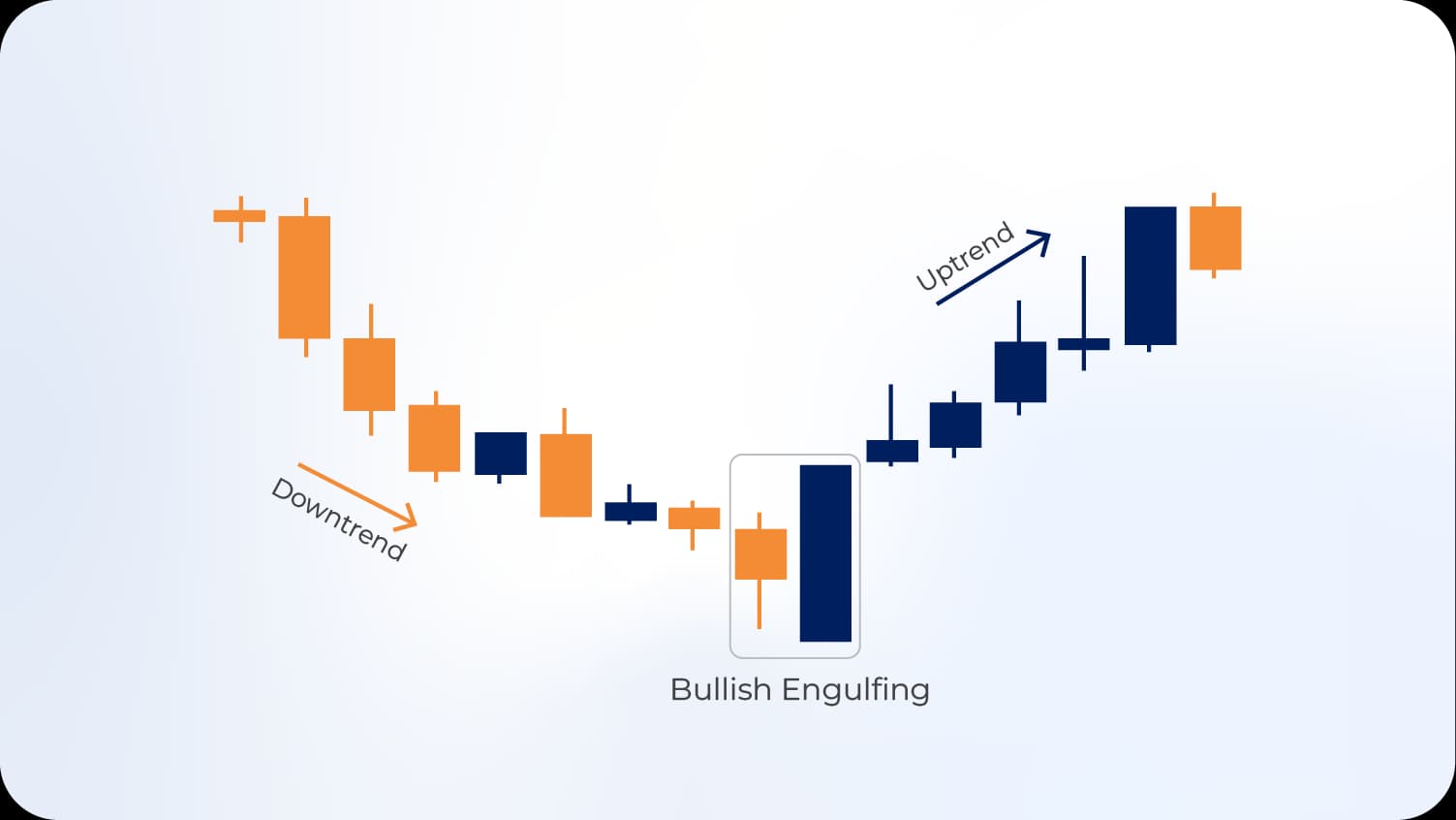

Contextual analysis enhances pattern interpretation substantially. A bullish engulfing pattern forming after an extended downtrend near a major support level carries far greater predictive value than the same pattern appearing randomly within a consolidation phase. Similarly, volume confirmation—where pattern formation coincides with increased trading activity—strengthens signal validity and improves probability estimates.

Bullish Candlestick Patterns

Bullish candlestick patterns indicate potential upward price movement, typically appearing at the conclusion of downtrends or during pullbacks within uptrends. These formations reveal shifts in market sentiment from bearish to bullish, as buying pressure begins overwhelming selling pressure.

Read More: Mastering Forex Trends: The Ultimate Guide for Traders

Hammer and Inverted Hammer

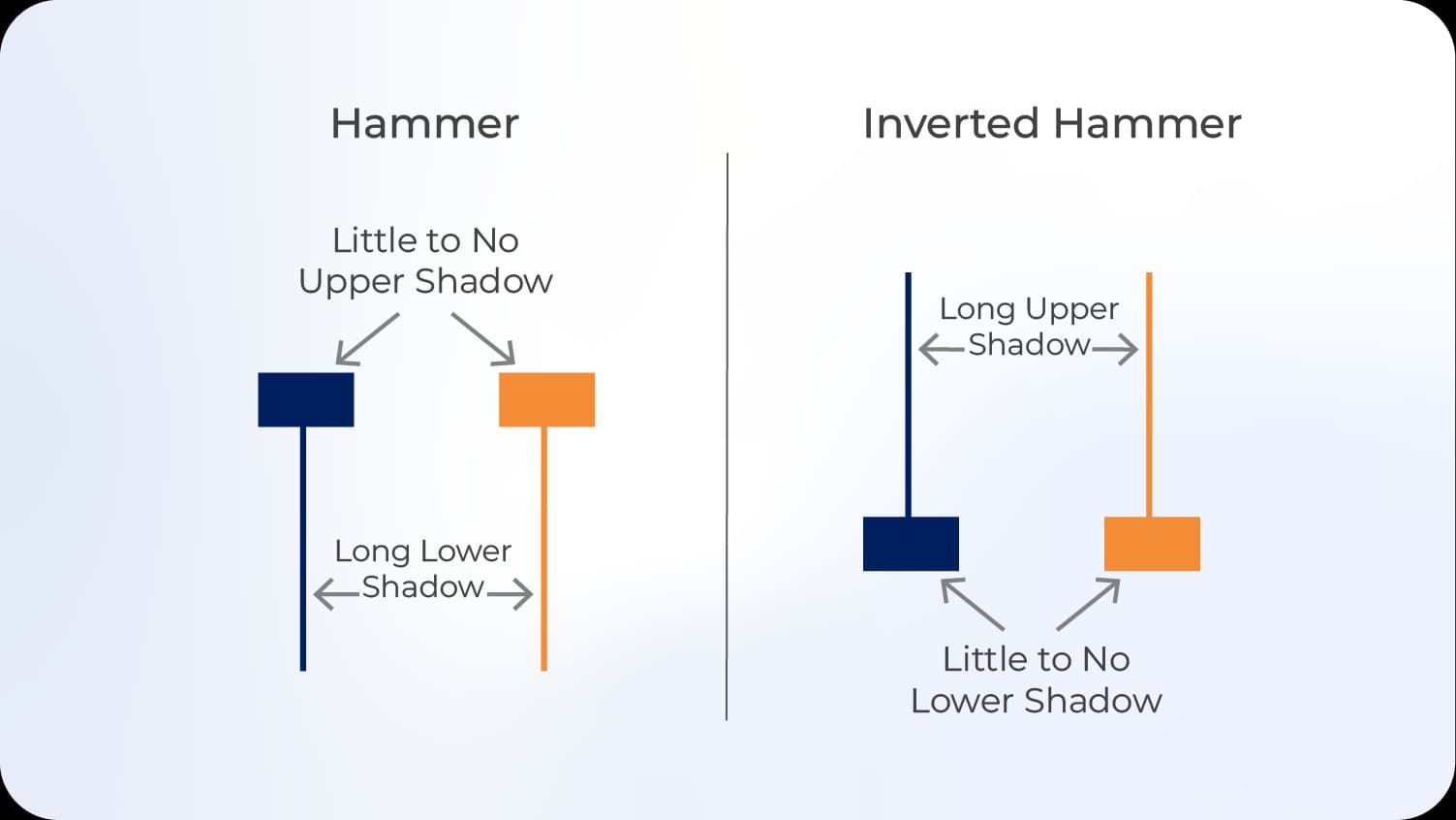

The hammer pattern features a small body near the upper end of the trading range with a lower wick at least twice the body length. This formation demonstrates that despite significant downward pressure during the period, buyers successfully pushed prices back toward the opening level. The inverted hammer maintains similar proportions but with the extended wick above the body, indicating that buyers tested higher prices before settling near the low—a tentative bullish signal requiring subsequent confirmation.

Bullish Engulfing

A bullish engulfing pattern occurs when a larger bullish candle completely encompasses the previous bearish candle's body. This formation signals a dramatic shift in momentum, as buyers not only absorbed all selling pressure from the prior period but pushed prices substantially higher. The pattern's reliability increases when the engulfing candle opens below the previous close and closes above the previous open, demonstrating comprehensive control reversal.

Morning Star

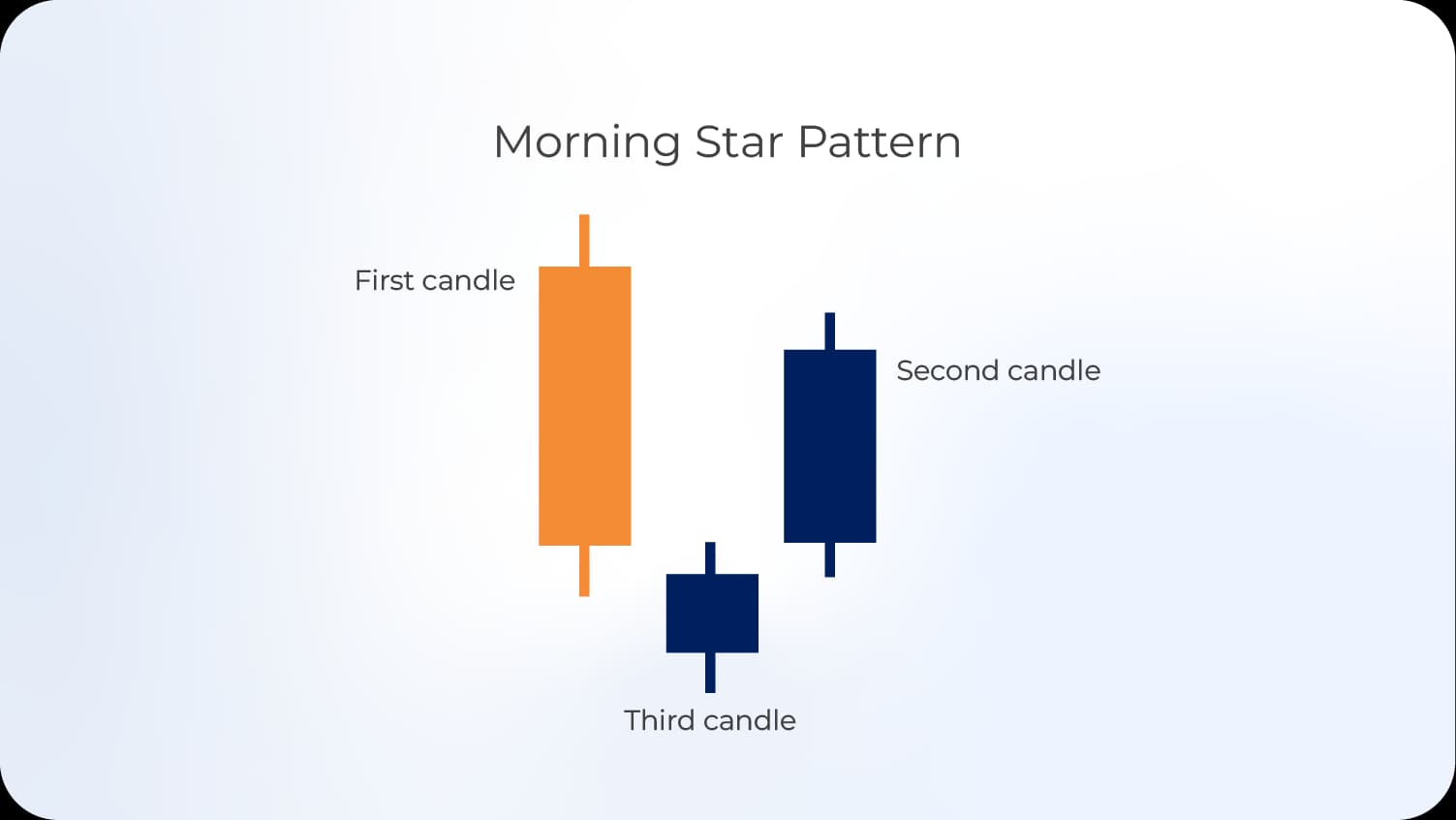

The morning star pattern consists of three candles: a large bearish candle, followed by a small-bodied candle (indicating indecision), and concluding with a large bullish candle. This formation illustrates the transition from bearish dominance through uncertainty to bullish control. The middle candle may gap down from the first and gap up from the third, though gaps are less common in 24-hour forex markets.

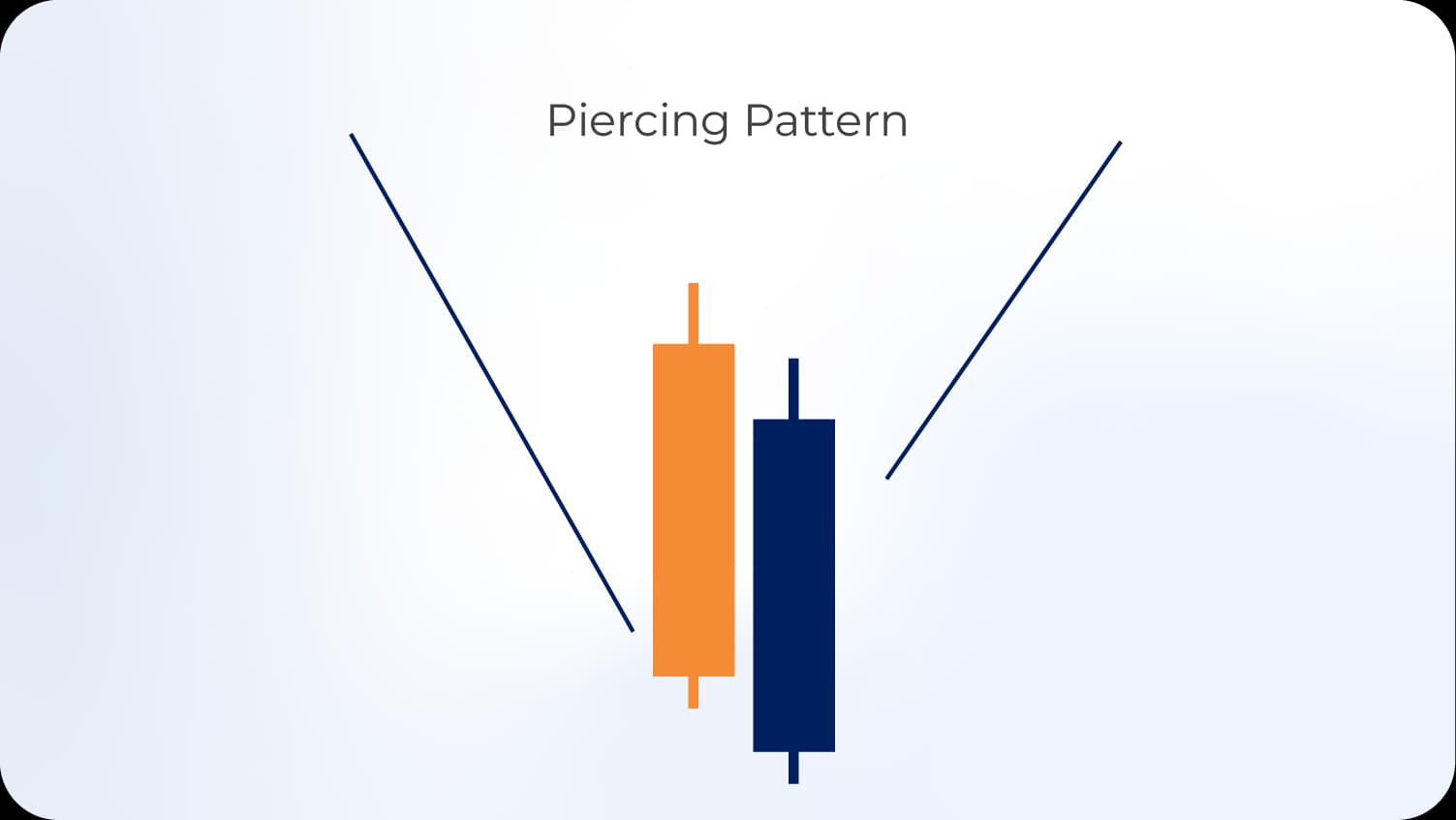

Piercing Pattern

The piercing pattern forms when a bullish candle opens below the previous bearish candle's low and closes above its midpoint. This demonstrates significant buying interest that reverses prior downward momentum. The pattern gains strength when the bullish candle closes closer to the bearish candle's high, indicating more complete rejection of lower prices.

Three White Soldiers

Three white soldiers consists of three consecutive long-bodied bullish candles with progressively higher closes and minimal upper wicks. This pattern indicates sustained buying pressure and strong upward momentum. Each candle should open within the previous candle's body and close near its high, demonstrating consistent bullish conviction across multiple periods.

Bearish Candlestick Patterns

Bearish candlestick patterns signal potential downward price movement, typically manifesting at trend peaks or during counter-trend rallies within established downtrends. These formations reveal transitions from bullish to bearish market sentiment as selling pressure overwhelms buying interest.

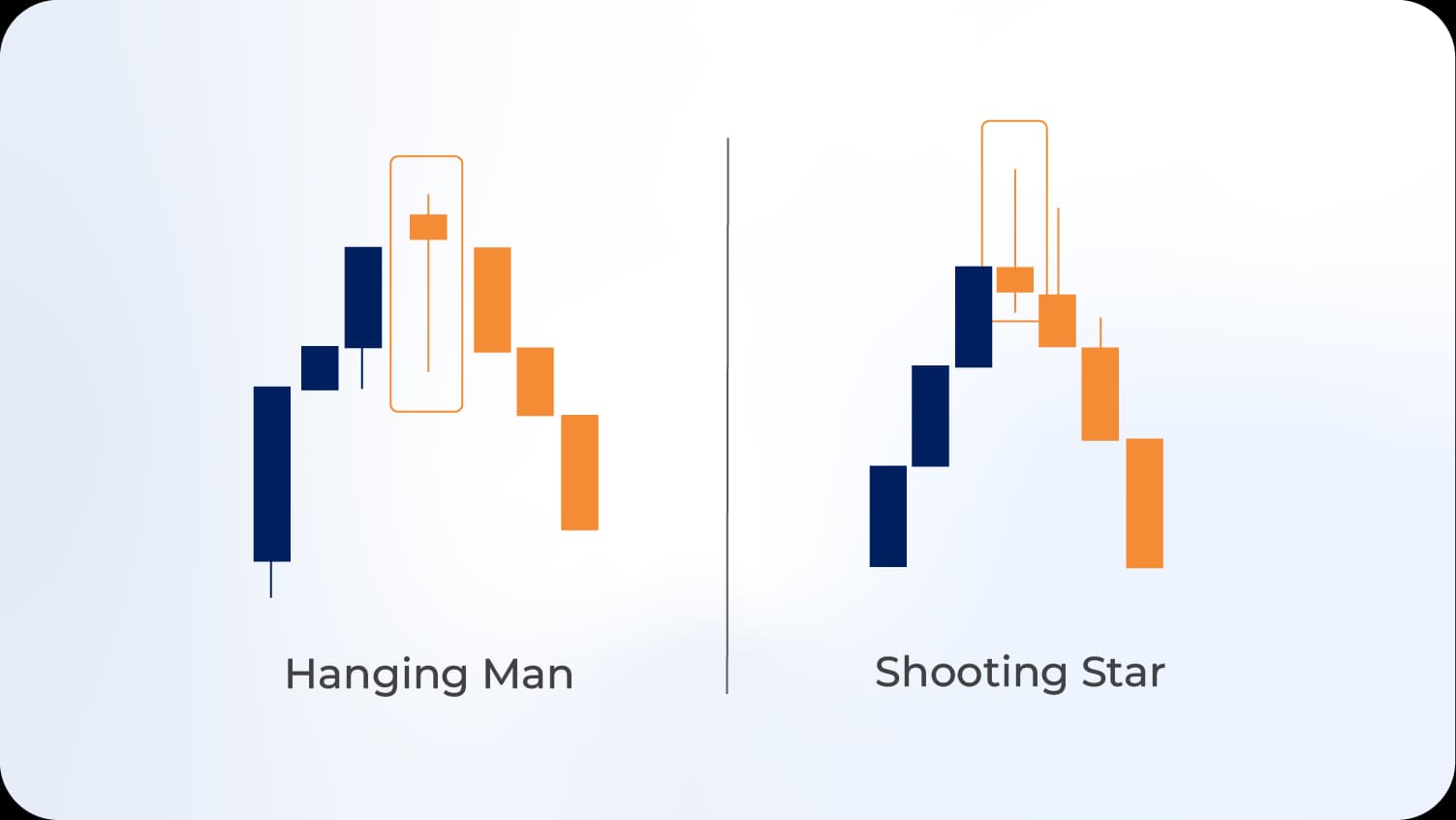

Shooting Star and Hanging Man

The shooting star appears at uptrend tops, featuring a small body near the lower range with an upper wick at least twice the body length. This indicates that buyers pushed prices significantly higher during the period, but sellers regained control and forced prices back down—a rejection of higher values. The hanging man maintains identical structure but appears after upward price movement, warning of potential reversal when confirmed by subsequent bearish action.

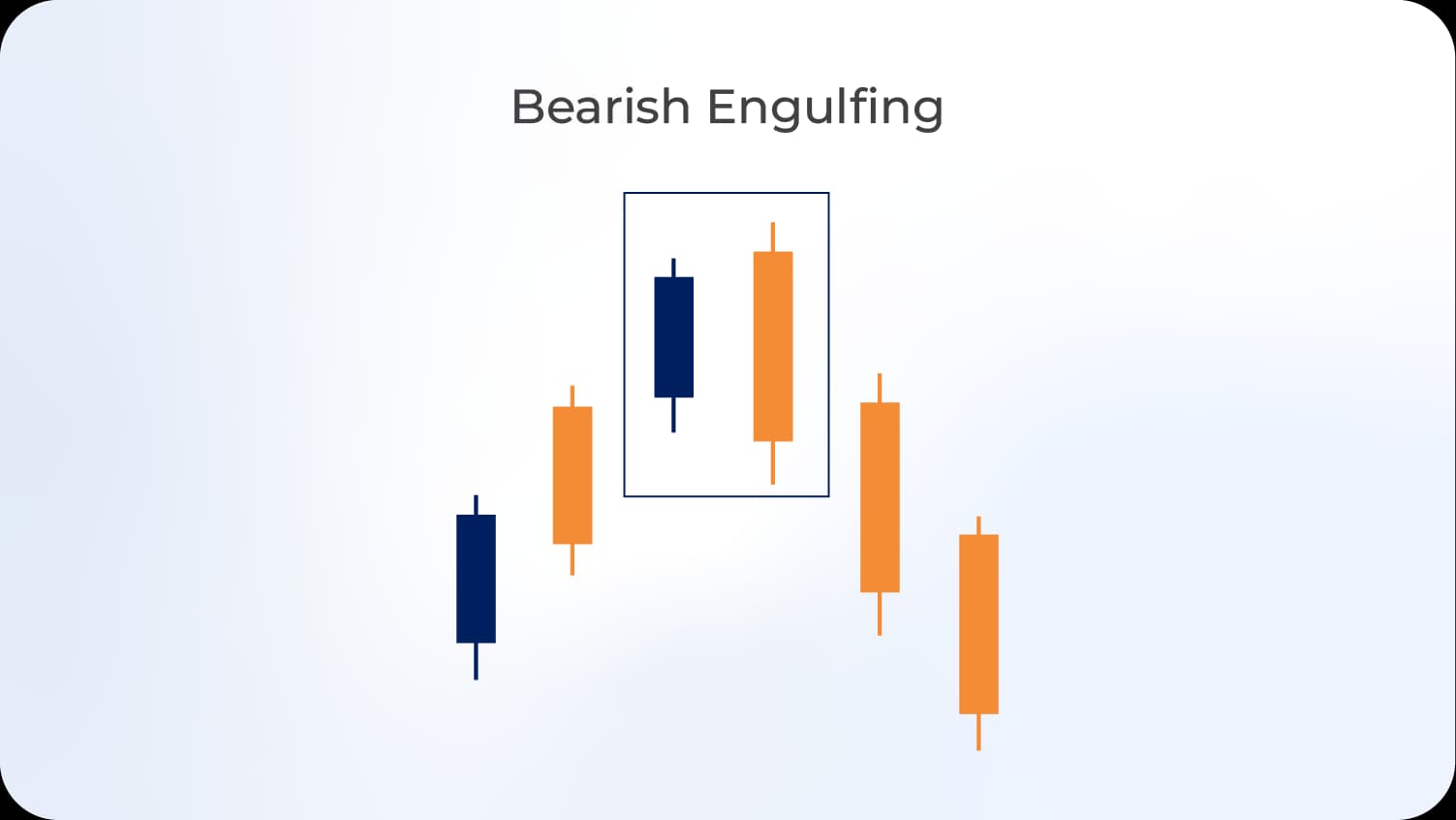

Bearish Engulfing

A bearish engulfing pattern occurs when a larger bearish candle completely encompasses the previous bullish candle's body. This formation demonstrates that sellers absorbed all buying pressure and pushed prices substantially lower, indicating momentum shift completion. Pattern strength increases when the engulfing candle opens above the previous close and closes below the previous open.

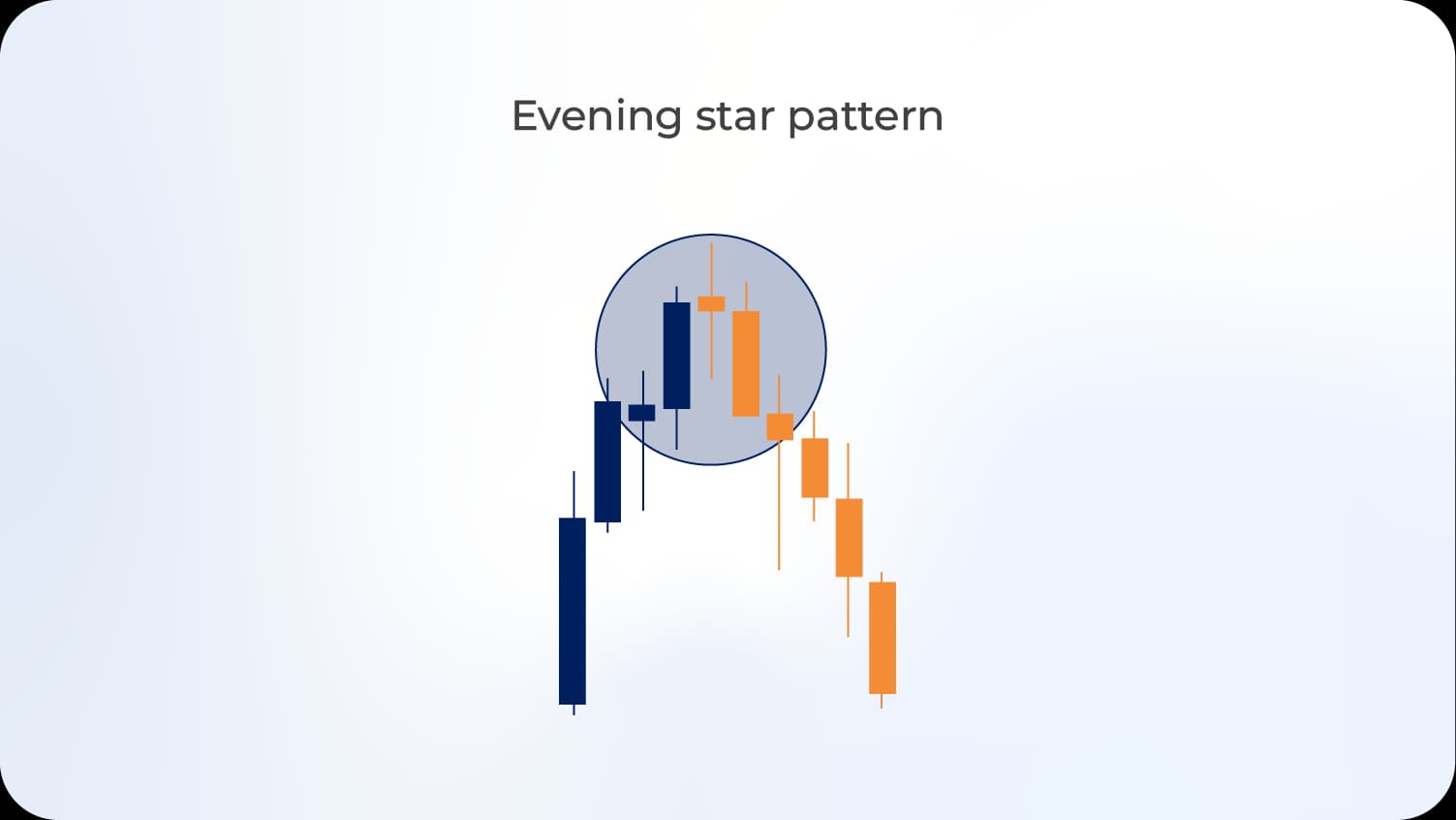

Evening Star

The evening star pattern mirrors the morning star in reverse: a large bullish candle, followed by a small-bodied candle showing indecision, and concluding with a large bearish candle. This three-candle formation illustrates the progression from bullish dominance through uncertainty to bearish control, signaling potential downtrend initiation.

Dark Cloud Cover

The dark cloud cover pattern forms when a bearish candle opens above the previous bullish candle's high and closes below its midpoint. This demonstrates that despite initial bullish momentum continuation, sellers seized control and pushed prices substantially lower. The pattern strengthens when the bearish candle closes nearer to the bullish candle's low, indicating more thorough rejection of higher prices.

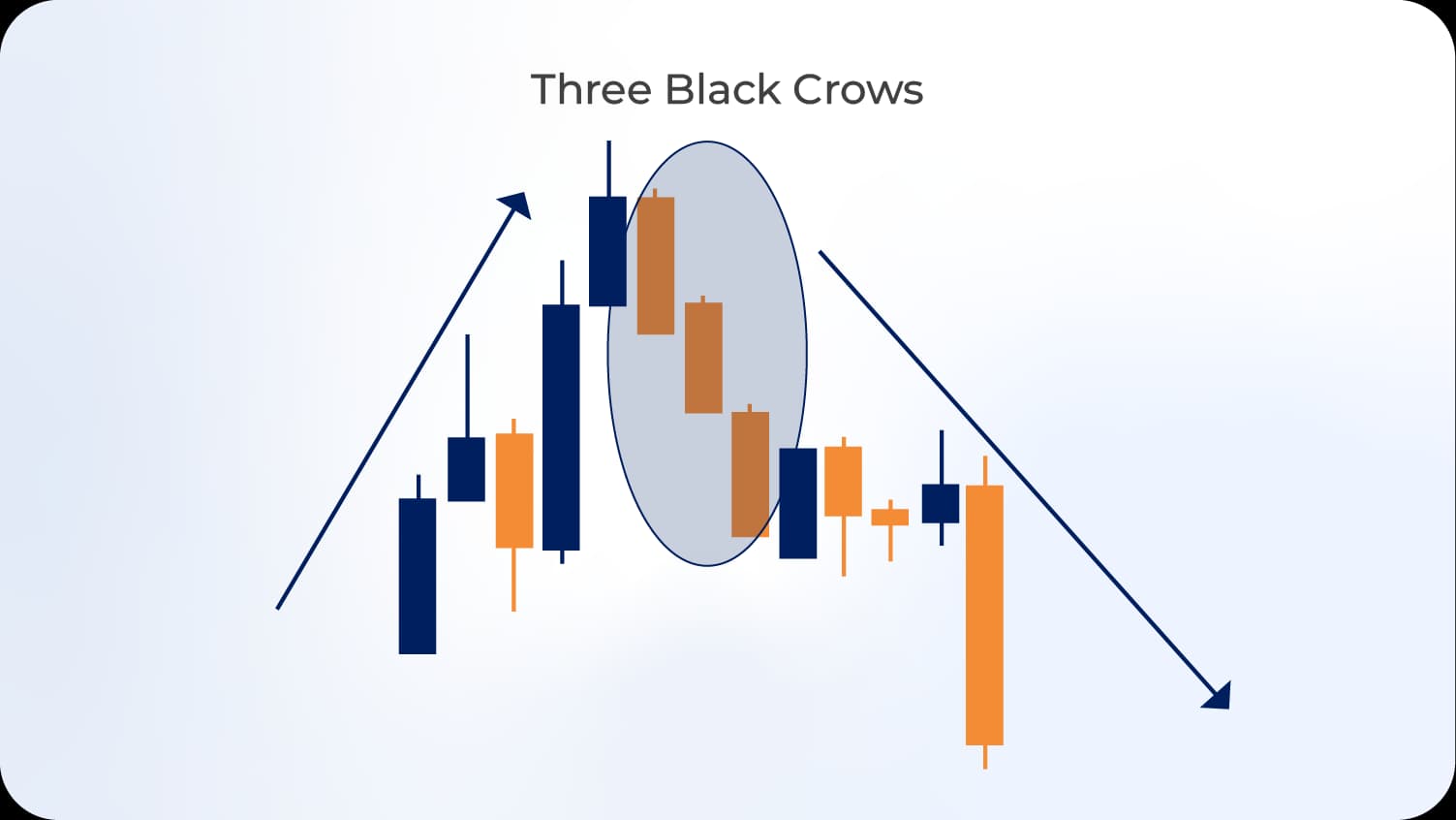

Three Black Crows

Three black crows consists of three consecutive long-bodied bearish candles with progressively lower closes and minimal lower wicks. This pattern indicates sustained selling pressure and strong downward momentum. Each candle should open within the previous candle's body and close near its low, demonstrating consistent bearish conviction across multiple periods.

Reversal Candlestick Patterns

Reversal candlestick patterns hold particular significance in trading strategies, as they signal potential trend exhaustion and directional changes. These formations appear at market extremes where existing trends lose momentum and opposing forces begin establishing control.

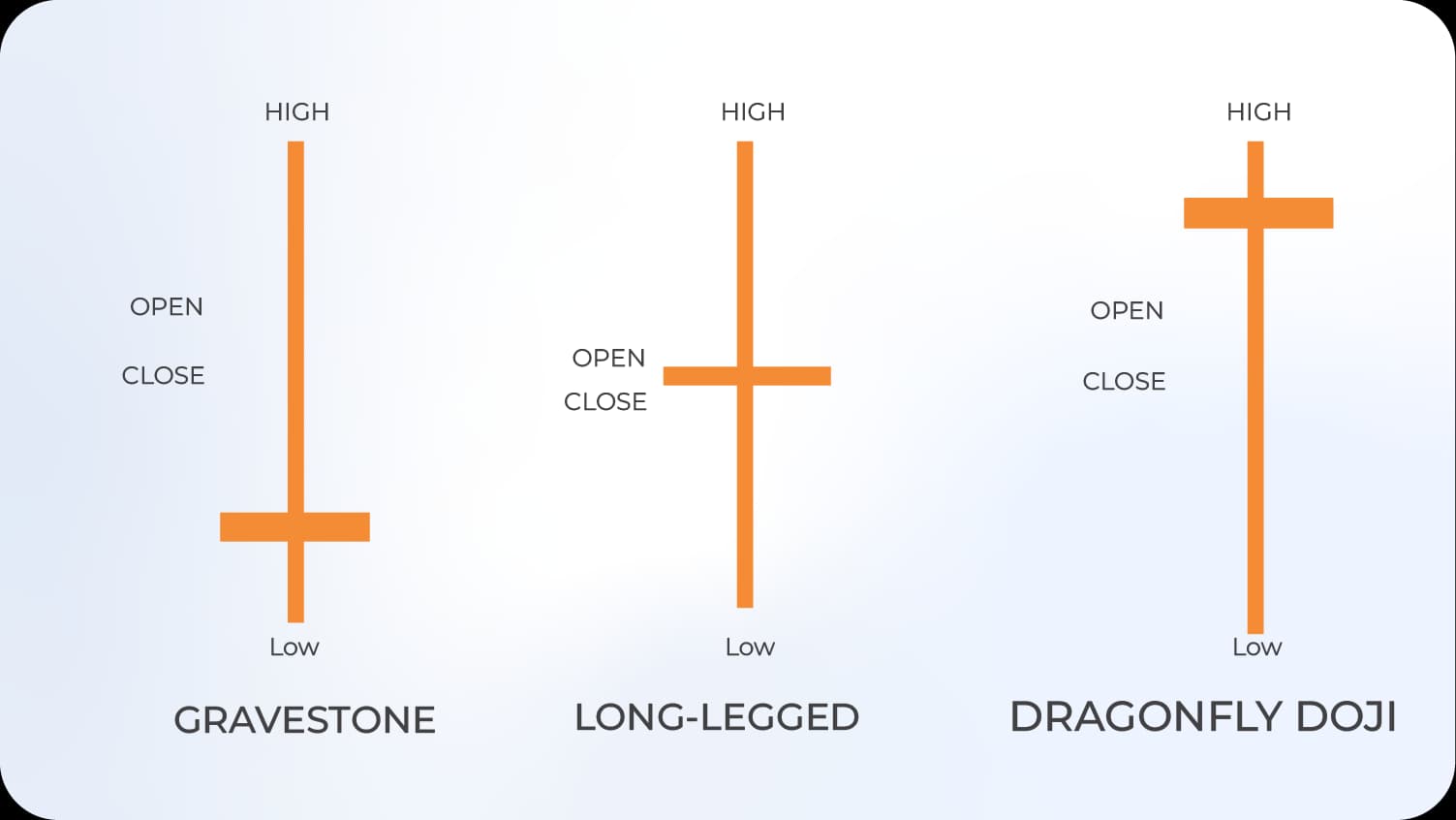

Doji Patterns

Doji candles form when opening and closing prices occur at or near identical levels, creating minimal or absent bodies with varying wick lengths. These formations indicate market indecision and equilibrium between buyers and sellers. Several doji variations carry specific implications: the long-legged doji with extended wicks on both sides shows extreme indecision; the dragonfly doji with a long lower wick suggests potential bullish reversal; the gravestone doji with a long upper wick indicates potential bearish reversal.

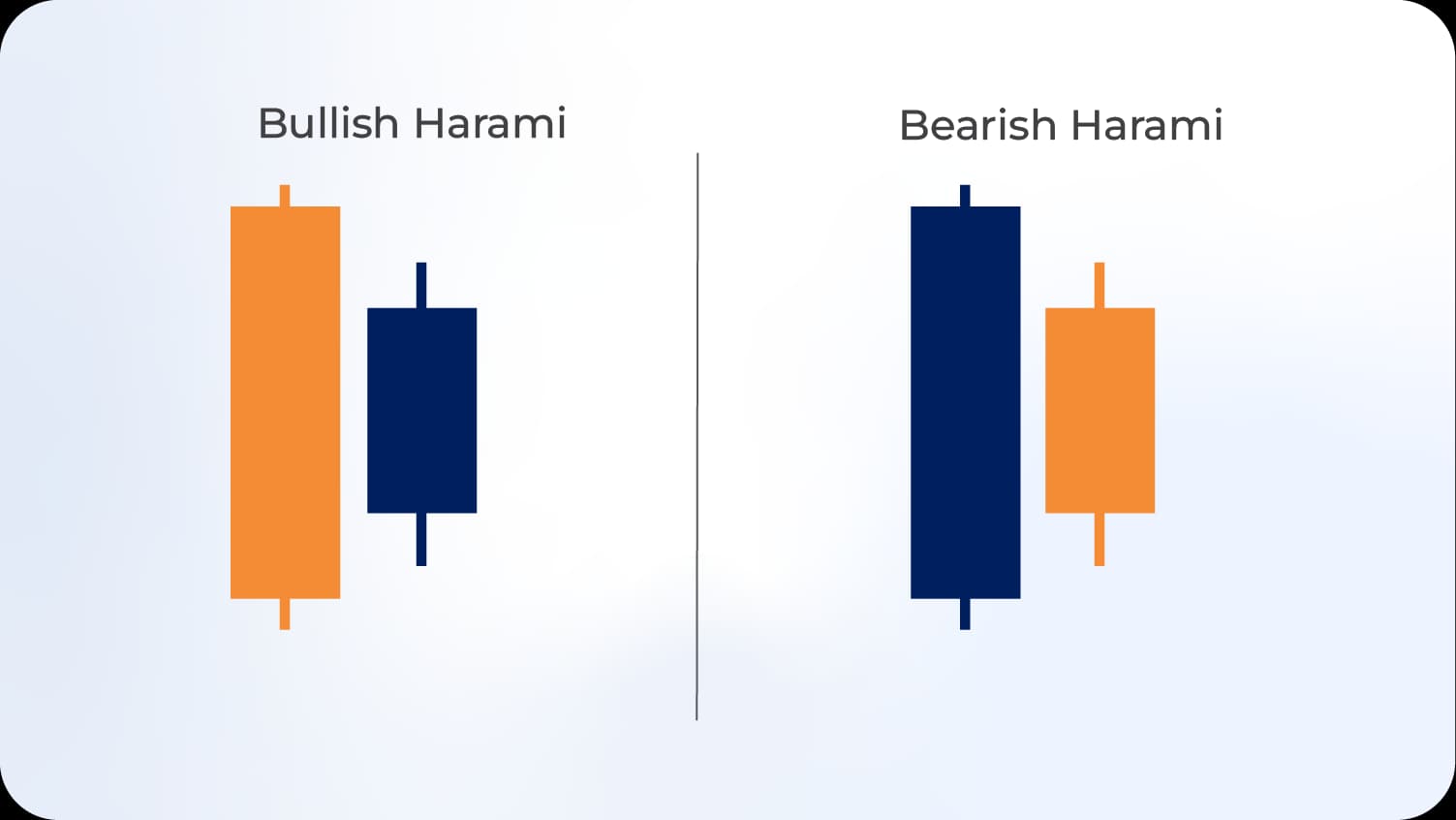

Harami Patterns

Harami patterns consist of two candles where the second candle's body falls completely within the first candle's body range. The bullish harami appears after downtrends when a small bullish candle forms within a larger bearish candle, suggesting weakening selling pressure. The bearish harami occurs after uptrends when a small bearish candle forms within a larger bullish candle, indicating diminishing buying momentum.

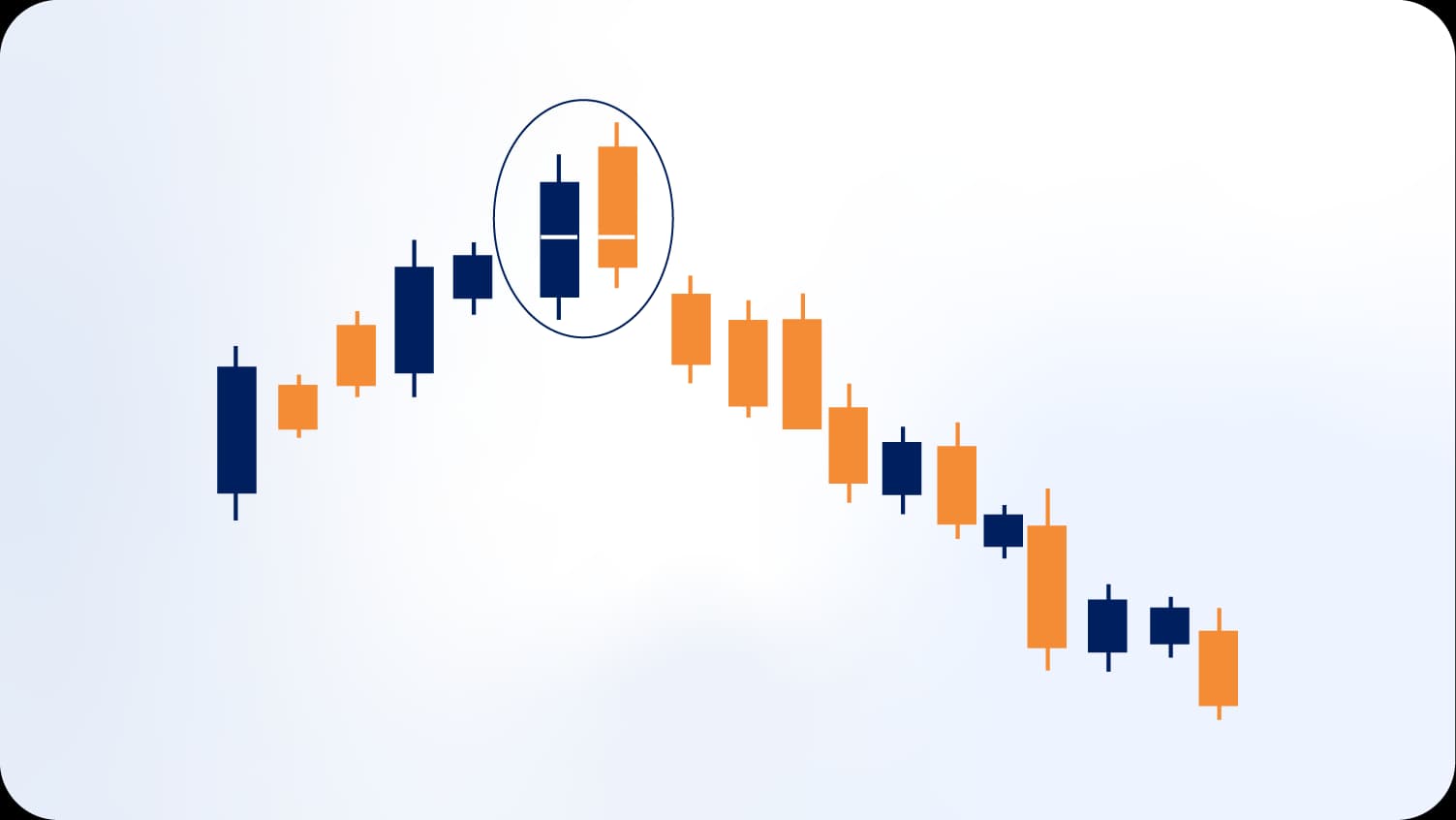

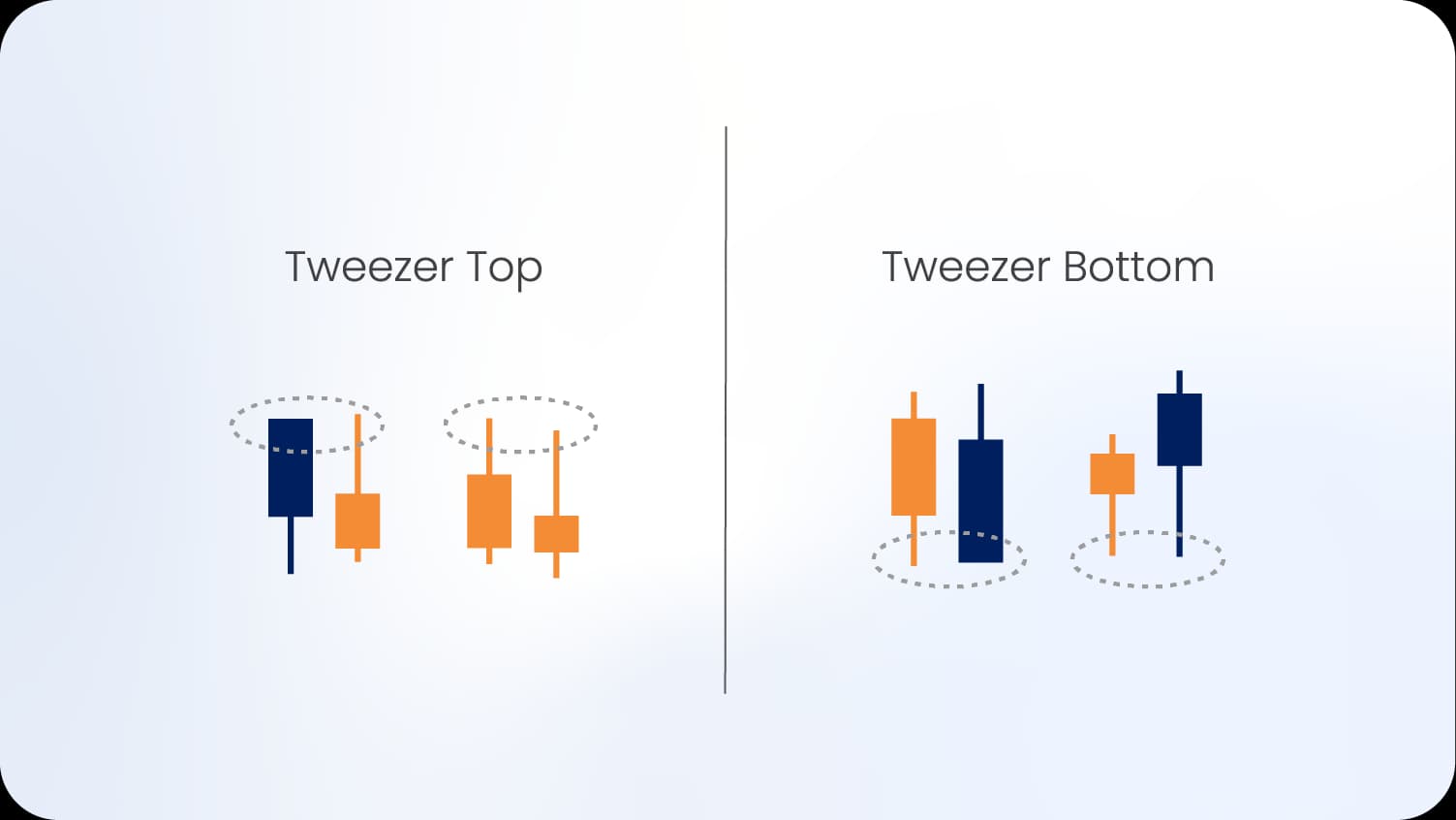

Tweezer Tops and Bottoms

Tweezer patterns form when two or more consecutive candles share identical or nearly identical highs (tweezer tops) or lows (tweezer bottoms). These formations demonstrate precise rejection levels where market participants repeatedly refused to accept prices beyond specific thresholds. Tweezer tops indicate potential bearish reversals, while tweezer bottoms suggest possible bullish reversals.

How Many Candlestick Patterns Are There

The quantity of recognized candlestick patterns varies depending on classification methodology and inclusiveness criteria. Traditional Japanese candlestick analysis identifies approximately 40 to 50 distinct patterns, ranging from single-candle formations to complex multi-candle combinations. However, when accounting for minor variations, alternative names for similar formations, and modern adaptations, traders reference upwards of 75 to 100 different patterns.

This extensive catalog divides into several primary categories based on structure and function. Single-candle patterns include formations like doji, hammer, shooting star, and spinning tops—each requiring only one period for completion. Two-candle patterns encompass engulfing formations, harami patterns, tweezers, and piercing or dark cloud cover setups. Three-candle patterns comprise morning and evening stars, three white soldiers, three black crows, and various abandoned baby formations.

The proliferation of pattern variations reflects both historical evolution and contemporary adaptation. Classical patterns documented in 18th-century Japanese rice markets established foundational principles, while modern technical analysts have identified additional formations emerging from electronic trading dynamics and different market structures. Some patterns demonstrate universal applicability across all markets and timeframes, while others prove more effective in specific contexts.

Practical trading applications rarely require mastery of all documented patterns. Most professional traders focus on 10 to 20 high-probability formations that align with their trading strategies and market preferences. This selective approach enables deeper understanding of chosen patterns' nuances, improving recognition speed and interpretation accuracy under real-time conditions.

For comprehensive pattern reference, traders can consult detailed resources such as classical candlestick pattern documentation that provide systematic categorization and visual examples of major formations.

How to Trade Candlestick Patterns

Trading candlestick patterns effectively requires integrating pattern recognition within comprehensive trading frameworks that address entry timing, risk management, and profit targeting. Successful implementation extends beyond identifying formations to understanding their probabilistic nature and contextual dependencies.

Entry Strategies

Pattern-based entry timing follows several established approaches. Conservative traders await confirmation candles that validate the pattern's directional signal before entering positions. This approach reduces false signals but may sacrifice optimal entry prices. Aggressive traders enter positions immediately upon pattern completion, accepting higher false signal rates in exchange for better price positioning. Hybrid approaches combine both methods, entering partial positions upon pattern completion and adding to positions following confirmation.

Confirmation Requirements

Confirmation mechanisms significantly enhance pattern reliability. Volume analysis provides critical validation—patterns forming with above-average volume demonstrate stronger commitment from market participants and increased follow-through probability. Support and resistance level alignment strengthens signals when patterns form at established price zones where historical reactions occurred. Momentum indicator confirmation through tools like RSI or MACD adds additional evidence of directional shift completion.

Risk Management Integration

Proper risk management protocols protect capital during inevitable failed signal instances. Stop-loss placement typically occurs just beyond the pattern's extreme point—below the low for bullish patterns or above the high for bearish patterns. This positioning ensures that if the pattern fails and prices move counter to expectations, the position closes with defined maximum loss. Position sizing calculations should consider stop-loss distance, ensuring that even if stops trigger, account damage remains within acceptable parameters.

Profit Targets and Exit Strategies

Profit target determination employs multiple methodologies. Measured move techniques project the pattern's height from the breakout point, establishing initial targets based on the formation's size. Support and resistance-based targets identify logical exit points at upcoming price levels where counter-trend reactions may occur. Trailing stop strategies allow profitable positions to run while protecting accumulated gains, moving stop-loss orders progressively in the favorable direction as prices advance.

Combining Patterns with Other Technical Tools

Candlestick pattern integration with additional technical analysis components creates robust trading systems. Trend-following tools like moving averages help filter pattern signals, accepting only those aligned with the broader directional bias. Fibonacci retracement levels identify high-probability reversal zones where pattern formation carries enhanced significance. Chart pattern recognition combines candlestick formations with geometric price patterns like triangles, head and shoulders, or double tops for multi-layered confirmation.

Candlestick Patterns Cheat Sheet

A comprehensive candlestick patterns cheat sheet serves as an essential reference tool for traders at all experience levels, enabling quick pattern identification and interpretation during active market analysis. While detailed study develops deep pattern understanding, condensed reference materials facilitate rapid decision-making under time-constrained trading conditions.

Essential Pattern Recognition Table

| Pattern Name | Candles | Signal | Key Characteristics | Confirmation |

|---|---|---|---|---|

| Hammer | 1 | Bullish Reversal | Small body at top, long lower wick (2x body) | Next candle closes above hammer high |

| Shooting Star | 1 | Bearish Reversal | Small body at bottom, long upper wick (2x body) | Next candle closes below star low |

| Bullish Engulfing | 2 | Bullish Reversal | Large bullish candle engulfs prior bearish body | Opens below previous close |

| Bearish Engulfing | 2 | Bearish Reversal | Large bearish candle engulfs prior bullish body | Opens above previous close |

| Morning Star | 3 | Bullish Reversal | Large bearish, small body, large bullish | Middle candle gaps down and up |

| Evening Star | 3 | Bearish Reversal | Large bullish, small body, large bearish | Middle candle gaps up and down |

| Doji | 1 | Indecision/Reversal | Open equals close, varying wick lengths | Requires trend context |

| Three White Soldiers | 3 | Bullish Continuation | Three consecutive long bullish candles | Each opens within previous body |

| Three Black Crows | 3 | Bearish Continuation | Three consecutive long bearish candles | Each opens within previous body |

| Harami | 2 | Reversal | Second candle body within first body | Indicates momentum weakening |

Quick Interpretation Guidelines

Pattern location within trend structures determines interpretation priorities. Reversal patterns generate strongest signals when appearing after extended trends at support or resistance levels. Continuation patterns prove most reliable when forming during brief counter-trend corrections within established trends. Indecision patterns like doji require subsequent candle confirmation to establish directional implications.

Body and wick proportions communicate momentum strength and rejection intensity. Patterns with larger bodies relative to total range demonstrate stronger directional conviction. Formations with extended wicks indicate significant price rejection at those levels. The absence of wicks suggests unopposed directional movement throughout the period.

Common Mistakes in Candlestick Pattern Trading

Pattern-based trading failures often stem from systematic errors rather than random chance. Understanding these common mistakes enables traders to develop more robust methodologies that avoid predictable pitfalls.

Ignoring Market Context

The most prevalent error involves applying patterns mechanically without considering broader market context. A bullish reversal pattern forming mid-trend carries far less significance than the identical formation appearing after extended downtrend at major support. Context analysis requires evaluating trend direction, market phase (trending or ranging), proximity to key price levels, and overall volatility conditions.

Insufficient Confirmation

Entering positions immediately upon pattern recognition without awaiting confirmation substantially increases false signal frequency. While aggressive entries occasionally capture optimal prices, the cumulative cost of numerous failed signals typically outweighs benefits. Implementing systematic confirmation requirements—whether through subsequent candle behavior, volume validation, or indicator alignment—improves overall trading performance.

Poor Risk Management

Many traders allocate disproportionate capital to pattern-based trades or fail to establish appropriate stop-loss orders. Pattern trading involves probabilistic outcomes where even high-reliability formations fail periodically. Without proper position sizing relative to stop-loss distance, individual losing trades can inflict substantial portfolio damage that multiple winners cannot offset.

Overtrading Pattern Signals

The abundance of candlestick patterns across multiple timeframes and currency pairs tempts traders toward excessive position taking. Quality pattern signals featuring optimal context, confirmation, and risk-reward parameters appear far less frequently than basic pattern formations. Selective trade execution focusing on highest-probability setups produces superior results compared to acting on every identified pattern.

Neglecting Timeframe Alignment

Patterns appearing on short-term charts sometimes contradict longer-term trends, creating conflicting signals that reduce reliability. Effective pattern trading incorporates multiple timeframe analysis, ensuring that short-term pattern signals align with intermediate and longer-term directional biases. This alignment increases follow-through probability and reduces instances where patterns quickly reverse.

Advanced Pattern Trading Strategies

Experienced traders develop sophisticated approaches that extend beyond basic pattern recognition to create comprehensive trading methodologies with enhanced reliability and profit potential.

Pattern Cluster Analysis

Multiple patterns forming simultaneously across different timeframes or currency pairs provide stronger signals than isolated formations. When bullish reversal patterns appear across 4-hour, daily, and weekly charts at the same price zone, the convergence suggests significant probability of sustained upward movement. This clustering effect reflects broad market participant agreement about value and direction.

Pattern Failure Trading

Counterintuitively, failed patterns generate trading opportunities themselves. When widely recognized formations fail to produce expected price movement, the subsequent move often proves powerful as trapped traders exit positions and momentum accelerates in the opposite direction. Failed pattern recognition requires identifying when expected follow-through doesn't materialize within normal timeframes, then positioning for reversal back through the pattern zone.

Volume Profile Integration

Combining candlestick patterns with volume profile analysis enhances entry precision significantly. Patterns forming at high-volume nodes (price levels where substantial historical trading occurred) demonstrate greater reliability than those appearing at low-volume levels. Volume profile identifies these critical zones, enabling traders to filter pattern signals based on volume-derived support and resistance.

Statistical Pattern Analysis

Quantitative traders document pattern occurrences and subsequent outcomes to develop statistical reliability databases. This systematic approach reveals which patterns perform best in specific market conditions, timeframes, or currency pairs. Statistical analysis might demonstrate that morning star patterns in EUR/USD on daily charts following 15-day downtrends produce profitable outcomes 68% of the time with average gains of 1.8 times risk—actionable intelligence that informs position sizing and expectation setting.

Frequently Asked Questions

How to Read Candlestick Patterns?

Reading candlestick patterns starts with identifying open, high, low, and close and assessing body and wick proportions. Next, match candle formations to known patterns, noting candle count and arrangement. Then evaluate context: trend position, nearby support or resistance, and agreement with other indicators. Finally, seek confirmation from subsequent price action before taking a position.

How Many Candlestick Patterns Are There?

Traditional Japanese candlestick analysis lists about 40 to 50 patterns, while modern sources cite 75 to 100 when variations are included. Core types are single-candle (doji, hammer, shooting star), two-candle (engulfing, harami), and three-candle (morning star, three white soldiers). Many minor variants exist, but traders usually focus on 10 to 20 high-probability patterns for deeper mastery and reliable real-time recognition.

How to Trade Candlestick Patterns?

Effective candlestick trading integrates signals into a broader framework. Identify patterns at trend extremes or key support and resistance. Enter immediately on completion or wait for candle confirmation. Manage risk with stop-losses beyond pattern extremes and position sizing that limits capital at risk. Set profit targets from measured moves, nearby levels, or trailing stops. Filter setups with volume, trend indicators, and multi-timeframe confirmation to trade only high-probability opportunities.

Conclusion: Mastering the Art of Candlestick Analysis

Candlestick patterns provide traders with powerful visual tools for interpreting market psychology and anticipating potential price movements. From single-candle formations revealing immediate sentiment shifts to complex multi-candle patterns signaling major trend reversals, these techniques offer systematic approaches to decision-making in dynamic forex markets.

The journey from pattern recognition to profitable trading requires progressing beyond mere memorization toward contextual understanding. Successful traders integrate candlestick analysis within comprehensive frameworks that incorporate trend analysis, support and resistance identification, volume confirmation, and rigorous risk management. This holistic approach transforms individual patterns from simple signals into components of robust trading methodologies.

Pattern reliability varies across market conditions, timeframes, and currency pairs. Continuous learning through pattern documentation, outcome tracking, and performance analysis enables traders to identify which formations perform best in their specific trading contexts. This empirical approach grounds pattern trading in personal experience rather than general assumptions.

The forex market's 24-hour nature and high liquidity create countless pattern opportunities across multiple timeframes simultaneously. Disciplined traders resist temptation toward overtrading, focusing instead on highest-probability setups that align with their strategic frameworks and risk parameters. Quality consistently outperforms quantity in pattern-based trading.

Begin implementing candlestick pattern analysis systematically: select five to ten core patterns matching your trading style, study their historical performance in your preferred currency pairs, and practice identification on historical charts before risking capital. Document each pattern trade's outcome, noting context, confirmation presence, and result. This deliberate practice accelerates skill development and builds the pattern recognition capabilities essential for real-time trading success.

The synthesis of classical Japanese wisdom with modern technical analysis tools creates exceptional opportunities for informed traders. By mastering candlestick patterns and integrating them within disciplined trading frameworks, forex participants gain significant advantages in interpreting market dynamics and executing well-timed, strategically sound trades that align with their financial objectives.