Price Action: A Comprehensive Guide for Forex Traders

Price action represents the fundamental analysis of market movements through the examination of historical price data displayed on charts. This trading methodology enables forex traders to make informed decisions by interpreting candlestick patterns and price action patterns without relying on technical indicators. The approach focuses on understanding market psychology, supply and demand dynamics, and price behavior at critical levels to identify high-probability trading opportunities.

Introduction

Financial markets communicate through price movements, creating a universal language that transcends borders and economic systems. In the forex market, price action trading has become one of the most trusted strategies for traders who want fast and accurate market analysis without relying on lagging indicators. This methodology focuses on the idea that all key market information such as economic data, geopolitical events, trader sentiment, liquidity shifts, and institutional activity is ultimately reflected in price movements on the chart.

The importance of price action in the forex market goes far beyond simple chart reading. It offers traders direct insight into market psychology and real-time supply and demand. By studying candlestick patterns, support and resistance levels, trend structures, and repeated formations, traders can anticipate market direction with greater confidence. Price action reveals the continuous battle between buyers and sellers, helping traders identify high probability setups across different timeframes and market conditions. As a result, price action trading has become a core technique for forex traders seeking clarity, precision, and consistent results.

Key Takeaways

- Price action eliminates indicator lag: Direct price analysis removes the delay inherent in mathematical indicators, enabling traders to respond to market changes in real-time and identify trend reversals at earlier stages.

- Candlestick patterns reveal market psychology: Specific formations such as pin bars, engulfing patterns, and inside bars communicate the balance of power between buyers and sellers, providing actionable signals at critical market junctures.

- Price action patterns work across all timeframes: The principles underlying support and resistance, trend lines, and chart patterns apply universally from one-minute charts to monthly charts, offering flexibility for different trading styles.

- Simplicity enhances decision-making clarity: Focusing exclusively on price movements reduces analytical paralysis, enabling traders to develop conviction in their trading decisions without conflicting signals from multiple indicators.

- Context determines pattern validity: The same candlestick or chart pattern produces different outcomes depending on its location within the broader market structure, emphasizing the importance of multi-timeframe analysis.

What Is Price Action?

Price action constitutes a trading discipline that analyzes the movement of security prices over time to forecast future direction. This methodology examines raw price data—open, high, low, and close values—without applying mathematical transformations or derivative calculations. The fundamental principle holds that price movements contain all necessary information for trading decisions, as market participants have already discounted news, fundamentals, and sentiment into current pricing.

The theoretical foundation derives from the Efficient Market Hypothesis, which suggests that asset prices reflect all available information instantaneously. Price action traders accept this premise but recognize that markets occasionally deviate from efficiency due to emotional decision-making, creating exploitable opportunities. These deviations manifest as recognizable patterns that repeat with statistical regularity.

At its core, price action analysis examines market structure—the formation of higher highs and higher lows in uptrends, or lower highs and lower lows in downtrends. Traders identify key price levels where historical buying or selling pressure concentrated, understanding that these zones often influence future price behavior. The interaction between price and these levels generates the signals that form the basis of trading strategies.

The Historical Development of Price Action Trading

Who Invented Price Action

The origins of price action analysis trace to Japanese rice traders in the 18th century, who developed candlestick charting techniques to track market sentiment and price movements in commodity markets. Munehisa Homma, a rice merchant from Sakata, Japan, pioneered systematic price recording methods that evolved into modern candlestick analysis. His observations about the relationship between price, supply, demand, and trader emotions laid the groundwork for contemporary price action principles.

Western adoption accelerated in the late 20th century through the work of several influential traders and authors. Charles Dow, co-founder of Dow Jones & Company, established principles in the 1890s that emphasized price movements as the primary indicator of market trends. His theories formed the basis of technical analysis and influenced generations of price-focused traders.

Modern price action methodology crystallized through contributions from traders such as Al Brooks, James "Jim" Weissman, and Nial Fuller, who systematized approaches to reading naked charts without indicators. These practitioners demonstrated that sustainable trading success derived from understanding market structure and price behavior rather than relying on complex indicator combinations. Their work established price action as a legitimate and effective trading discipline within professional trading communities.

Fundamental Principles of Price Action Analysis

Market Structure Recognition

Market structure forms the skeleton upon which all price action analysis builds. An uptrend establishes through a sequence of higher swing highs and higher swing lows, indicating persistent buying pressure that overwhelms selling attempts. Conversely, downtrends display lower swing highs and lower swing lows, reflecting dominant selling pressure. The transition between these states—when market structure breaks—often signals significant trading opportunities.

Swing points represent local extremes where price temporarily exhausted its directional momentum before reversing. These pivots serve as reference markers for drawing trend lines, identifying support and resistance zones, and measuring the strength of trends. The distance between swing points and the time required to traverse these distances provide insight into momentum and volatility characteristics.

Consolidation phases occur when neither buyers nor sellers achieve dominance, resulting in sideways price movement within defined boundaries. These ranges often precede significant directional moves, as the market accumulates energy for the next trend impulse. Price action traders monitor consolidation breakouts carefully, as they frequently initiate high-momentum trending conditions.

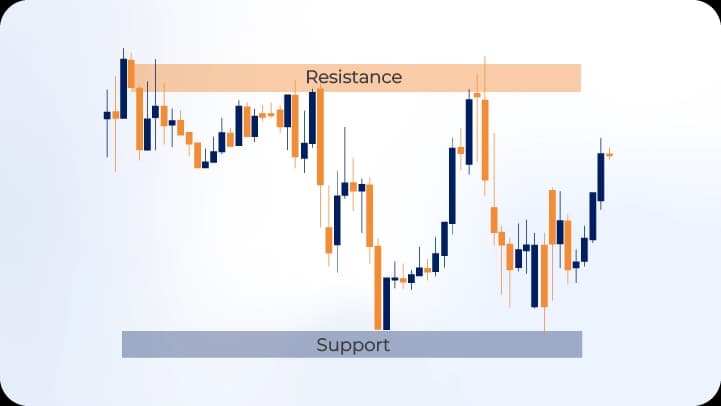

Support and Resistance Dynamics

Support represents a price level where buying interest historically concentrated with sufficient strength to prevent further price decline. These zones emerge from previous price reactions—areas where price bounced multiple times or where significant consolidation occurred. The psychological principle underlying support suggests that traders remember price levels where value emerged previously and anticipate similar opportunities at comparable prices.

Resistance operates inversely, representing levels where selling pressure historically overwhelmed buying attempts. Previous swing highs, round numbers, and moving average levels commonly function as resistance. The interaction between price and these zones generates trading signals, particularly when price demonstrates rejection through specific candlestick formations.

The concept of support-resistance role reversal adds sophistication to level analysis. When price breaks above resistance and later declines to test that level, former resistance often transforms into support. This phenomenon occurs because traders who missed the initial breakout view the retest as a second opportunity to enter, concentrating buying orders at the previous resistance level.

| Level Type | Characteristics | Trading Implication |

|---|---|---|

| Horizontal Support/Resistance | Forms at specific price levels tested multiple times | High-probability reversal zones; breakouts signal trend continuation |

| Dynamic Support/Resistance | Created by trend lines or moving averages | Provides sloping levels in trending markets |

| Psychological Levels | Round numbers (1.3000, 1.3500) | Attracts order clustering; increases breakout/reversal likelihood |

| Previous High/Low | Swing extremes from recent price action | Natural profit-taking zones; breakouts confirm strength |

Candlestick Patterns and Their Significance

What Does Price Action Mean Through Candlesticks

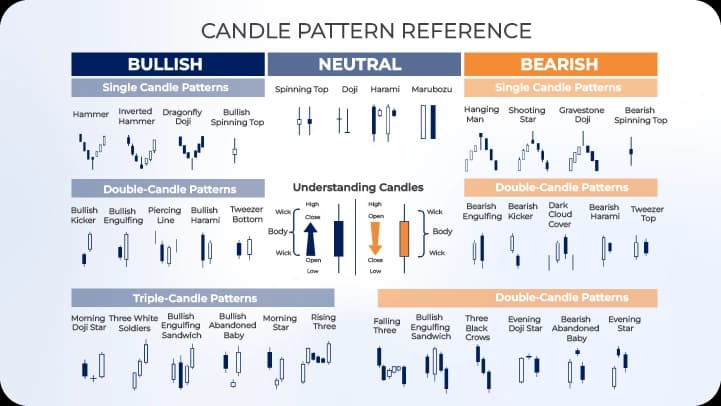

Candlestick patterns translate price action into visual representations that communicate market sentiment and potential future direction. Each candlestick displays four critical data points: opening price, closing price, high, and low within a specific time period. The body—the thick portion connecting open and close—indicates the direction and magnitude of net price change, while wicks or shadows represent intrabar volatility and rejection.

Individual candlestick formations provide insight into single-period sentiment. A long bullish candle with small wicks suggests strong buying pressure throughout the period, with buyers controlling price from open to close. Conversely, long wicks relative to body size indicate rejection—price tested extreme levels but reversed, suggesting the tested level holds significance.

Pattern combinations enhance predictive value beyond individual candles. Multiple candlesticks forming specific sequences reveal evolving market dynamics and often precede directional moves. The context surrounding these patterns—their location within broader market structure—determines their reliability and trading applicability.

Critical Candlestick Patterns for Price Action Trading

Pin Bar (Hammer/Shooting Star)

The pin bar represents one of the most reliable single-candle reversal patterns. Characterized by a small body and extended wick in one direction, this formation signals rejection of extreme prices. A bullish pin bar forms at support with a long lower wick, indicating sellers drove price lower but buyers aggressively reversed the move, closing near the high. Bearish pin bars appear at resistance with extended upper wicks, demonstrating buyer exhaustion and seller dominance.

Effectiveness increases when the pin bar's wick extends beyond nearby swing points, demonstrating a clear failure to maintain prices at tested levels. The pattern works optimally when aligned with major support or resistance zones, as the rejection confirms the level's continued relevance.

Engulfing Patterns

Engulfing patterns occur when a candle completely encompasses the previous candle's body, signaling momentum shift. A bullish engulfing pattern forms when a large bullish candle follows a smaller bearish candle, with the bullish candle's body completely covering the bearish candle's body. This sequence indicates buyers overwhelmed recent selling pressure, potentially initiating trend reversal or continuation.

The pattern's reliability correlates with the size differential between candles. Larger engulfing candles demonstrate more decisive shifts in market sentiment. Location matters critically—engulfing patterns at major support or resistance levels, or following extended trends, carry greater predictive value than those appearing mid-range.

Inside Bar

Inside bars represent consolidation within the previous candle's high-low range, indicating market indecision or momentum pause. The entire inside bar—both high and low—must remain within the previous "mother bar's" range. This pattern often precedes breakouts in the direction of the prevailing trend, serving as continuation signals.

Trading inside bars requires patience, as the breakout direction determines the trade setup. Conservative traders wait for price to break decisively above or below the mother bar before entering, while aggressive approaches enter at breakout with stops beyond the opposite side of the pattern.

Doji and Spinning Tops

Doji candles, characterized by nearly identical opening and closing prices, represent perfect equilibrium between buyers and sellers. The small-bodied spinning top similarly indicates indecision, though with slightly more directional bias. These patterns gain significance at trend extremes, warning of potential exhaustion and reversal.

The pattern's context determines interpretation. A doji within a strong trend may signal temporary consolidation before continuation, while dojis at major levels after extended moves often precede reversals. Multiple consecutive doji or spinning tops increase the probability of significant upcoming directional movement.

Price Action Patterns and Chart Formations

Trend Line Analysis

Trend lines connect swing points to visualize trend direction and strength. In uptrends, lines drawn along swing lows provide dynamic support, while downtrend lines connecting swing highs offer dynamic resistance. Valid trend lines require at least two contact points, with reliability increasing with additional touches.

The angle of trend lines conveys information about trend sustainability. Steep trend lines indicate strong momentum but often prove unsustainable, leading to breaks and consolidation. Shallow trend lines suggest gradual, sustainable trends but may lack sufficient momentum for profitable trading opportunities. Optimal trading trends maintain moderate angles, balancing momentum with sustainability.

Trend line breaks generate trading signals, though false breaks occur frequently. Confirmation techniques—waiting for closes beyond the trend line rather than simple touches, requiring breaks by specific pip amounts, or demanding follow-through in subsequent candles—reduce false signal frequency.

Read More: Mastering Forex Trends: The Ultimate Guide for Traders

Chart Patterns: Head and Shoulders, Double Tops/Bottoms

Classical chart patterns provide high-probability trading setups when properly identified and executed. The head and shoulders formation, consisting of a high (shoulder), higher high (head), and subsequent lower high (second shoulder), signals trend reversal. The neckline connecting the lows between shoulders establishes the critical breakout level. Pattern completion occurs when price breaks below the neckline, with projected decline equal to the distance from head to neckline.

Double tops and double bottoms represent simplified reversal patterns where price tests a level twice without breaking through, then reverses direction. The pattern's reliability increases when the two peaks or troughs occur at similar price levels with separation by a multi-candle corrective move. Breakout of the intervening low (double top) or high (double bottom) confirms the reversal.

Triangle patterns—ascending, descending, and symmetrical—indicate consolidation and impending breakouts. Ascending triangles form with horizontal resistance and rising support, suggesting accumulation and probable upside breakout. Descending triangles display horizontal support with declining resistance, indicating distribution and likely downside break. Symmetrical triangles show converging trend lines, with breakout direction typically following the preceding trend.

| Pattern | Entry Point | Stop Loss Placement | Profit Target | Success Rate Context |

|---|---|---|---|---|

| Head and Shoulders | Break below neckline | Above right shoulder | Distance from head to neckline | Higher after extended uptrends |

| Double Top | Break below intervening low | Above second peak | Distance from peaks to intervening low | Strongest at major resistance |

| Ascending Triangle | Break above resistance | Below rising support | Height of triangle | Reliable in uptrends |

| Pin Bar at Support | Above pin bar high | Below pin bar low | Previous swing high | Best with confluence factors |

| Engulfing at Resistance | Below engulfing bar low | Above engulfing bar high | Previous swing low | Requires volume confirmation |

How to Use Price Action in Trading Strategies

Developing a Price Action Trading System

Systematic price action trading requires defined entry criteria, risk management parameters, and exit strategies. The process begins with timeframe selection based on trading style—day traders operate on 5-minute to hourly charts, swing traders analyze 4-hour to daily charts, and position traders focus on daily to weekly timeframes. Multi-timeframe analysis enhances probability by ensuring trade direction aligns with larger timeframe trends.

Entry triggers combine candlestick patterns with support/resistance levels and market structure. A conservative approach waits for price to reach identified key levels, form reversal candlestick patterns, then enter on breakout of the pattern high or low. Aggressive entries occur at level touches based solely on anticipated bounces, accepting higher risk for better reward potential.

Stop-loss placement follows logical price action structure rather than arbitrary percentage or pip values. Stops position beyond the pattern that triggered entry—below pin bar lows for long trades, above pin bar highs for shorts. This approach ensures stops only trigger if the price action setup invalidates, reducing premature stop-outs from normal volatility.

Profit targets derive from measured moves using chart patterns, previous swing points, or risk-reward ratios. A minimum 1:2 risk-reward ratio ensures trading systems remain profitable with moderate win rates. Advanced traders scale out of positions at multiple levels, securing partial profits while allowing remaining positions to capture extended moves.

Combining Price Action with Market Context

Pure price action analysis gains sophistication through integration with broader market context. Economic calendar awareness prevents trading during major news releases when price action becomes erratic and patterns fail more frequently. Understanding scheduled announcements enables traders to avoid positions ahead of high-impact events or position specifically to trade news-driven volatility.

Market session characteristics influence price action behavior. The London session typically generates significant movements in European currency pairs, while the New York session impacts USD pairs most substantially. Asian session trading often displays range-bound behavior with lower volatility, affecting pattern reliability and trading approach selection.

Correlation analysis between different currency pairs provides confirmation signals. When multiple pairs involving the same currency show aligned price action signals, the probability of successful trades increases. Divergences between correlated pairs sometimes precede reversals, offering contrarian trading opportunities.

Common Price Action Trading Strategies

Trend Trading with Price Action

Trend following strategies identify established trends on higher timeframes, then enter during pullbacks to key levels on lower timeframes. Traders wait for price to correct against the trend, form reversal patterns at support (uptrends) or resistance (downtrends), then enter in trend direction. This approach captures momentum while entering at favorable prices with defined risk.

The strategy requires patience, as optimal entries occur infrequently during strong trends. However, the trade alignment with dominant momentum increases success probability and enables wider profit targets. Position sizing can increase relative to counter-trend trades due to favorable probability and risk-reward characteristics.

Range Trading Strategy

During consolidation phases, price oscillates between defined support and resistance boundaries. Range trading strategies enter long positions at support with targets near resistance, and short positions at resistance targeting support. The approach works optimally in ranging markets on higher timeframes, where boundaries remain clearly defined over extended periods.

Risk management proves critical, as range boundaries eventually break, potentially generating losses for traders positioned against the breakout. Stop losses must position beyond support or resistance zones, with position sizing reduced relative to trend trades due to lower probability and risk-reward ratios.

Breakout Trading Methodology

Breakout strategies capitalize on price movements beyond established ranges or chart patterns. Entry occurs when price closes beyond resistance (long) or support (short), confirming the breakout's validity. Momentum often accelerates following breakouts as trapped traders exit positions and new traders enter in breakout direction.

False breakouts represent the primary challenge, occurring when price briefly exceeds boundaries before reversing into the prior range. Confirmation techniques—requiring specific percentage moves beyond levels, waiting for retests, or demanding increased volume—reduce false breakout frequency but may cause missed opportunities on strongest breakouts.

Advanced Price Action Concepts

Order Flow and Market Manipulation

Sophisticated price action analysis considers institutional order flow and potential manipulation tactics. Stop hunts occur when price briefly spikes beyond obvious technical levels to trigger retail stop losses before reversing, as institutional traders intentionally push price to accumulate positions at favorable levels. Awareness of common stop placement locations enables traders to position stops at less obvious levels, reducing vulnerability to these tactics.

Absorption represents the phenomenon where large institutional orders prevent price movement despite significant opposing flow. Price stalls at levels despite apparent momentum, forming tight consolidation as institutions accumulate or distribute positions. Recognition of absorption enables traders to anticipate subsequent directional moves once institutional activity completes.

Price Action in Different Market Conditions

Market behavior varies across different volatility and momentum regimes, requiring adaptive approaches. High-volatility environments produce larger candle ranges, wider swings between support and resistance, and increased false signal frequency. Trading adjustments include wider stop losses, reduced position sizes, and emphasis on stronger confirmation signals before entry.

Low-volatility periods generate compressed ranges, smaller candlesticks, and frequent ranging behavior. Strategies emphasizing range trading and mean reversion perform optimally, while trend-following approaches underperform due to limited momentum and frequent reversals. Pattern reliability changes—inside bars and tight consolidation patterns gain importance relative to large reversal formations.

Transitional periods between volatility regimes offer specific opportunities. Compression following high volatility often precedes renewed trending, while volatility expansion after extended low-volatility periods frequently initiates significant directional moves. Traders monitoring these regime shifts position for breakouts and trend initiation.

Risk Management in Price Action Trading

Position Sizing and Risk Control

Effective risk management determines long-term trading success regardless of strategy sophistication. The foundational principle limits risk on any single trade to 1-2% of total trading capital. This constraint ensures that strings of losing trades—inevitable in all trading approaches—cannot significantly deplete capital or force trading cessation.

Position sizing calculations derive from the distance between entry and stop-loss levels. Wider stop distances require smaller position sizes to maintain consistent percentage risk. The formula: Position Size = (Account Size × Risk Percentage) / (Stop Loss Distance in Pips × Pip Value) generates appropriate lot sizes for each trade setup.

Correlation exposure requires monitoring across open positions. Holding multiple positions in positively correlated pairs multiplies risk, as trades likely succeed or fail simultaneously. Correlation awareness enables traders to limit exposure, ensuring overall portfolio risk remains within acceptable parameters despite multiple open positions.

Psychological Aspects of Price Action Trading

Price action trading demands disciplined psychology and emotional regulation. The simplicity of analyzing naked charts paradoxically increases temptation to overtrade, as patterns appear frequently across multiple timeframes and pairs. Discipline requires waiting for optimal setups meeting all criteria rather than forcing trades during periods lacking high-probability opportunities.

Confirmation bias affects price action interpretation, as traders unconsciously emphasize patterns supporting predetermined directional views while dismissing contradictory signals. Objective analysis requires systematic evaluation of all visible patterns and structures, deliberately seeking evidence against initial biases before committing capital.

Loss aversion influences stop-loss management, as traders resist accepting losses and sometimes remove or move stops to avoid trade closure. Adherence to predetermined stops regardless of subsequent price action prevents small losses from becoming account-threatening disasters. The psychological shift from avoiding losses to managing them marks critical development in trader maturity.

Frequently Asked Questions

What is price action?

Price action constitutes the analytical study of security price movements over time, utilizing raw price data without mathematical indicators or transformations. The methodology examines candlestick formations, chart patterns, support and resistance levels, and market structure to forecast future price direction and identify trading opportunities.

How to use price action?

Using price action effectively requires multi-step analysis beginning with market structure identification on higher timeframes to determine overall trend direction. Traders then identify key support and resistance levels where price action signals may develop. Entry occurs when specific candlestick patterns form at these levels, with stop losses positioned according to pattern structure and profit targets based on measured moves or previous swing points.

What does price action mean?

Price action means that all relevant market information, including fundamentals, news, sentiment, and institutional activity, manifests in actual price movements displayed on charts. The term encompasses both the literal price changes occurring in markets and the analytical discipline of studying these movements to inform trading decisions.

Who invented price action?

Price action's origins trace to 18th-century Japanese rice trader Munehisa Homma, who developed candlestick charting and systematic price analysis methodologies. Modern price action trading evolved through contributions from Charles Dow in the late 19th century and contemporary traders including Al Brooks and Nial Fuller, who systematized approaches to reading naked charts without indicators.

Conclusion

Price action trading represents a pure, fundamental approach to market analysis that transcends the limitations of lagging indicators and complex systems. The methodology empowers traders to understand market dynamics directly through price movements, recognizing the psychology and order flow underlying every chart pattern and candlestick formation. Mastery requires dedicated study, practice, and disciplined execution, but rewards committed traders with versatile skills applicable across all markets and timeframes.

The path to price action proficiency begins with understanding core concepts—market structure, support and resistance, and basic candlestick patterns. Progressive skill development incorporates advanced pattern recognition, context analysis, and psychological mastery. Traders who invest time learning to read naked charts develop intuitive market understanding that indicator-based approaches cannot replicate.

Success in price action trading ultimately derives from consistency and discipline rather than complex analysis or perfect pattern identification. The trader who executes a simple strategy with rigorous risk management outperforms the analyst identifying numerous patterns without systematic execution. Begin with fundamental principles, develop trading rules through systematic backtesting, and maintain unwavering discipline in strategy implementation.