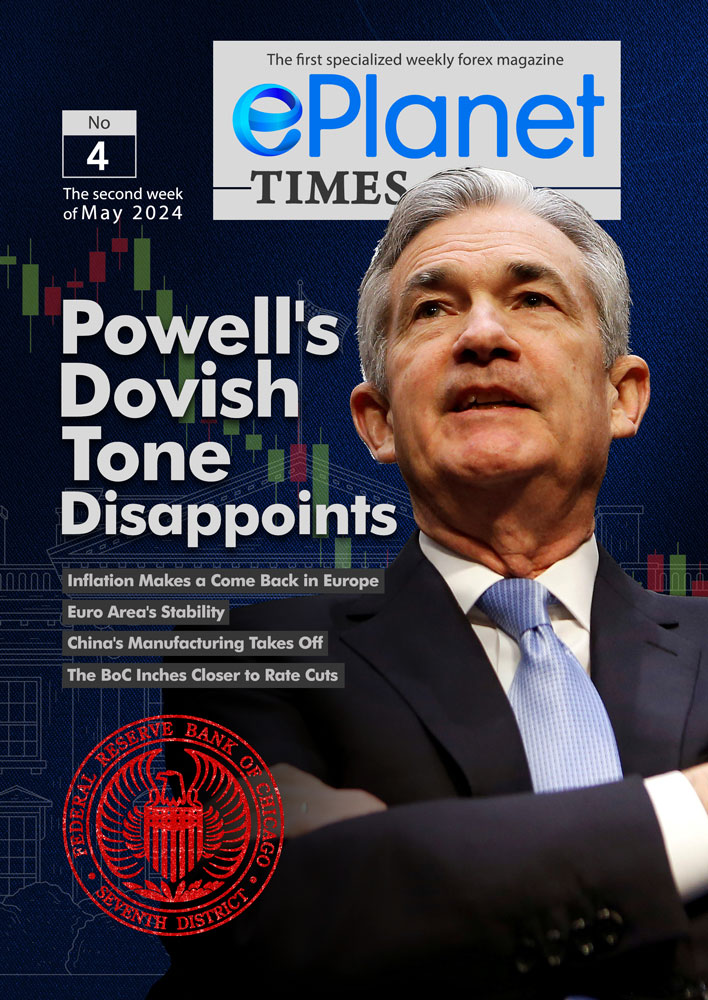

ePlanet Times No.4 weekly forex newspaper

As a comprehensive forex-based resource, ePlanet Times (weekly forex newspaper) enables you to understand and analyze price movements in the global markets. Through this weekly newspaper we strive to create a suitable medium for our traders to recognize factors affecting prices and to prepare them for the key events in the coming week. By providing unbiased opinions and analyses, ePlanet’s analytical team accompanies you towards more conscious and well-informed decisions for their trades.

A Summary of ePlanet Times the 4th Edition

The fourth edition of ePlanet Times published on Sunday, strives to guide all market participants and traders towards more conscious and profitable trading decisions by providing in depth analysis of the global financial markets. This edition focuses on the most influential developments of the previous week while presenting key events in the coming week with potential scenarios and their impacts on the global financial markets.

Let’s begin with the weekly wrap up. The first week of May was busy for financial markets with the Federal Reserve meeting being the center of attention. The Fed decided to hold interest rates steady but signaled a willingness to cut them later in 2024 if inflation eases. This dovish stance surprised markets as some expected the Fed to maintain a hawkish tone.

The NFP report signaled that the labor market is finally showing some signs of slowing down since the actual print fell short of all forecasts and the unemployment rate rose by 0.1%. The weakness in the labor market was also supported by the declining job openings and decreasing quit rates.

Beyond the Fed and the US labor market, other noteworthy events included the Eurozone exiting recession, positive signs from China’s manufacturing sector, and continued debate about future interest rate cuts in Europe and Canada.

After long-standing theories and speculations, Japan finally intervened in the currency market to strengthen the yen against the dollar which led to a sharp drop in USDJPY’s exchange rate from 160 to 153.

On the other side of the world, Switzerland’s inflation rate rose but remained within the central bank’s target range.

In the News Digest section ePlanet Times focuses on recent updates and developments reported by reliable news sources or stated by influential figures in the financial markets. This edition showed a mix of positive and uncertain outlooks mainly focusing on the crude oil market, earning reports from amazon and apple and remarks from central banks’ policy makers.

After a whirlwind week of economic reports, the coming days offer a breather for investors. However, there are still key events to watch that could impact markets.

Firstly, as mentioned in the 4th edition of ePlanet Times, the week offers a chance to wrap up the first quarter earnings season with reports from major corporations like Toyota and Walt Disney. Additionally, central banks in Australia and England will hold policy meetings. While interest rate changes are unlikely, their statements will be scrutinized for hints about future monetary policy direction.

Looking closer at the week’s schedule, Monday features China’s Caixin PMI for services. The US 10-year Treasury bond auction is on Wednesday which could impact the dollar’s value and The Bank of England’s meeting on Thursday is likely to maintain interest rates but might offer hints of a potential cut later in the year. Finally, the University of Michigan consumer sentiment report will be a key indicator of household spending habits, which can play a role in future inflation levels.

The economic analysis of the week, Written by Saghar Hosseinpoor focuses on Copper and its recent outstanding performance in the metals market while the technical analysis of the week provides possible trading scenarios for symbols like Dow Jones, GBPJPY, EURUSD and NZDCAD.

For a deeper dive into the reports and developments mentioned, we recommend exploring the fourth edition of ePlanet Times: “Powell’s Dovish Tone Disappoints.”

Click here to view the previous version ePlanet Times No.3