Ever watched a trader nail the perfect entry while you’re still figuring out what just happened in the market? Chances are they’re using order blocks – one of trading’s most powerful yet misunderstood concepts. I’ve spent years refining this technique, and today I’m breaking it down for you, no complicated jargon required.

Key Takeaways

- Order blocks are price zones where institutional activity occurred before a significant move in the opposite direction

- Bullish order blocks form as bearish candles before upward moves, while bearish blocks appear as bullish candles before downward moves

- The most reliable order blocks show clear momentum afterward and form at key market structure points

- Always wait for confirmation signals when price returns to an order block before entering a trade

- Proper risk management with stops placed logically around block structure is essential for long-term success

What is Order Block in Trading?

Picture this: you’re watching a cricket match, and suddenly there’s a power surge from the batting team that changes the game’s momentum. In trading, order blocks work similarly – they’re those critical zones where big players (institutional traders) make significant moves that change market direction.

This guide is part of our comprehensive article Smart Money Concept: Unlocking Institutional-Level Trading Insights, where we break down how to identify and trade with institutional order flow.

An order block is essentially a price zone where major buying or selling occurred before a significant move in the opposite direction. Think of it as the “launching pad” before a price reversal. These blocks represent institutional order flow and often become key areas where price returns later, creating excellent trading opportunities.

I remember when I first discovered order blocks – I was constantly missing entries and wondering how other traders seemed to predict market turns with such precision. Once I understood this concept, my trading took on a whole new dimension of clarity.

Order Block Trading Strategy: The Basics

A solid order block trading strategy focuses on identifying these institutional footprints and using them to anticipate future price movements. Here’s how you can build one step by step:

- Identify significant price moves: Look for sharp, decisive price movements in the market

- Locate the origin: Find the candle or zone that preceded this movement

- Mark the order block: This is your zone of interest for potential trade entries

- Wait for price to return: Patience is crucial here

- Look for confirmation: Additional signals that strengthen your trade case

- Execute with proper risk management: Always protect your capital

What makes this strategy powerful is that you’re essentially trading in harmony with the market’s biggest players. Rather than trying to predict the market, you’re reacting to evidence of institutional activity.

Bullish Order Block vs Bearish Order Block

Understanding the difference between bullish and bearish order blocks is essential for applying this concept correctly.

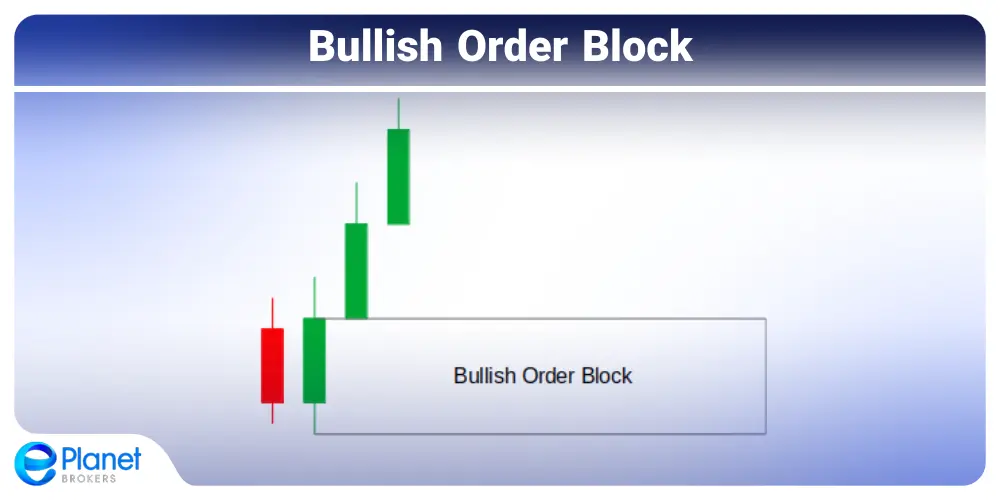

Bullish Order Block

A bullish order block forms when sellers temporarily push prices down before buyers take control, creating a strong upward move. These blocks often appear as bearish candles before a bullish run and represent accumulation by institutional buyers.

Key characteristics of bullish order blocks:

- Often appears as a bearish candle (counterintuitive, right?)

- Precedes a strong upward movement

- Represents institutional buying interest

- Provides potential support when price returns

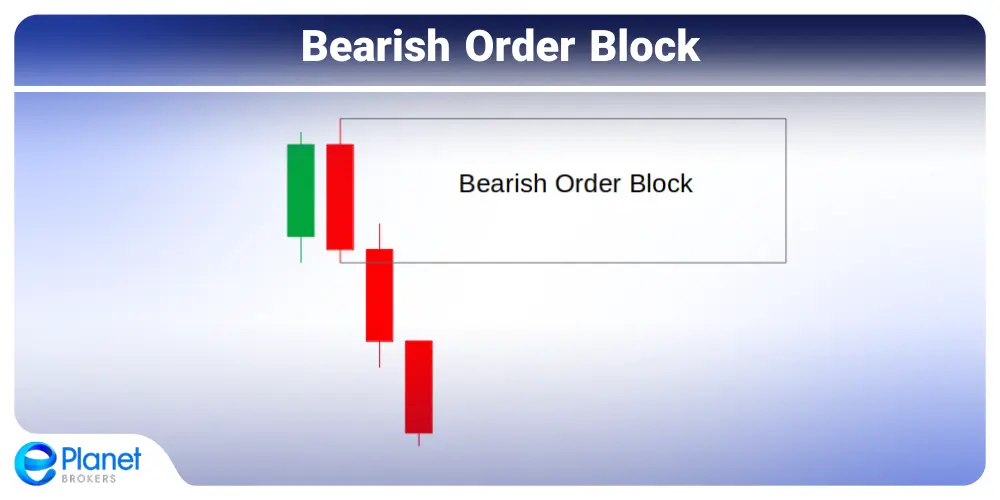

Bearish Order Block

Conversely, a bearish order block forms when buyers temporarily push prices up before sellers take control, creating a strong downward move. These blocks often appear as bullish candles before a bearish run and represent distribution by institutional sellers.

Key characteristics of bearish order blocks:

- Often appears as a bullish candle

- Precedes a strong downward movement

- Represents institutional selling interest

- Provides potential resistance when price returns

I find it helpful to think of these order blocks as the “last stand” of the losing side before the winning side takes over with force. The market often returns to these zones to test whether the original sentiment still holds.

ICT Order Block: The Inner Circle Trader’s Approach

The term “ICT order block” has gained popularity thanks to the trading educator known as the Inner Circle Trader. This specific approach to order blocks emphasizes:

- Precision in identification: Using specific candle structures

- Market structure understanding: Combining order blocks with market structure concepts

- Smart money concepts: Focusing on institutional activity rather than retail trading patterns

- Fair value gaps: Incorporating related concepts like fair value gaps

The ICT methodology places heavy emphasis on understanding order flow and institutional trading behavior. While the core concept remains similar, ICT order blocks often involve more specific identification criteria.

Read More: What is ICT in Trading?

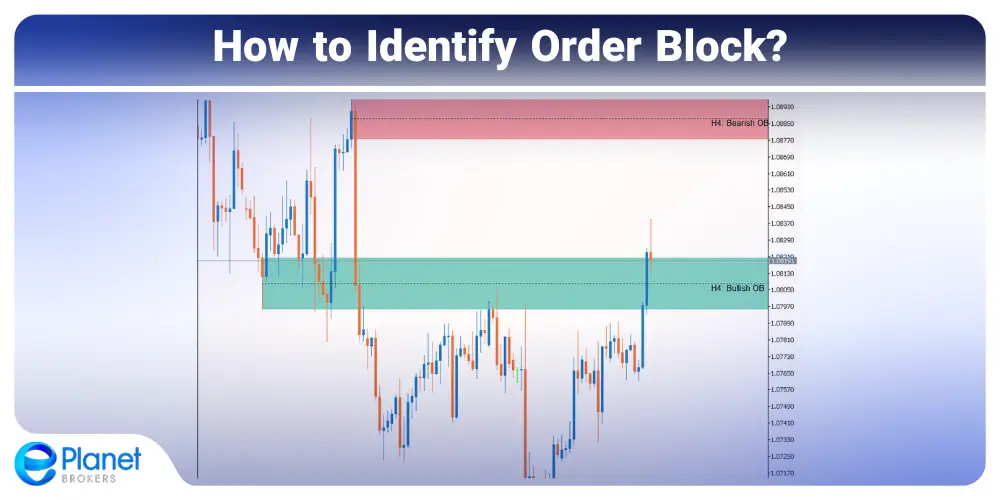

How to Identify Order Block?

Identifying valid order blocks requires attention to detail and practice. Here’s my step-by-step approach:

- Look for strong momentum moves: Significant price movements in a clear direction

- Find the last opposing candle: Before the momentum move, locate the last candle in the opposite direction

- Confirm volume if possible: Higher volume can indicate institutional participation

- Check the subsequent move: The stronger and more directional the move away from the block, the more significant it likely is

Let’s make this more practical with an example:

If you see a strong upward movement of several candles, look back to find the last bearish (red) candle before this upward surge began. This bearish candle, or sometimes a group of candles, forms your bullish order block.

Common mistakes when identifying order blocks include:

- Selecting random candles without clear subsequent momentum

- Ignoring the market context and structure

- Not considering timeframe relevance

- Focusing on too many potential order blocks

Order Block Examples from the Forex Market

Let’s look at some real examples from popular forex pairs that traders frequently trade:

EUR/USD Example

EUR/USD, the world’s most traded currency pair, frequently displays textbook order blocks. During major trend reversals, these blocks often form at key psychological levels or after significant economic announcements from the ECB or Federal Reserve.

For instance, when EUR/USD made a significant bearish move, smart traders identified the last bullish candle before the drop as a bearish order block. When price later returned to this zone, it created a high-probability short opportunity with a favorable risk-reward ratio.

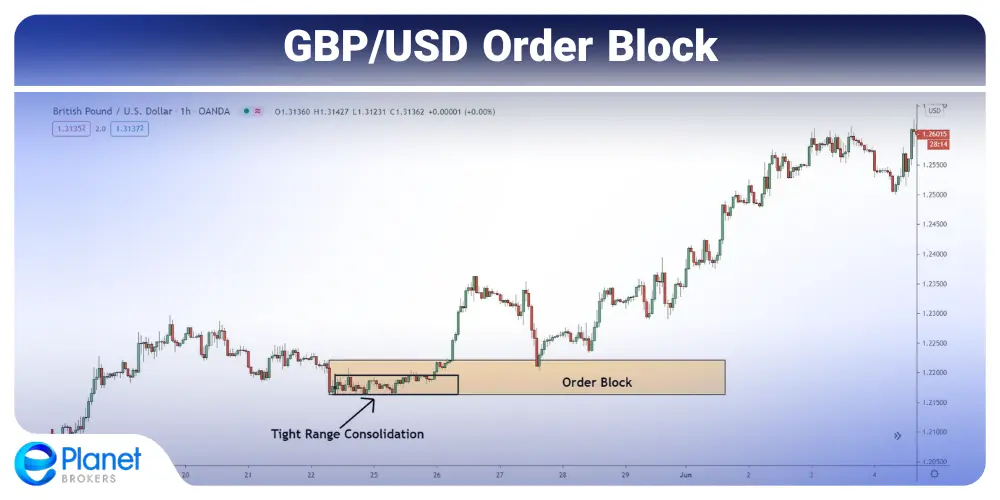

GBP/USD Example

The British Pound versus US Dollar pair (also known as “Cable”) creates excellent order block setups, especially around UK inflation data or Bank of England announcements.

One notable example occurred when GBP/USD formed a bullish order block during a correction in an uptrend. When price later revisited this zone, it presented a low-risk entry opportunity for traders looking to join the prevailing trend.

XAU/USD Example

Gold (XAU/USD) presents some of the clearest order block patterns in the financial markets due to its status as a safe-haven asset and high institutional participation.

A textbook example occurred when gold formed a bullish order block during a pullback before continuing its uptrend. This block developed after a significant US inflation report, creating a low-risk entry zone when price later returned to test it. The subsequent move provided a substantial reward-to-risk ratio, demonstrating why gold is often called the “order block trader’s paradise.”

Another classic example showed a bearish order block forming at a psychological resistance level before a sharp decline. Smart traders who identified this block were able to position themselves perfectly for the downward move when price retested the zone.

Read More: Understanding the key terms in Forex trading

Valid Order Block: What Makes It Reliable?

Not all order blocks are created equal. The most reliable order blocks share these characteristics:

- Clear preceding momentum: The move following the order block should be decisive

- Logical market context: The order block should make sense within the larger market structure

- Clean price action: Less noise and cleaner candles often indicate stronger institutional presence

- Reasonable time frame consistency: The order block should be visible across multiple time frames

I’ve found that order blocks with these characteristics have a much higher probability of providing profitable trading opportunities when price returns to test them.

Let’s compare some examples:

Strong Valid Order Block:

- Decisive momentum move after formation

- Created at key market structure level

- Clean price action with minimal wicks

- Visible on multiple timeframes

Weaker Order Block:

- Choppy movement after formation

- Created in the middle of a range

- Messy price action with multiple wicks

- Only visible on a single timeframe

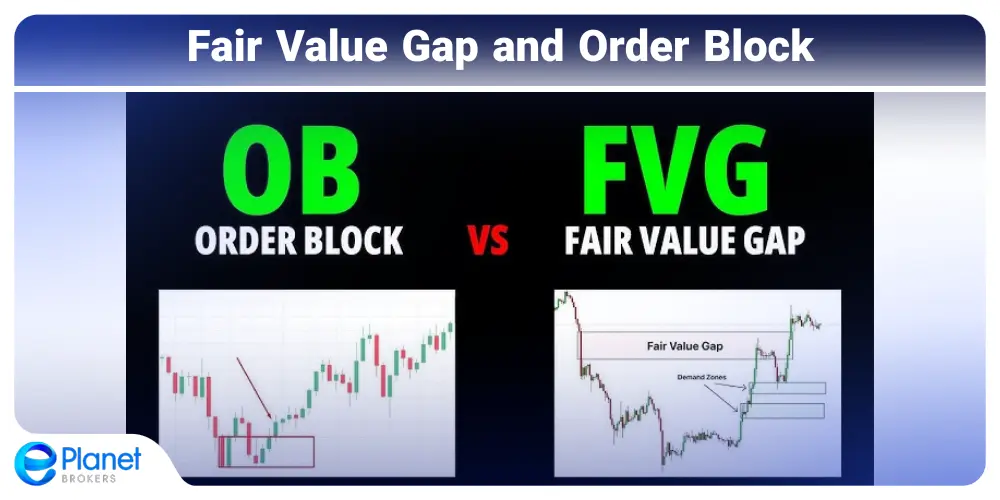

Fair Value Gap and Order Block: Understanding the Connection

Fair value gaps (FVGs) and order blocks are related concepts that both stem from institutional trading activity, but they have distinct characteristics:

| Feature | Fair Value Gap | Order Block |

|---|---|---|

| Formation | Price “jumps” creating unfilled space | Last opposing candle before momentum |

| Visual appearance | Gap between candle bodies | A candle or zone |

| Market indication | Extreme imbalance between buyers/sellers | Institutional order absorption |

| Trading approach | Often filled more quickly | May take longer to return to |

While both concepts identify institutional footprints in the market, they can be used together for more powerful analysis. When a fair value gap coincides with an order block, it often creates an especially strong zone of interest.

What is the Difference Between Fair Value Gap and Order Blocks?

Building on our comparison, let’s explore the key differences more thoroughly:

Fair value gaps represent areas where price has moved so quickly that it’s left unfilled space in the market. They appear as gaps between the candle bodies (not wicks) on a chart and signal extreme imbalance. These gaps often get filled as the market seeks equilibrium.

Order blocks, meanwhile, represent zones where significant orders were absorbed before a momentum move. They don’t necessarily create gaps but instead show where institutional traders may have accumulated or distributed positions.

The main practical difference for traders is how we use them:

- Fair value gaps are often targets for price to return to and fill

- Order blocks are zones where we might look to enter trades in the direction of the prior momentum

I often use both in my analysis, looking for fair value gaps as potential targets while using order blocks as entry zones.

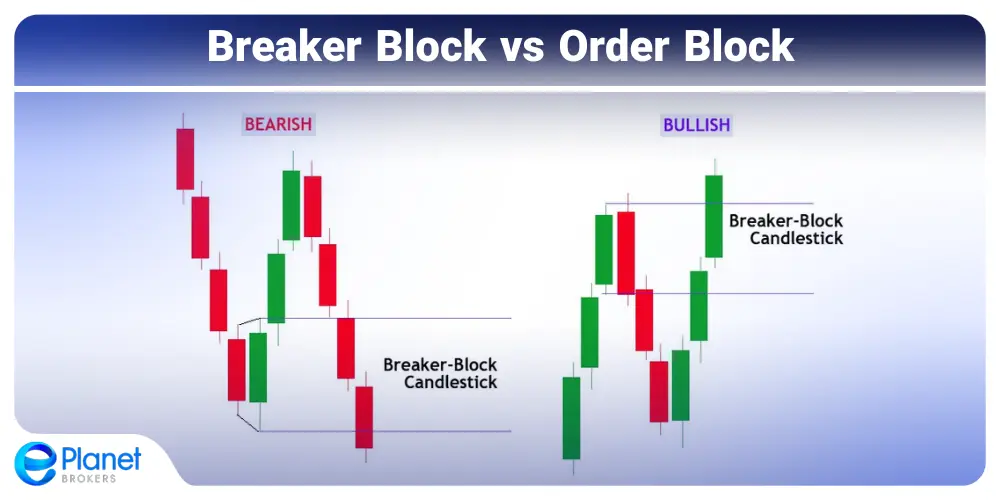

Breaker Block vs Order Block

Another concept you might encounter is the “breaker block.” While similar to order blocks, there are important distinctions:

Key Differences:

- Formation context:

- Order blocks form before a momentum move

- Breaker blocks are former support/resistance zones that have been broken and retested

- Usage in trading:

- Order blocks are primarily entry zones

- Breaker blocks often serve as both entry and confirmation zones

- Market structure significance:

- Order blocks focus on institutional activity

- Breaker blocks emphasize market structure changes

When to Use Order Block and Breaker Block?

Both concepts have their place in a trader’s toolkit, but knowing when to apply each can significantly impact your results:

Use Order Blocks When:

- You’re looking for high-probability entry points

- The market is showing clear institutional footprints

- You want to trade in the direction of the larger trend

- You seek precise entry zones rather than general areas

Use Breaker Blocks When:

- You want confirmation that a support/resistance flip is valid

- Market structure is changing significantly

- You’re looking for continuation trades after a breakout

- You need additional confirmation beyond just price action

The most effective approach often combines both concepts. I personally start by identifying significant order blocks, then look for breaker blocks as additional confirmation when setting up trades.

What is the Difference Between Order Block and Breaker Block?

Let’s examine this important distinction more closely:

Order blocks are essentially the origin of a strong move – the last opposition before a significant price movement. They represent where big market participants (institutions) absorbed orders before pushing price in their desired direction.

Breaker blocks, on the other hand, are former support or resistance levels that have been broken and then retested from the opposite side. They represent a change in market structure – what was once support becomes resistance, or vice versa.

This table clarifies the key differences:

| Aspect | Order Block | Breaker Block |

|---|---|---|

| Formation | Before a momentum move | After a support/resistance break |

| Primary function | Entry zone | Confirmation zone |

| Market context | Shows institutional order absorption | Shows market structure change |

| Identification | Last opposing candle before momentum | Former S/R level broken and retested |

| Trading psychology | Represents smart money accumulation/distribution | Represents trend confirmation |

Understanding these differences helps you apply each concept appropriately depending on market conditions.

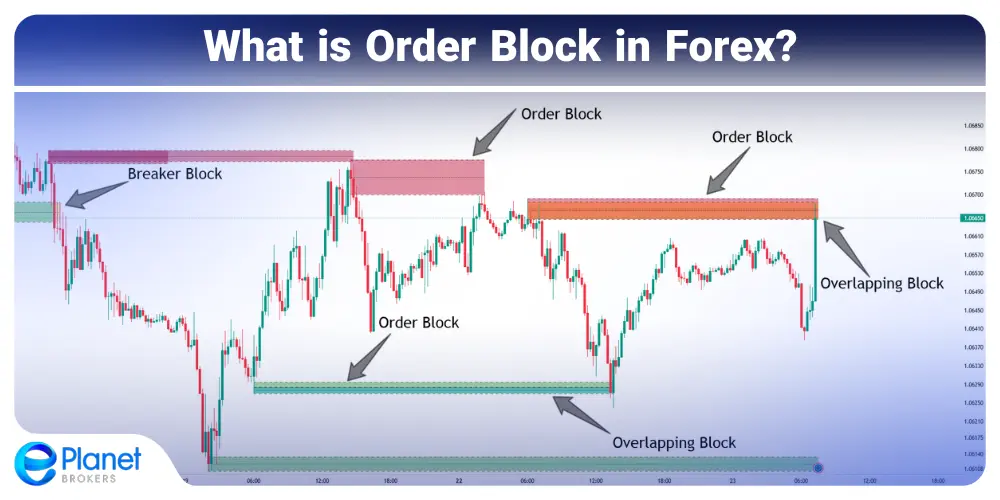

What is Order Block in Forex?

While order blocks apply to all markets, they’re particularly popular in forex trading due to the high institutional participation in currency markets.

In forex, order blocks often coincide with key technical levels like daily pivots, psychological whole numbers (like 1.2000 in EUR/USD), or significant moving averages. The 24-hour nature of forex markets also creates interesting order block opportunities around session transitions.

For forex traders, particularly those trading USD/JPY or popular global pairs like EUR/USD, order blocks provide excellent entry opportunities, especially during major economic releases or central bank announcements.

Forex-specific considerations for order blocks include:

- Wider spreads during lower liquidity periods can affect block identification

- Economic calendar awareness is critical as news can create or invalidate blocks

- Session overlaps often create stronger order blocks due to higher participation

What is the Difference Between Order Flow and Order Blocks?

These related concepts are often confused but understand both improves your trading:

Order flow refers to the continuous stream of buying and selling transactions in a market. It’s the moment-by-moment activity showing who’s aggressive (buyers or sellers) and can be analyzed through tools like footprint charts, DOM (Depth of Market), or time and sales data.

Order blocks are specific zones where significant order flow imbalance occurred before a strong directional move. They’re essentially “snapshots” of critical order flow moments that created important price levels.

Think of it this way:

- Order flow is like watching a cricket match ball by ball

- Order blocks are like identifying the key moments that changed the match’s momentum

For practical trading:

- Order flow analysis requires specialized tools and often suits shorter timeframes

- Order block trading can be done with standard charts and works across multiple timeframes

Both approaches focus on understanding institutional activity, but order blocks provide a more accessible entry point for most traders.

How to Take Entry in Order Block?

This is where theory meets practice. Taking entries in order blocks requires patience and precision. Here’s my step-by-step approach:

- Wait for price to return to the order block – This might take hours, days, or even weeks depending on your timeframe

- Look for confirmation signals within the block, such as:

- Candlestick patterns (pin bars, engulfing patterns)

- Volume spikes

- Momentum indicator divergence

- Lower timeframe price action

- Set precise entry orders – Place limit orders within the order block or market orders after confirmation

- Define your risk clearly – Place stops beyond the order block or at logical technical levels

- Manage the trade based on market structure – Use multiple targets based on previous swing points or key levels

Let me share an example entry technique I often use:

When price returns to a bullish order block, I drop down to a lower timeframe and look for a bullish reversal pattern, like a pin bar or bullish engulfing. I then enter with a stop loss below the low of the order block and target the next significant resistance level.

[Insert image showing entry technique with annotations here]

Order Block Trading Strategy PDF

For traders wanting to deepen their knowledge, several comprehensive resources explore order block trading strategies in detail.

- Order Blocks in Forex Trading PDF – A comprehensive PDF guide from the HowToTrade website on understanding and implementing order block strategies

- Books focusing on institutional trading and order flow concepts

- Technical analysis publications that explore advanced price action patterns

Many traders have access to education platforms through their brokers that offer specialized order block trading materials. These resources can provide additional insight into applying these concepts in various market conditions.

Integrating Order Blocks into Your Trading Plan

Successfully implementing order blocks requires integrating them into a complete trading plan. Here’s how:

1. Choose Compatible Markets and Timeframes

Not all markets show clear order blocks. I’ve found that:

- Large-cap stocks often display cleaner order blocks than small caps

- Major index futures frequently form textbook order blocks

- Forex markets, particularly major pairs, provide excellent opportunities

- Commodities like gold and oil regularly create tradable order block patterns

For timeframes, start with daily charts to identify significant blocks, then use 4-hour or 1-hour charts for more precise entries.

2. Combine with Other Technical Tools

Order blocks work best when confirmed by:

- Key support/resistance levels

- Trendlines and chart patterns

- Volume analysis

- Key moving averages popular in Forex Market (9, 20, 50, 200)

3. Practice Proper Position Sizing

Given the precise nature of order block entries, position sizing becomes critical:

- Smaller positions allow for wider stops that respect the block structure

- Scale-in approaches can work well when entering larger blocks

- Always calculate position size based on your predetermined risk percentage

4. Develop a Trading Journal Focused on Order Blocks

Track your order block trades with specific metrics:

- Block type (bullish/bearish)

- Block quality (based on criteria we discussed)

- Confirmation signals used

- Entry precision

- Outcome and lessons learned

Common Order Block Trading Mistakes to Avoid

Through years of trading and teaching, I’ve noticed several common mistakes:

- Forcing order blocks where none exist – Not every candle before a move is a valid order block

- Ignoring the broader market context – Order blocks work best when aligned with the larger trend

- Impatience when waiting for returns – Quality order blocks may take time to be retested

- Neglecting confirmation signals – Blindly entering any price returning to an order block can lead to losses

- Using inappropriate stops – Stops should respect the block structure, not arbitrary pip amounts

- Overcomplicating the concept – The power of order blocks lies in their simplicity

- Not adapting to different market conditions – Order blocks behave differently in trending vs ranging markets

Avoiding these pitfalls will significantly improve your order block trading results.

Conclusion: Mastering the Art of Order Block Trading

Order blocks represent one of the most powerful concepts in technical analysis, giving traders a window into institutional activity and high-probability trading opportunities. By understanding how to identify, validate, and trade these blocks, you can transform your approach to the markets.

For Forex traders particularly, mastering order blocks can provide a competitive edge in markets that are increasingly influenced by institutional participation. Whether you’re trading equity indices, large-cap stocks, or currency pairs, order blocks offer a universal approach to finding quality entries.

Remember that becoming proficient with order blocks takes practice and screen time. Start by identifying them on historical charts, then paper trade your entries before committing real capital. Over time, you’ll develop an intuitive sense for the most promising blocks and the patience to wait for ideal setups.